Black-Owned Jewelry Brands to Add To Your Collection in 2022

As anyone who loves fashion knows, jewelry is the perfect way to add a little personality to any outfit. Whether you prefer dainty or bold statement pieces, there is a jewelry brand that suits your style.

These Black-owned jewelry brands are a great way to add some unique and stylish pieces to your collection. Whether you’re looking for something flashy or understated, there’s a brand with precisely what you need.

So go ahead and add one (or all!) of these fantastic brands to your list, and enjoy the added confidence and beauty that their jewelry provides.

Black-Owned Jewelry Brands

Afro Deco

Handmade pieces by British jewelry designer and visual artist Natasha Lisa. Operating under the name Afro Deco, Natasha channels the stylistic influences of Art Deco and the vibrant patterns of African fabric in her diverse range of afrofuturist-themed Lucite designs.

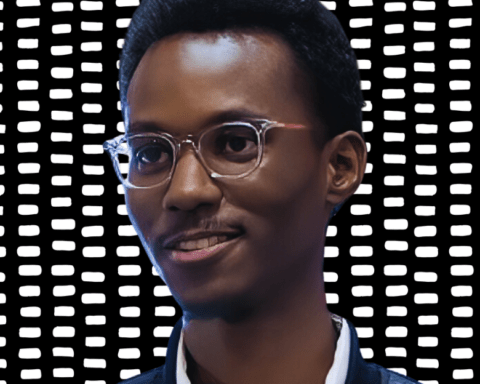

YAM

Yam is a made to order, handmade jewelry brand based in Queens, NY. The brand is dedicated to creating new, yet nostalgic pieces through up-cycled materials and vintage silhouettes. Designs incorporate classic and industrial hardware elements, complimented with cheeky and charming nature motifs and pearl accents.

Jooel

Jooel was born out of a desire to curate timeless luxury jewelry pieces for every wardrobe. With a careful blend of trendy and classic pieces, Jooel offers something for everyone. Whether you’re a bling queen or prefer understated lux, Jooel has something for you.

Leliamae

Leliamae is a New York-based, woman-run jewelry brand that strives to balance integrity and unique style. The artist behind the brand, Lelia, sources quality gold materials that are ethically produced and made to elevate your everyday collection.

HOME by Areeayl

Each Beads Byaree piece is created with a focus on quality and attention to detail. The results are beautiful, one-of-a-kind pieces that are sure to make a statement. Whether you’re looking for a unique gift or a treat for yourself, Beads Byaree has something for everyone.

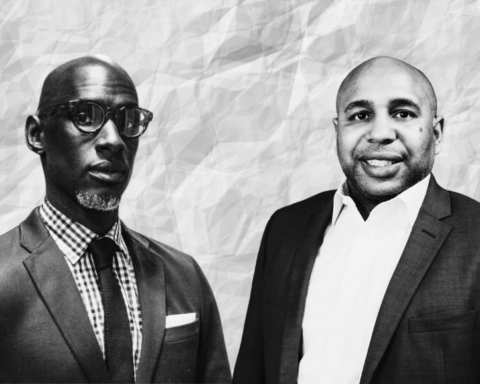

Third Crown

The husband-and-wife team behind Third Crown aims to celebrate the merging of two forces coming together to form something new – a powerful pair. They fuse their love of geometric shapes with the details found in their architectural surroundings to create their collection of men’s and women’s jewelry.

ALMASIKA

ALMASIKA makes fine jewelry that tells stories across generations and cultures. The sculptural designs are handcrafted using precious metals and shimmering gems. Pieces include the debut ‘Le Cauri Endiamante’ collection – inspired by the rich history and symbolism of cowrie shells – as well as newer styles from the ‘Sagesse’ range, which explores ancient motifs associated with traditional wisdom.