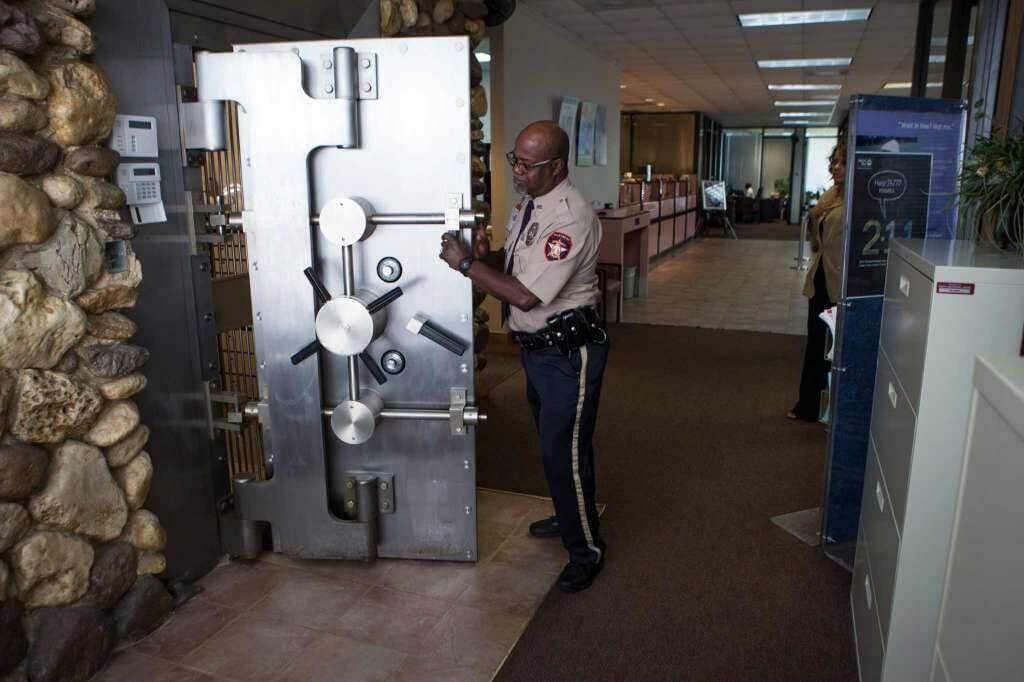

Over the past few years, Black-owned banks have had some difficulty attracting IT professionals. And a national labor shortage, a pandemic, and the “great resignation” have not made this issue any easier to resolve.

Over the past few months, a slowdown in venture capital funding into the fintech sector has led to a wave of layoffs as a result of high interest rates, rising inflation, and falling stock market valuations.

Coinbase announced in June that it was laying off 18% of its workforce. Robinhood cut 9% of its workforce in April, followed by a 23% reduction in August. PayPal’s security R&D team, which was focusing on emerging technologies, was also laid off.

The fintech sector’s funding woes could possibly be the answer to the tech talent shortage at Black-owned banks. The opportunity presents itself at a pivotal time as the banking sector accelerates its transition to modern technology across the board, from artificial intelligence software to core computing in the cloud.

Black-owned banks now have an opportunity to hire innovative candidates that possess a combination of tech, customer experience, and finance skills.

But first, banks should ensure they have the systems in place to hire as quickly as possible.

Solutions include video interviews or implementing an interview and evaluation structure that allows multiple stakeholders to speak with applicants over the course of a single day. These “marathon interviews” can be demanding but will accelerate the hiring process.

A particular focus should be placed on hiring those who specialize in artificial intelligence, machine learning, and data science. Banks have lagged behind when it comes to personalizing financial services and products. Meanwhile, fintech’s have done a great job of understanding client concerns.

As more fintech talent becomes available, banks should also consider what customer experience experts with fintech experience can bring to the table.

This would be an opportunity to hire those who have a thorough understanding of millennial and Gen Z customers and know how to cater to their needs.

These experts specialize in paying attention to consumer behavior and pain points while collaborating with technology teams to create personalized solutions.

Another reason that banks have struggled to attract tech talent is that their traditional cultures do not align with that of tech workers.

Traditional financial institutions should explore key motivators which would make their culture appealing to those who have developed skills in the fintech industry.

Flexible scheduling and the option to work from home are benefits that will help lure fintech talent. Talented millennial employees have realized the benefits of working when they are most effective as individuals, as opposed to the typical 9–5.

However, although fintechs’ cool culture and excitement gave them an advantage in recruiting, in uncertain economic times, workers with families may find greater security in traditional banks.

All of that being said, recruiting is only half the battle. As the skills gap continues, banks will also need to prioritize employee retention. Investing more in emerging technology and updating legacy systems will help retain these tech savvy professionals.