Few institutions are as strongly connected to black communities as historically black banks. Where others see neighborhoods that are too risky or, conversely, only targets for predatory lending, they see differently.

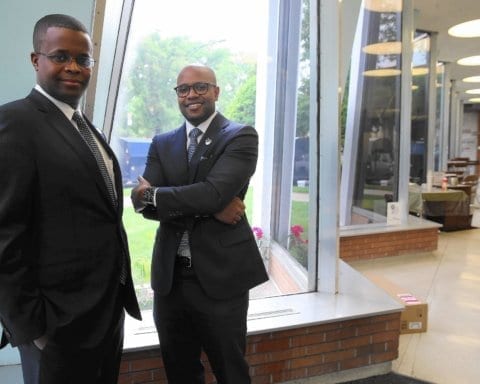

Joseph Haskins, CEO of The Harbor Bank of Maryland, tells of a black entrepreneur from an inner-city neighborhood who came needing a loan to get started working on a new contract for his storage and junk removal business. The loan would allow him to hire another 15 people on top of the 25 he already employed. Interested in the impact of such a loan, Haskins asked about who those 15 people would be.

“He has no problem finding people in the inner city because they know each other,” Haskins, who co-founded Harbor Bank 35 years ago, adds. “He’s not holding an incarceration against them, or counting them out because they didn’t finish high school. He said, ‘If I can get this money, it’ll allow me to do this contract, and you can come up and see who I’ll hire.’”

Historically black banks have had a strong role in black communities. Their loans often finance projects that other banks wouldn’t take on, and at fairer interest rates.

And yet partnering with or addressing the top priorities of historically black banks hardly registers a blip on policymakers’ radar screens. At best, banks that serve black communities have been left to fend for themselves, while public policies provided an extra boost to banks serving exclusively white communities. At worst, policymakers from both parties have held up historically black banks as a way of distracting from structural changes necessary to address the racial wealth gap in the United States.

That history of black banks is now more accessible than ever before, contained in the pages of The Color of Money: Black Banks and the Racial Wealth Gap, by author and law professor Mehrsa Baradaran.

“I want to attack this myth about small banking in general, that poor, marginalized communities can overcome systemic macro-economic problems through small banks or community banks,” Baradaran says. “If we’re trying to close the wealth gap, we have to do it the way that everyone else has been able to gain wealth,” referring to the long history of government working hand-in-hand with private banks to create widespread wealth—but only for white households.

As Bardaran’s book shows, banks that focus on lending to black households have never gotten the policy support needed to create wealth.

A bank instead of 40 acres

Offering up a bank as a distraction or a consolation prize in lieu of structural change was there at the very beginning of black banking in the United States.

As told in Baradaran’s book, General William Tecumseh Sherman had confiscated some 400,000 acres of land in the South during the Civil War, and the U.S. government was prepared to hand it over to ex-slaves as a place for them to live free of white control. After President Abraham Lincoln’s assassination, the plan was called off, and all that was left was Freedman’s Savings Bank, the first historically black bank and the only savings bank ever created by an act of Congress. As the book notes, the bank’s intention was to allow ex-slaves to save up their new wages to buy the land that Sherman had promised them. Instead, ex-slaves soon ran into the policies of Jim Crow that denied them the means to make the purchase. In the end, all they got was the bank.

A century later, after the Civil Rights Movement achieved a string of key policy victories including the Civil Rights Act, Voting Rights Act, and Fair Housing Act, President Richard Nixon “threw his weight behind black banking so that he could oppose controversial desegregation programs and woo white moderates and conservatives unwilling to push further on racial reforms,” Baradaran writes. So politically successful was Nixon’s platform of “black capitalism,” Baradaran writes, that every administration since Nixon’s has adopted it in one form or another, including current or former members of the current administration. From Reagan, to Carter, to both Bushes, to Clinton, to Obama, Baradaran shows how each administration has said a lot about the importance of black-owned business and black-banks, while mostly ignoring the structural changes and policy shifts needed to actually create wealth in black communities. The pattern has continued for members of the Trump administration.

“When Steve Bannon is pushing black businesses, you’ve got to wonder,” says Baradaran. “It’s surprising to some, but not if you understand the history.”

There are positive lessons to learn from history, too—like the power of policy to work with the banking system to create wealth for an entire generation of people at a time. Between 1934 and 1968, Baradaran writes, mortgage insurance from the Federal Housing Administration and an accompanying Veterans Administration program opened a spigot of mortgage lending, resulting in millions of mortgage loans on mass-produced homes in ready-made communities across the country. “If you could save a few thousand dollars, you could buy a house, build wealth, and become middle class,” Baradaran writes.

But those loans were only available to white households. The Federal Housing Administration’s rules also contained a number of restrictions that made it essentially impossible to offer those mortgages to people or neighborhoods of color. As Baradaran notes in her book, from 1934-1968, 98 percent of federally insured home mortgages went to white households—the practice that became known as redlining. Those homebuyers left behind black households in inner city neighborhoods that began to decay. Meanwhile, because they focused on lending to black households, historically black banks never got the same boost that other banks got.

