Clockwork Raises $2M to Revolutionize Financial Planning For Entrepreneurs

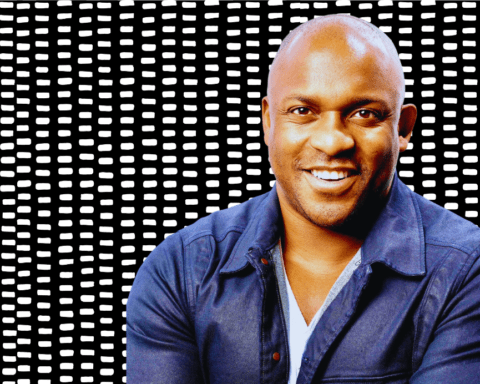

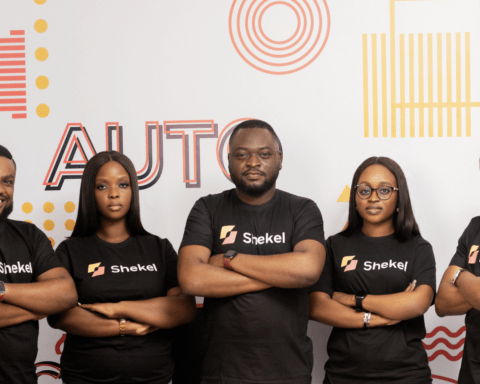

Mike Webb is the Co-Founder & COO at Clockwork. Clockwork is a software company that uses real-time information to automatically build out financial projections and cash flow forecasts for small to medium-sized businesses.

Through their Startup and Inclusion Program, the company helps any minority-owned company making less than $1 million in revenue with discounted tools and support.

In this episode, Mike shares:

- The problem that his business was created to solve.

- His experience raising a $2 million investment.

- How Clockwork is using their investment capital.

- Advice for other founders who are trying to raise money.

Don’t forget to “LIKE” the video and SUBSCRIBE to our YouTube channel!