Unity National Bank, the only Black owned bank in Texas, has opened its first out-of-state branch in Atlanta. This is happening in a time when the number of Black owned banks in the U.S. is on decline.

The expansion caps recent years of financial growth at Houston-based Unity, driven in part by the bank’s continued commitment to its Third Ward neighbors, and recent social justice movements. Unity is the only Black owned bank in Texas.

In September 2017, the bank reported assets of more than $98 million, up from $84 million in the same period a year earlier. Between 2015 and 2017, it reported an 18.4 percent increase in assets making it one of the top-performing Black owned banks in the U.S., according to a report from the Federal Deposit Insurance Corp.

Unity’s financial success is an outlier, said William Michael Cunningham, D.C.-based economist and banking expert.

In 1994, there were 55 African-American-owned banks in the U.S. By 2010, that number dwindled to 34. Today, it’s less than 30.

Unity also was able to avoid taking up any government bailouts after its board members and shareholders invested their own capital into keeping the bank open. They weren’t willing to let go of its historic and symbolic significance, Brooks added.

Banks like Unity popped up across the nation during the 1960s civil rights movement. African-American small business owners, denied financing at white-owned banking institutions, opened their own banks within their neighborhoods. They served as a means to build their own capital, and as a symbol of black economic power.

Unity was originally founded in 1963 as Riverside National Bank, led by local doctors and lawyers.

Cunningham said that often these founders had no plan of succession, leading to bank closures by the next generation.

In 1985, the bank’s name changed to Unity National Bank. Four years later, Unity was acquired by a new set of minority leaders who continued the bank’s legacy of serving lower-income residents in Houston’s Third Ward, going to so far as to offer financial literacy services to customers denied loans at other banks. Workers at Unity continued to sit down with customers, walking them through why they were denied and helping them brainstorm ways to improve their financial standing to qualify.

For all its efforts, Unity was losing higher-earning clients to larger banks such as Wells Fargo that offered more resources.

By 1998, Unity opened its first branch in Missouri City where it attracted black customers from a higher income bracket, as well as a greater variety of customers including Latinos and Asians.

Brooks noted that as Unity continued to serve its community, this time as a regional bank, there was some question over whether the community appreciated Unity’s services and history.

In 2016, the bank got its answer.

Following the police shootings of black men across the country in 2016, including Alton Sterling in Louisiana and Philando Castile in Minnesota, rapper Killer Mike offered an alternative to protests. At an MTV and BET town hall meeting, as an extension of the Black Lives Matter movement, he called for 1 million African-Americans to deposit $100 in black-owned banks. It would be a means to heal by strengthening the community’s power, specifically its economic power.

The movement #BankBlack took off. Unity was taken by surprise.

More than 350 people opened new accounts at Unity days after Mike’s announcement. They waited in line for hours, some traveling from out-of-state where their black-owned banks had closed.

Across the nation, Mike’s million goal was met and banks like Unity experienced a revival that some academics, including Cunningham, cite as potential for these banks to grow in size rather than shrink as projected

“In history, movements pop-up that change the trajectory of a given industry,” Cunningham said.

Sherifat Lawal, assistant vice president of lending at Unity, said that the push from #BankBlack is still being felt today with residents from across Texas and out-of-state asking for new branches to open.

The expansion into Atlanta this year, Lawal added, was in part driven by the public support in 2016.

Kase Lawal, local billionaire and chairman of Unity, had been interested in having Unity enter the Atlanta market since 2007 because it’s the so-called “mecca” of black business. Opportunity opened up in 2017 after one of Atlanta’s prominent Black owned banks closed, leaving a void Unity could fill.

More than 500 guests attended the grand opening ceremony on March 26 at the corner of Peachtree Street and M.L.K. Jr. Drive, including U.S. Rep. John Lewis, D-Ga., and Atlanta’s Mayor Keisha Lance Bottoms.

“By providing opportunities to achieve financial success, businesses like Unity National Bank help build equity into the fabric of our community,” Bottoms said in a statement. “Having a bank that understands the needs of the unbanked and that specializes in serving Black entrepreneurs is an essential part of my administration’s goal to build one Atlanta.”

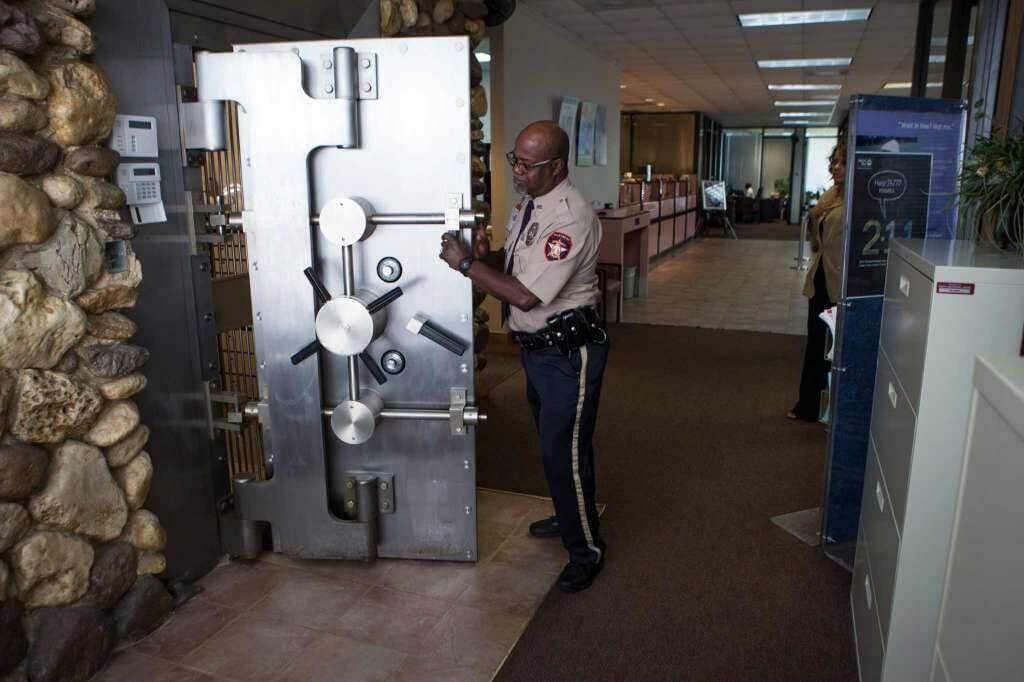

Back at the Houston branch, a sign announcing the Atlanta expansion greets clients.

“They’re excited about their bank going to Atlanta,” Brooks said. “Everyone wants pride of ownership, and our customers own the bank with us.”

Unity continues to be a supporter of Black people in the Houston region, including members of the Greater Houston Black Chamber of Commerce.

To further tap into the renewed public interest in Black owned banks, Unity is set to launch a full online banking service by year-end so residents from across Texas and the U.S. can open accounts electronically.

Source: The Chron