The dream of a Black owned credit union in north Minneapolis is close to becoming a reality. The Association of Black Economic Power is behind the movement that has city leaders pledging money to help.

Black Owned Credit Union

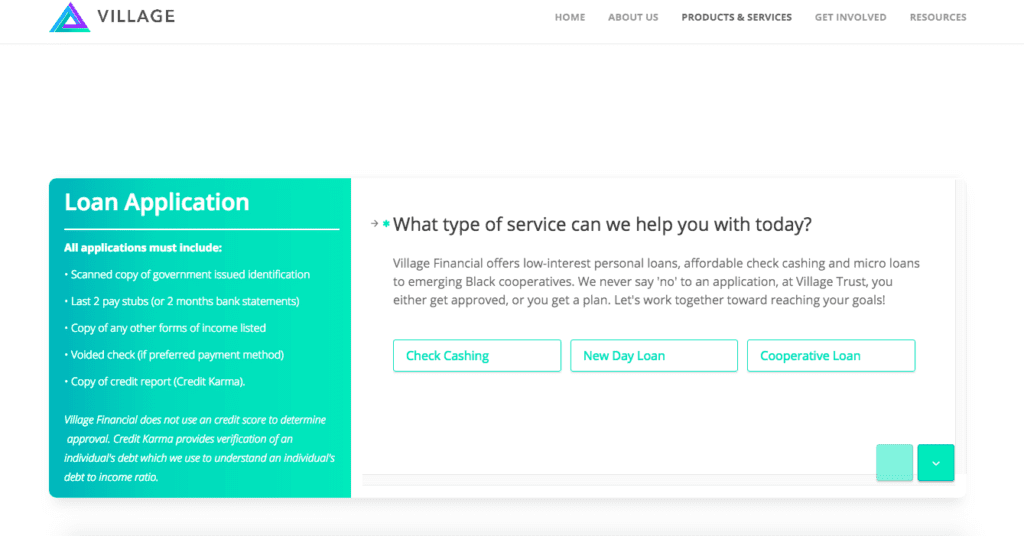

The community development financial cooperative is called Village Financial Cooperative – to build trust within the community. Village is already helping those who have pledged to be part of the cooperative.

The small space on Colfax Avenue in north Minneapolis is poised to bring about big change to a community looking for economic empowerment.

“This work actually came out of a community voice in a meeting we had on the north side right off Broadway a week after Philando Castile was killed,” Me’Lea Connelly said.

The anger and frustration of a community was put into action. Connelly, director of the Association of Black Economic Power, says it was the community that decided a black-led financial institution was the best way to address racial disparities.

“We’ve been unapologetic about making sure that the folks that have been carrying the burden of racially-charged oppression in the financial sector are in the position of making decisions and leading in this institution,” Connelly said.

“This isn’t a parachute model of someone coming in from the outside of the community and dictating what solutions need to be made.”

“This isn’t a parachute model of someone coming in from the outside of the community and dictating what solutions need to be made.”

Among the supporters of the new venture is Minneapolis Mayor Jacob Frey. In his first budget address in August, Frey earmarked $500,000 of the city budget for the Village Financial Cooperative, though those designated funds must be confirmed by the Minneapolis City Council at its December meeting in order to become a reality.

North side residents are doing their part as well. At the end of 2017, 1,100 people pledged their support.

So far, Village has $3.4 million in pledge deposits.

“Owning a home, purchasing a car, going to school, taking out personal loans to achieve whatever goal it might be — we want to partner with folks, especially those on the north side and black community, to make sure they have someone on their side,” Connelly said.

Village is waiting for the credit union’s charter and insurance to be approved, but it’s already helping the community.

“We’ve developed an alternative to payday lending called the new day loan,” Connelly said.

Village is also doing affordable check cashing until it officially opens in 2019.

Connelly says the foundation of services is all about relationships and being with the members on their financial journey.

Source: Minnesota CBS