Their $30M Investment Fund Focuses on Closing the Wealth Gap Through Employee Ownership

Apis & Heritage Capital is a $30 million investment fund that uses a novel “employee-led buyout” (ELBO©) structure to provide workers of color and workers in essential industries with the most powerful wealth building tool in the nation: equity in a thriving business.

The Washington, DC-based firm finances the acquisition of companies from retiring owners/founders and converts them into 100% employee-owned enterprises. A&H invests in companies where at least 40% of the workforce consists of workers of color.

In June 2021, the firm announced its first close at $30 million through its flagship Legacy Fund I.

The fund was supported by investments from the Ford Foundation, The Rockefeller Foundation’s Zero Gap Fund, The Skoll Foundation, Capricorn Investments, Gary Community Investments, Ascension Investment Management, and many other impact investing institutions and individuals.

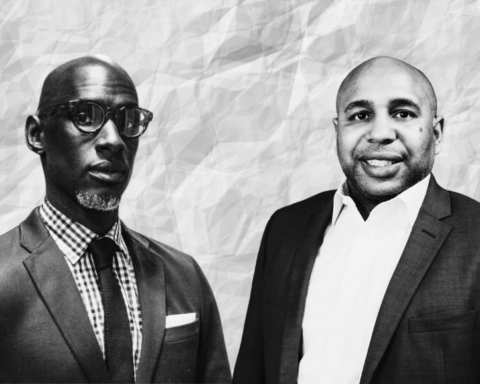

We caught up with the founders, Todd Leverette and Phil Reeves to learn more:

What inspired you to start a fund focused on employee ownership?

TODD: It’s interesting, I was raised by my parents to always ask “Given what you have, how are you using it to make things better for your community and for others?” That same inquiry and conviction was accentuated and refined at Morehouse College, where I met my partner at A&H, Phil Reeves. That question stayed with us as we moved through our respective careers.

For me, I was always trying to figure out how to use the blessing of having the opportunity to work on Wall Street and go to law and business school—how to take those skills and that information and pour it back into the community in a way that changes people’s lives for the better. It was while I was working with the Democracy at Work Institute, the incubating and technical assistance partner for the Fund, that I found that answer.

At the Democracy at Work Institute, I was tasked with bringing the power and benefits of employee ownership to Black and Brown communities. Employee ownership has the power and potential to create great companies that stay rooted in their communities, provide better workplaces, generate higher job satisfaction, and most importantly, help workers build wealth.

So, given that tall order, I did what I always do—I called the smartest guy I know, my partner, Phil Reeves, and together we developed the financing model for what we now call our “employee-led buy out” model and conceived of Apis & Heritage to bring the power of employee ownership to workforces of color.

Initially, we were trying to arrange financing for a single acquisition of a company to prove that our model could work, but our first outside partner, Michael Brownrigg, came in with a lot of fund management expertise and pushed us to create a larger fund for investment into numerous companies, rather than just raising money for a single acquisition. And here we are, Apis & Heritage Capital Partners (A&H), Legacy Fund I, having had a first close of $30M on Juneteenth of 2021, looking to announce our final close very soon, and having completed our first 2 “employee-led buy out” transactions in Colorado and Texas.

How do you plan to help employees create wealth?

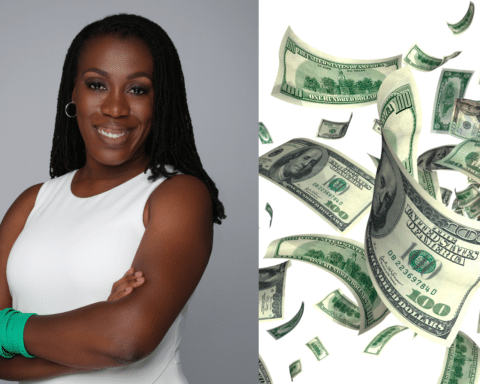

PHIL: First, it is important to understand that 60% of Black workers and 75% of Brown workers retire with no retirement assets according to the Economic Policy Institute. Through employee ownership, the average worker nearing retirement in an employee-owned business has $147,000 in their retirement account. This is transformative.

Although the first generation of wealth in a company should go to the founders—the ones who took the risk to start the business and probably sweated to make payroll along the way—we are focused on helping employees earn the next generation of enterprise wealth. When we help a company transition into an A&H 100% employee-owned business, the mechanics of wealth creation are pretty simple: each year, the company gives a portion of shares to each full time employee.

The employees do NOT pay for those shares; they earn them through their hard work. Each year the company’s value is assessed by an outside expert, and that then sets the “share price” for each share.

When an employee is ready to retire, he or she then sells the shares they have earned back to the company. It is like owning shares in the stock market, except you own shares in your own company and you can help your company grow and become more valuable every day.

What are the benefits of a business becoming employee-owned?

TODD: The data after almost 50 years is crystal clear—companies that are employee-owned, where workers feel like worker-owners, tend to outperform their peers in all of the important metrics: they are more profitable, more productive, and more resilient in economic downturns.

Additionally, research shows that the mental health of employees improves. And the reason is obvious—when employees are engaged and empowered as owners, they take more care about expenses, they look for ways to improve their work, they generate more ideas for new products or services, and they are happier.

And to be clear, these are not niche companies, these are strong and growing businesses. Indeed the world of employee-owned companies in America includes firms with tens of thousands of employee-owners; there are employee-owned companies that make billions of dollars in revenue.

In addition to all that—which is really important!—100% employee-owned businesses also pay ZERO federal taxes and in 44 out of 50 states, zero state taxes, which is another obvious financial advantage.

An estimated 10,000 Baby Boomers are retiring each day. What opportunities does this present for A&H?

PHIL: As you say, there is a massive transfer of business assets happening right now and for the next decade, as the Baby Boomer generation begins to retire and looks for ways to exit their businesses.

The reality is that some will be handed down to family members, but most will either be shut down or sold to private equity firms or to competitors. We want employees to have a shot at owning those businesses!

And we think a lot of owners want that too, they just may not be aware that the option exists for them or fear that they will have to carry a very large “seller’s note” for years if they try to sell to their employees.

A&H exists to make this transaction easier for owners by handling all the red tape and ensuring that they do not have to carry large seller’s notes if they sell through A&H to their employees.

Where do you see A&H in the next 5 years?

PHIL & TODD: As your prior question makes clear, there is a massive opportunity for A&H in the next 5-10 years. Only 17% of Baby Boomers who own companies have succession plans putting workers, particularly Black and Brown workers, at risk.

We think we can help thousands of workers of color, and low-income workers generally, become employee-owners, putting them on a path to financial security for themselves and their families, and really putting a dent in the racial wealth gap and even intergenerational poverty over time.

Moreover, our efforts so far demonstrate that there is a hunger for this approach in the ownership world. We have seen it first hand: if owners can get a fair price for their companies and receive assistance navigating the process and paperwork, they would prefer to hand the company over to their employees. So we are really only limited by how much capital we can raise and how well we execute.

However, we are enormously grateful to our Legacy Fund I investors, particularly The Rockefeller Foundation for its early investment and ongoing support of our model. The early investments from The Rockefeller Foundation Zero Gap Fund and other leading investors helped us attract additional capital, making our first fund raising a success.

All of our investor partners have enabled us to establish a track record so that, in the future, we can raise Fund 2 and transition more and larger companies to employee ownership, potentially impacting thousands of workers and their families.

Expanding the ownership model has the power to help eliminate the racial wealth gap and make this country a stronger and more equitable place to work. Our goal is to establish Fund 2 within the next 5 years.