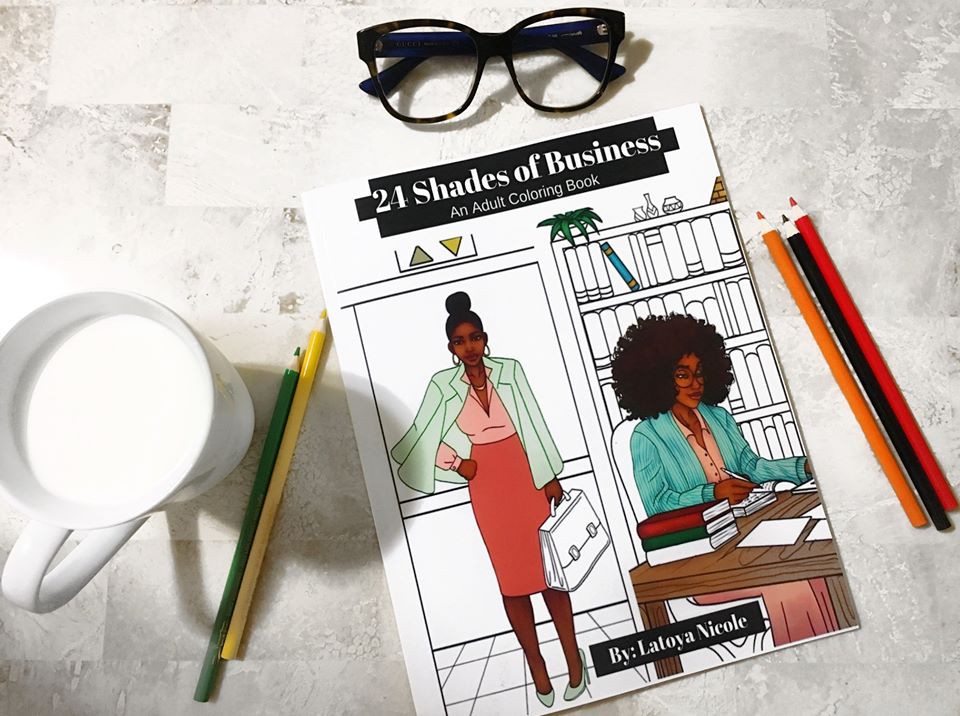

This Black Owned Coloring Book Series Was Created To Inspire and Relieve Stress

Today is National Coloring Book day! This is the perfect day to support a Black owned coloring book business that celebrates Black women and girls!

