How My Handmade Jewelry Business has been affected by the Rona

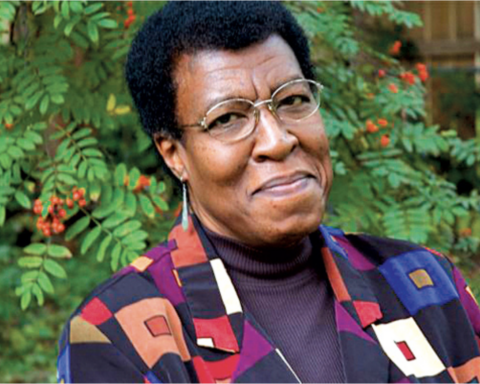

Alicia Goodwin has been creating jewelry since childhood. In 2003, she started her handmade jewelry business, Lingua Nigra. Her pieces range from hand reticulated brass and etched sterling silver, to blossom-like jewelry.

Since the outbreak of the Coronavirus, business has slowed dramatically. We caught up Alicia to find out how she’s dealing with this new reality.

What were your initial thoughts when you learned about the outbreak?

How has it affected your business?