Community College Startup Campus Scores $23 Million to Expand Access to Top-Tier Education

Campus, a startup focused on revolutionizing community college education, has announced an additional $23 million in funding.

This Series A extension round was led by Founders Fund, with participation from 8VC. The news comes just over a year after Campus secured $29 million in its initial Series A round.

Campus offers a unique approach to higher education, providing students with access to high-caliber instruction at an affordable price. They achieve this by employing adjunct professors who are currently teaching at prestigious universities like Vanderbilt, Princeton, and NYU.

These professors are compensated competitively, at a rate of $8,000 per course, which is significantly above the national average for adjunct faculty.

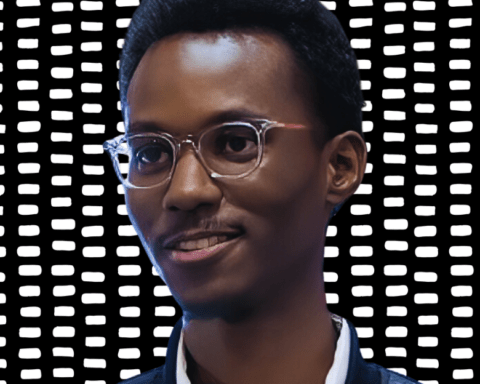

“Campus is obsessed with giving everybody access to these amazing professors,” said founder Tade Oyerinde, highlighting their commitment to quality education.

The funding will allow Campus to further develop its innovative learning platform and expand its course offerings. While the majority of students participate online, the company also maintains a physical campus in Sacramento, California. This campus offers hands-on learning experiences in fields like phlebotomy, medical assisting, and cosmetology.

This latest investment demonstrates the confidence that venture capitalists have in Campus’s ability to disrupt the traditional community college model. Their focus on affordability and access to renowned instructors positions them well to address the growing demand for quality higher education.