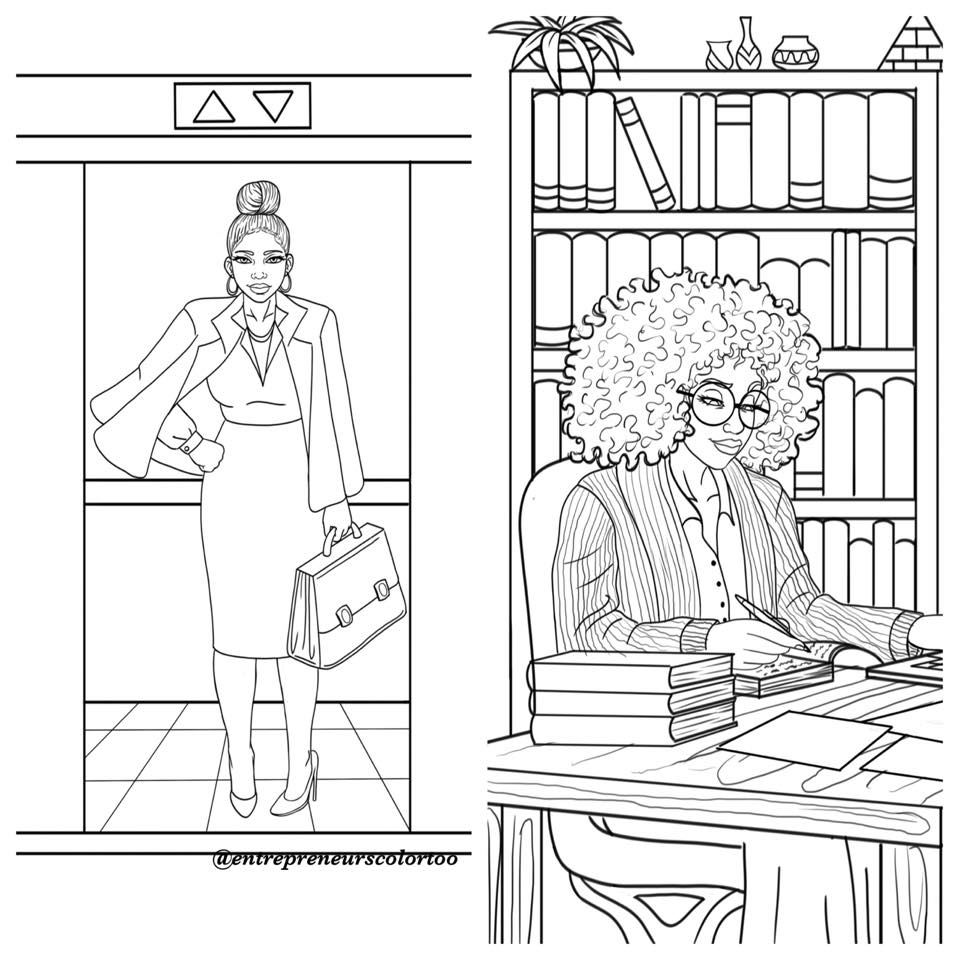

Entrepreneurs Color Too creates adult coloring books to help creatives and entrepreneurs practice self care. Each book is filled with 24 inspiring illustrations that celebrate the beauty of black women and they are the perfect way to de-stress, relax, and get motivated.

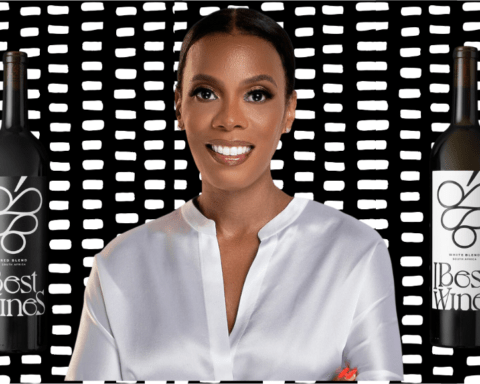

We caught up with founder, Latoya Nicole to find out more about her and her business.

What inspired you to start your business?

I was at work a while back and it was a really busy season and we were all frustrated and overwhelmed with the workload. Some of the managers wanted to try and make things better so they were doing “stress relieving” things like providing free coffee, massages and they also brought each of us coloring books to help “take the load off.”

To be honest, when I first saw the coloring book I was thinking “What am I gonna do with this?” because I hadn’t used a coloring book since I was a child. But one day I had become frustrated to the max and jokingly said to the guy beside me, “Pass me one of those colored pencils!” Once I started coloring, I noticed that I started feeling calmer!

But, I thought nothing else of it until years later and I was browsing the internet trying to figure out great ideas to put in place so that I could create passive income. I was browsing the internet and asking God what my next move should be when I heard “24 Shades of Business.”

When I hear certain things, especially after I ask, I don’t take them lightly because I’m a believer that I have always been given “witty inventions.” I quickly jotted down the title that I had heard and put it in my journal.

Later, I started putting pieces together and remembered how the coloring book from my job had really helped. I also remembered that the coloring book only had trees, mandalas, and birds for me to color but nothing that I could relate to. I started doing more research and found lots of coloring books but very few that looked like me on the cover.

