Adebayo Ogunlesi’s Infrastructure Fund Acquired by BlackRock for $12.5 Billion

In a groundbreaking move poised to redefine the global infrastructure landscape, BlackRock, the world’s largest asset manager, has entered into a monumental deal to acquire Global Infrastructure Partners (GIP) for a staggering $12.5 billion.

Global Infrastructure Partners (GIP) is a leading infrastructure investor that specializes in investing in, owning, and operating some of the largest and most complex assets across the energy, transport, digital infrastructure, and water and waste management sectors.

The agreement, expected to be finalized in Q3 2024, involves a payment of $3 billion in cash and approximately 12 million shares, valued at around $9.5 billion based on January 11 closing prices.

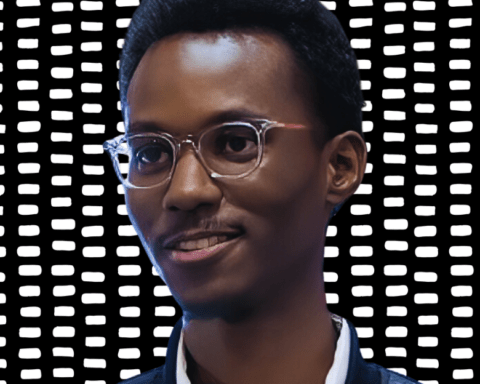

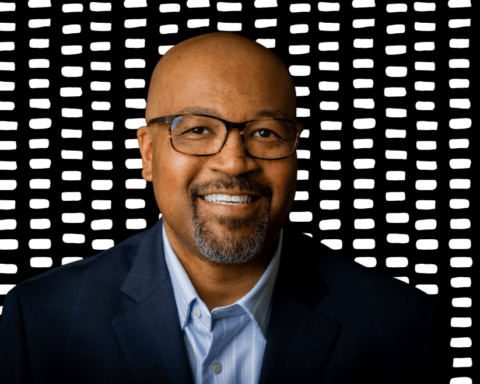

At the forefront of this strategic merger is Adebayo Ogunlesi, the Chairman and CEO of Global Infrastructure Partners. Ogunlesi, along with four founding partners, leads the GIP management team, playing a pivotal role in guiding the combined infrastructure platform. As the Chairman and CEO of GIP, Ogunlesi is strategically positioned to navigate the integration of GIP and BlackRock operations, expanding his influence beyond the boardroom to orchestrate a consolidation that maximizes synergies while minimizing disruption.

The significance of this deal is underscored by its timing, making it BlackRock’s largest transaction since the acquisition of Barclays Global Investors in 2009. This strategic move reflects BlackRock’s ambition to solidify its position in the rapidly expanding market for private and alternative assets.

The GIP management team, under Ogunlesi’s leadership, is not only instrumental in the merger but also represents a continuation of GIP’s legacy in infrastructure funds management. GIP currently oversees a portfolio valued at about $100 billion, with companies within its equity portfolio collectively generating an impressive annual revenue of $80 billion. Notable assets in GIP’s portfolio include Gatwick Airport, London City Airport, Port of Brisbane, Port of Melbourne, Sydney Airport, and the Ruby Pipeline, a 680-mile gas pipeline in the US.

This strategic partnership between BlackRock and GIP is more than a mere acquisition; it’s a calculated alliance leveraging the strengths of both entities. BlackRock gains immediate access to GIP’s proven expertise and established portfolio, while Adebayo Ogunlesi secures his legacy by assuming a crucial role in the newly formed entity.

The $12.5 billion BlackRock-GIP merger is set against the backdrop of a growing trend in the alternatives market. Infrastructure has emerged as a lucrative investment opportunity as investors seek to profit from addressing a projected $15 trillion spending gap in global infrastructure by the end of the decade, as projected by McKinsey consultants.

This strategic partnership holds the promise of driving innovation, democratizing access to investments, and prioritizing sustainability in the global infrastructure landscape. With Adebayo Ogunlesi’s visionary leadership and the backing of the GIP management team, the BlackRock-GIP alliance sets the stage for a future built on vision, expertise, and a commitment to shaping a more connected and sustainable world.

by Tony O. Lawson

:max_bytes(150000):strip_icc():format(webp)/Untitleddesign2-8e54289f55594e32aba19c3b19d3c1b6.png)