Saalex Corp Strengthens Defense Presence with $75 Million Acquisition

Saalex Corporation is a federal services contractor that provides engineering and information technology services for the Department of Defense, municipalities, and small to medium-sized businesses.

On January 24th, Saalex announced the acquisition of Spalding Consulting, for over $75 million. This strategic move positions Saalex as a major player in the lucrative defense sector, expanding its reach and expertise.

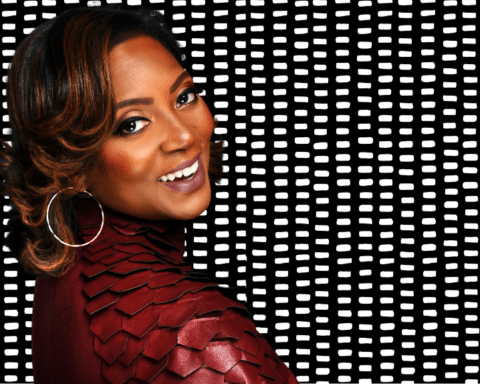

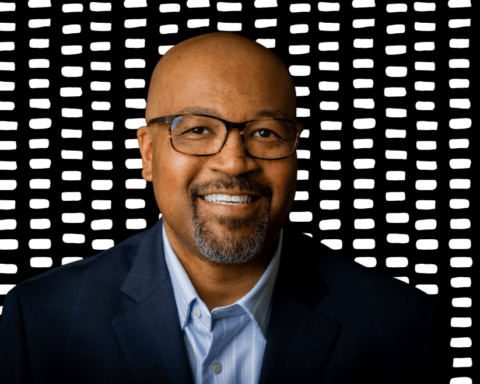

“At Saalex, we are continually exploring avenues for inorganic growth to complement our strong proposal capabilities. The acquisition of Spalding Consulting aligns seamlessly with our expansion objectives,” said Travis Mack, Chairman and CEO of Saalex. “

This acquisition follows Saalex’s 2022 purchase of Netsimco, an information technology services provider, for approximately $30 million. The transaction aimed to enhance Saalex’s IT capabilities in the Department of Defense and aerospace markets. Netsimco, with over 180 employees across four states and a consistent annual growth rate of 20 percent, played a crucial role in Saalex’s long-term growth strategy.

The Spalding Consulting acquisition brings several key benefits to Saalex:

Expanded Defense Footprint: Gaining access to Spalding’s established clientele and expertise strengthens Saalex’s presence in the defense industry, unlocking doors to new contracts and opportunities.

Talented Workforce Integration: With Spalding’s 430 skilled professionals joining Saalex’s ranks, the employee base surpasses 1,200 nationwide. This influx of talent enhances Saalex’s ability to deliver a broader range of services to its clients.

Enhanced Software Development Capabilities: Spalding’s expertise in software development complements Saalex’s strengths, enabling the combined entity to offer more comprehensive solutions to clients.

Projections suggest an annual revenue increase exceeding $175 million, solidifying Saalex’s position as a major player in the aerospace and defense market.

This acquisition signifies a significant step forward for both Saalex and Spalding Consulting. Saalex gains a valuable foothold in the defense sector while Spalding gains access to resources and opportunities that fuel continued growth.

The strategic synergy not only benefits the companies involved but also their clients, who can expect a wider range of innovative and comprehensive solutions to meet complex needs.

Looking ahead, Spalding will operate as a wholly owned subsidiary of Saalex, with the executive leadership remaining in place during the transition.

:max_bytes(150000):strip_icc():format(webp)/Untitleddesign2-8e54289f55594e32aba19c3b19d3c1b6.png)