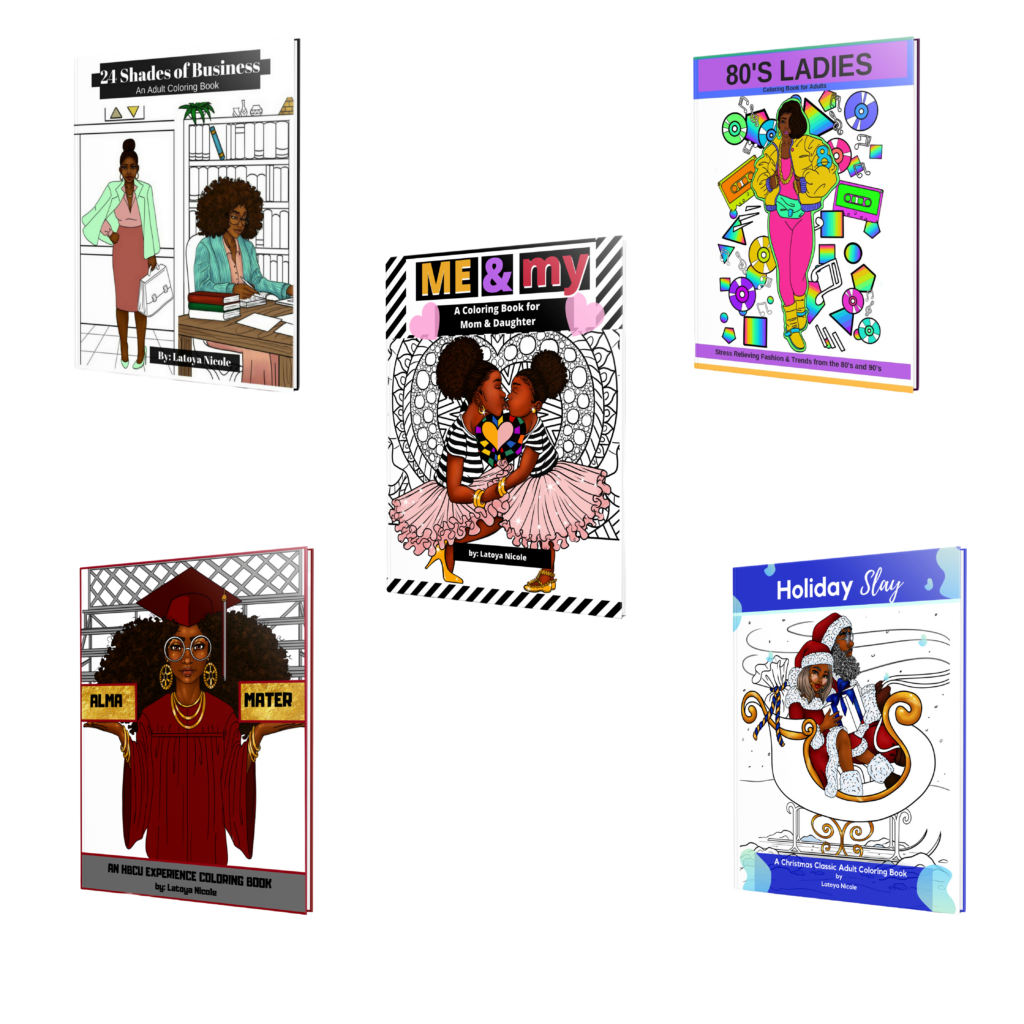

So, I knew that I had to fill the diversity void and create books celebrating Black women. Now, my company Entrepreneurs Color Too has grown into a series of 5 coloring books aimed to help women relieve stress, practice self care, and release their creativity.

How do you decide what images to use in your coloring books?

I like to create a story with my coloring books. Each book tells a different story. For example, my HBCU coloring book tells the story of an HBCU experience including memories from the culture on the yard to the experiences in the classroom.

So, when I‘m creating a new book I start by brainstorming ideas to include everything I already know about the specific topic or niche. Then, I plan out all of the images and types of settings I will want to include.

Next, I take time to research and gather inspiration from little things including people that I see every day along with any trends that I may see that I want to incorporate into my vision.

