This Black Owned Candle Business Won’t Let a Pandemic Put Its Fire Out

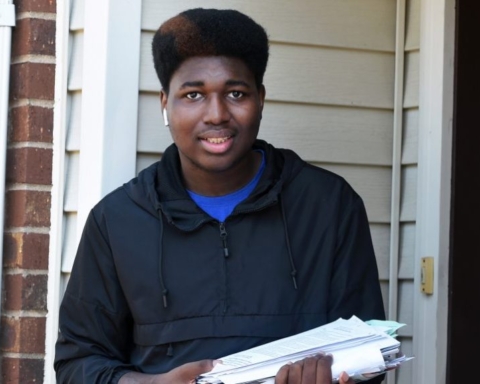

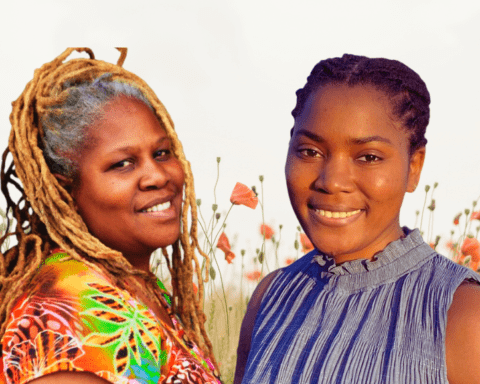

Scent & Fire Candle Company is a Black owned candle business that makes products for those who enjoy using aroma-driven mood enhancers to beautify their environment.

We caught up with founder, Monisha Edwards to find out what she did to increase her sales in a time when many businesses are struggling.

What inspired you to start your business?

I started Scent & Fire Candle company because I have suffered from anxiety, stress, and depression for many years.

I started looking into holistic ways to alleviate stress and anxiety and stumbled upon aromatherapy. From there, I started getting into candle making. I created three signature scents for myself and being a brand strategist, I decided to design a mockup of my labels and posted them on Facebook.

Everyone wanted to buy my candles, so I set aside some time over a weekend and designed a website, ordered supplies to make more candles, come up with the name Scent & Fire, and registered the business.

I decided to use my candle company as a platform to educate about mental health, wellness, and the importance of practicing self-care.

What were your initial thoughts when you learned about the Coronavirus outbreak?

When I initially heard about the Coronavirus outbreak, I thought that it would be another Ebola or Swine Flu phase. I felt bad for the people who were contracting it and becoming ill, but I had no idea that it was what it is now.

Once I started hearing about the seriousness of the virus, I started taking extra precautions in my daily routines and started going out less often. When we were all encouraged to stay home, I basically self-quarantined even though I wasn’t sick. I have chronic asthma, so I definitely couldn’t afford to get sick.

How has it affected your business?

The Coronavirus crisis affected my business tremendously. Sales from my online store decreased and by the time March came around, I had no income lined up, so I had to figure out how to make money to help me pay bills.

What new strategies have you implemented or do you plan to implement in your business?

My sales increased after I created a Quarantine based theme and playlists that came with the candles. The names are Socially Distant, Shelter & Chill, Living Room Flex, and Therapy In Place.

People thought that the names were really creative, and they also liked the fact that you could scan a QR code on the box that the candles come in, light the candle, and vibe out to some good music to create an experience right at home.

Once I did this, my story was picked up by the news, and sales increased even more due to people loving my story about how I basically “turned lemons into lemonade” during this tough time where many small businesses are struggling to keep doors open. I definitely made a great pivot with my candle brand, and I feel like things will do even better in the coming months.

I also plan to do more marketing via social media. I feel its essential because even after the Shelter-In-Place mandate is lifted, many people will still be cautious of going out in public or be in big crowds, and they will still be online more often than not.

If you had one ask of your community right now, what would it be?

If I would ask that my community pray for and support all small businesses right now, especially black-owned businesses and establishments. We need you the most.

Share a post, buy a gift card, or patron a black-owned establishment as often as you can. Times like these are difficult and we are in dire need of support from our very own community.

–Tony O. Lawson