“The Federal Housing Administration did more to shape American life than any other government agency during the New Deal,” Baradaran writes. “It is also unparalleled in the injustice its policies wrought on the black population.”

What can policy do for black banks today?

Campaigns to move money to black banks are helpful, in Baradaran’s view, but they are far from sufficient to address the racial wealth gap. In the most recent Federal Reserve estimates, the median net worth of white households is $171,000, while median net worth for black households is $17,600.

Others agree. “I always start by raising the question as to whether or not the racial wealth gap can be closed by autonomous actions by black Americans,” says William “Sandy” Darity Jr., principal investigator for the National Asset Scorecard for Communities of Color project, based at Duke University.

In her book, Baradaran proposes a short litmus test to any proposal meant to address the racial wealth gap: “Does the program require some collective sacrifice or does it place the burden of closing the wealth gap entirely on the black community? If the latter, this is a cop-out that refuses to acknowledge that the black community did not create the problem in the first place.”

If policymakers are committed to closing the wealth gap, she continues, black bankers must be seated at the head of the table—and they should not be the only ones in the room. “Black bankers have a firsthand understanding of the headwinds affecting black prosperity. While black banks cannot close the wealth gap alone, their specialized focus and expertise must play a role in any plan to address this problem,” she writes.

While black bankers would certainly have a lot to say about all kinds of policy or regulatory reforms that would help black households create wealth, the top priority for black banks today is raising capital.

“It always comes back to raising capital,” says Doyle Mitchell, president and CEO of D.C.’s Industrial Bank, which his grandfather founded in 1934. “It’s the biggest challenge for black-owned businesses, period. Raising capital, trying to get to a scale where we can be more profitable.”

In banking terminology, capital is different from deposits. While deposits can come from anyone, capital comes from the bank’s shareholders or from retained profits of the bank. Generally, federal regulators want banks to hold around eight dollars of capital for every $100 they make in loans and other investments, partly as a cushion against losses or downturns.

Crucially, a bank can’t grow without more capital—if a bank doesn’t have enough capital to meet the necessary ratio, regulators might limit the bank’s activities, perhaps even ordering the bank to stop making new loans until it raises more.

“If I can raise the capital, I can scale Harbor eight to ten fold over the next two years or so,” Haskins says. “The demand is there.”

Bigger national or regional banks can attract capital from investors around the world. Community banks—the category of banks that most historically black banks fall into, because of their size and geographic focus—have a shallower pool to draw from. A community bank’s shareholders typically come from its community—local businesses, independently wealthy individuals, or sometimes straight from friends and family of the bank founders.

For historically black banks, community sources are often far thinner than they are for mainstream community banks. On top of the household racial wealth gap, white-owned businesses are bigger and more profitable, averaging $2.4 million in annual revenues, compared with $1.3 million in average annual revenues for black-owned businesses, according to the U.S. Census Bureau’s most recent Survey of Business Owners.

Evelyn Smalls is president and CEO of United Bank of Philadelphia. In a rare breakthrough for a black-owned bank, United scored two capital investments last year, from two larger financial institutions in the Philadelphia region whom Smalls found through industry circles or prior business with United Bank. It’s not just about finding people with money, Smalls explains, it’s about finding investors who also understand and place value in the mission of a community bank and especially a black-owned community bank.

In 2012, United Bank joined the Small Business Administration’s 7(a) Loan Guarantee Program, which provides federal loan-loss guarantees to support small business lending to borrowers who would not qualify for conventional small business loans. United Bank is the only historically black bank in the Philadelphia region, and since joining the 7(a) program they’ve made loans to 47 businesses that it otherwise wouldn’t have been able to—and their pace is accelerating, now doing 10-14 such loans a year, at an average loan size around $840,000.

But even with a loan guarantee program, or down payment assistance programs, any bank still needs capital to keep growing.

Mitchell, of Industrial Bank, thinks policy can do more to address the capital issue directly for black banks. For a little over a year now, he says, he’s been talking up the idea of creating a tax credit for investing in minority banks, to incentivize investors who might be interested in making a difference when it comes to equal opportunity for minority communities. He’s had talks with investors who have expressed such an interest, but no one has written a check yet.

Others, like Darity, are more muted about the potential impact of supporting black banks or black businesses. “It’s not necessarily a bad idea, but it’s not going to accomplish the objective of closing the racial wealth gap,” he says.

In Darity’s view, any direct help for black banks would need to be part of a larger program, what he’s referred to as “a portfolio of reparations.”

“Some component would involve distribution of checks,” he says, “but there could also be components of it that could involve various institution building, or small business building. If you had a total sum of funds devoted to reparations, you could design the program so there were multiple ways in which those funds could be used.”

Source: NextCity