After I finish jotting down sketches and/or creating all the types of images that I want to add in a particular book, I send my illustrator the list using stick figures, ink pen & pencil drawings as well as pictures that inspired me so that she can make the images come alive and look professional.

What differentiates your products from other coloring books out there?

My coloring books, largely for adults, are focused on black women, black concerns, and my creative vision as a black author who wanted to self-publish images that celebrate, uplift and inspire women and young girls like me, because representation matters.

I will never get tired of hearing words like “I’m 40 years old and this is the first time I have ever seen a coloring book with women that have my features and hairstyles”. It’s good to know that people feel included.

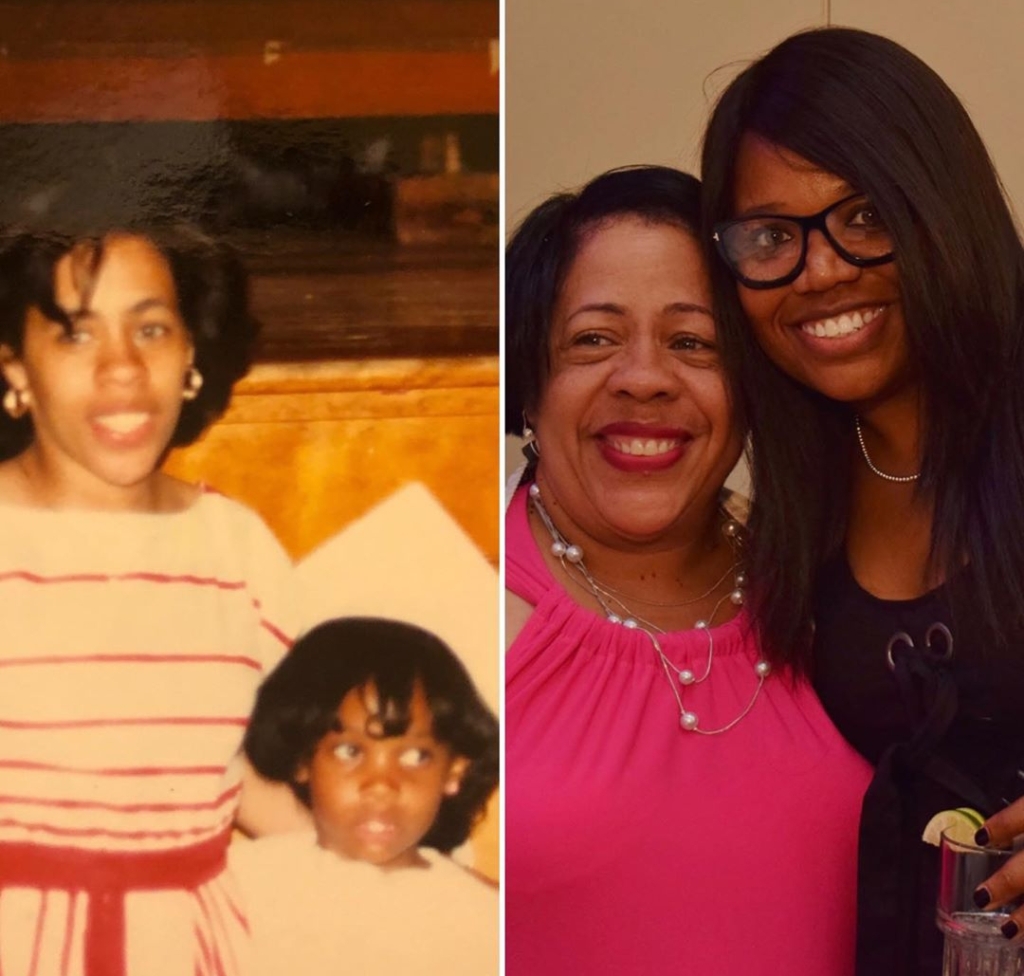

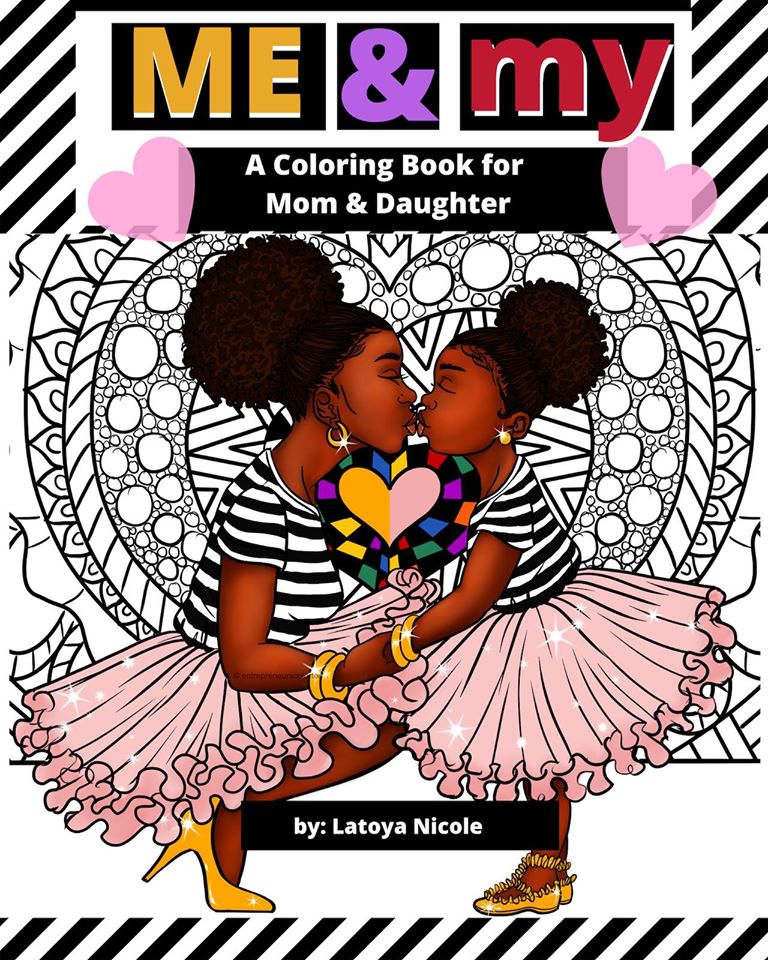

And, it’s so important not only for women but for children to understand the importance of diversity. That’s why I was intentional with the release of my most recent mommy and me coloring book because I wanted to be sure that young girls could also see positive reflections of themselves too.

Where do you see the business in 5 years?

My vision is to continue to expand. I have a lot more books to publish and plan to add other unique and creative things to the brand as well, including a line of journals.

What advice do you have for aspiring entrepreneurs?

Don’t be afraid to take risks. Even during this time, I’ve heard so many success stories, particularly from authors, about how their sales are growing because so many people are looking to support Black Owned Businesses now more than ever. The key is that they were not afraid to start and also not afraid to take calculated risks.

Remember that you are going to need a plan and some traffic in order to sell anything. To start, you should focus on creating something that solves a problem. Then, focus on ways that you will bring traffic to your website to sell that product. This could be from creating an email list to marketing with ads. Ultimately, you need more people to learn about what you do and to become a customer.

Look at what’s working for others. If you follow someone on social media that you like or admire, look at what they’re doing. Of course, do not copy their success, but follow the clues of their success. Whatever they’re doing is working for them and could also work for you.

After you have done your own research, which is extremely important, don’t be afraid to reach out to others who have been successful and done what you want to do. It’s ok to “slide in those DM’s” or email people for advice or even set up a consultation with them. I even offer consultation services and courses at iamlatoyanicole.com teaching others how to start and market their online businesses.

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram &Twitter

Get your SHOPPE BLACK Apparel!