When Christopher Wallace—better known as The Notorious B.I.G.—was killed in 1997, his estate was worth an estimated $10 million.

What happened next is one of the most remarkable legacy-building stories in music and entrepreneurship.

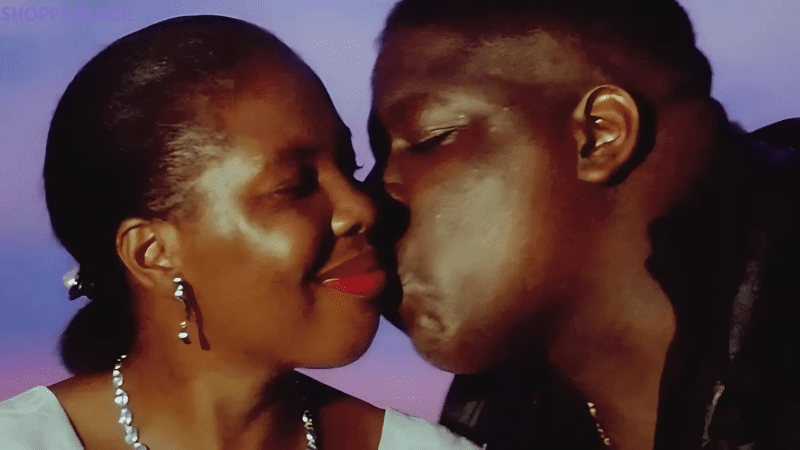

At the center of it all was his mother, Voletta Wallace. With no formal business background, she transformed grief into purpose, strategically growing her son’s estate into a brand now valued at over $200 million, continuing to influence culture and generate wealth decades later.

How Voletta Wallace Protected and Grew Biggie’s Legacy

She became the executor and face of the estate. Rather than selling off assets for short-term gain, she made deliberate decisions to retain ownership, build long-term value, and reintroduce Biggie’s music to new generations.

Under her leadership, the estate:

Secured licensing and merchandising deals with global brands

Released the Notorious (2009) biopic and a Netflix documentary

Oversaw streaming, reissues, and anniversary campaigns

Reclaimed full ownership of Biggie’s publishing and master rights

Secured his 2020 induction into the Rock & Roll Hall of Fame

The $200M Deal That Cemented Generational Wealth

In one of her final moves as executor, she negotiated a landmark deal with music investment firm Primary Wave, finalized in early 2025. According to The Wall Street Journal, Primary Wave acquired a 50% interest in Biggie’s estate, valuing his life’s work at over $200 million.

The deal included rights to:

Biggie’s full music catalog (publishing + master recordings)

Name, image, and likeness (NIL)

Branding and merchandising assets

Future opportunities in film, TV, and media development

This wasn’t just a financial transaction—it was a strategic handoff. Primary Wave is known for legacy partnerships with the estates of Bob Marley, Whitney Houston, and Luther Vandross. The firm brings global marketing power and long-term licensing capabilities to scale Biggie’s legacy far beyond music.

In this case, Primary Wave pledged to continue building on Wallace’s vision by:

Reintroducing Biggie’s music to Gen Z and Gen Alpha

Exploring immersive tech like AR/VR concerts and documentaries

Launching new product collaborations and limited-edition drops

Positioning Biggie as a global cultural icon, alongside Tupac and Bob Marley

For Voletta Wallace, the deal was never about an exit—it was about amplifying. By retaining 50% ownership and selecting a mission-aligned partner, she ensured that her family would remain at the center of all future decisions—financially, legally, and creatively.

“This is about preserving Christopher’s legacy the right way,” a family spokesperson said. “He meant something to people across generations—and that’s only going to grow.”

The move capped decades of stewardship, turning a tragic loss into a lasting empire.

Lessons for Entrepreneurs and Creatives

This isn’t just a story about music—it’s a case study in legacy, ownership, and disciplined brand building. Voletta Wallace’s approach offers powerful lessons for anyone building something meant to last:

Own your rights: IP, content, and brand equity are the foundation of long-term value.

Be strategic with partnerships: Not every deal is worth doing—align values first.

Think beyond the now: She played the long game, building patiently and intentionally.

Protect the mission: She stayed focused on honoring Biggie, not exploiting him.

In an industry where too many estates are mismanaged or undervalued, Voletta Wallace built a blueprint.

She didn’t just preserve Biggie’s legacy—she expanded it, institutionalized it, and turned it into an intergenerational asset.