Africa Focused Private Equity Firm Raises $900 Million

Development Partners International (DPI), a premier investment firm focused on Africa, today announced that African Development Partners III Fund (ADP III), has exceeded its US$800 million target, and is set to hold a final close at US$900 million, with an additional US$250m of dedicated co-investment capital. This brings a total of US$1.15 billion for investments on the continent. The fundraising establishes ADP III as one of the largest funds dedicated to investing global capital in Africa.

ADP III will invest in established and growing companies in industries that benefit from Africa’s fast-growing middle class and the increasing digital transformation of the continent. All investments have the highest standards of impact and environmental, social and governance (“ESG”) work. In doing this work DPI is using its proprietary DPI Management System (“DPIMS”) toolkit to deliver impact in line with 10 of the UN Sustainable Development goals, as well as driving the highest standards of ESG.

Runa Alam, co-founder and Chief Executive of DPI commented: “Africa remains an exciting investment destination with positive demographics, rising adoption of technology, and rising consumer and business spending. Against this backdrop, DPI has continued to generate top quartile returns by leveraging our team’s deep-rooted local expertise across the African continent.

“As we look towards the future with our ADP III fund, we will focus on innovation-driven companies leading the digital transformation of the economies in which they operate. In addition, our deep integration of impact and ESG initiatives in the investment life cycle has been widely recognised and ensures we are known as a trusted partner.”

ADP III secured capital from a broad range of leading pension and sovereign wealth funds, development finance institutions, endowment and foundations, insurance companies, fund-of-funds, asset managers, and impact investors. The global investor base represents 20 countries across North America, Europe, Middle East and Africa. In addition to strong support from existing investors, DPI welcomed over 25 new LPs into its investor base. This is testament to DPI’s track record and ability to create institutional-grade investment opportunities in Africa, while continuing to deliver sustained environmental and economic impact.

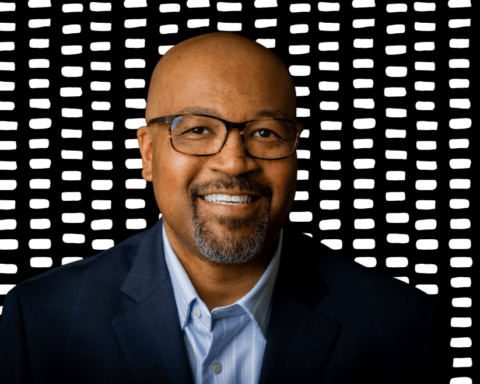

Joanne Yoo, Managing Director at DPI, said, “The strong support for ADP III validates our strategic focus, creative approach and investment discipline. We are grateful for the trust that our investors have placed in DPI, and we are confident that our talented team will continue to deliver competitive returns and impact.”

ADP III has made four investments to date, including:

- Channel VAS, a leading global fintech business providing mobile financial services;

- SICAM, a leading Tunisian tomato producer, in one of the largest private equity transactions undertaken in the country;

- Kelix Bio, a biopharmaceutical platform broadening access to speciality generic drugs across Africa; and

- MNT-Halan, Egypt’s leading fintech ecosystem.

Additionally, DPI has a significant pipeline of investment opportunities across the continent, focused on key sectors of the economy such as financial services, healthcare, agri-business, education, and telecom infrastructure.

DPI places an emphasis on promoting best in class standards in ESG through its investments, with the aim of creating institutionalised high-performing companies at exit. Working with its portfolio companies, DPI seeks to contribute to the UN Sustainable Development Goals by implementing its proprietary Impact and ESG Management System based on three key impact themes: Job Quality, Climate Change, and Gender Balance.

ADP III was the first African fund signatory to the Operating Principles for Impact Management (“Impact Principles”), an international market standard for impact investing and the first to be granted 2x Flagship Fund status, as part of the 2x Challenge, a gender-lens initiative.

PJT Park Hill acted as advisor and placement agent for ADP III, and Debevoise & Plimpton LLP served as legal adviser for the Fund.

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram & Twitter