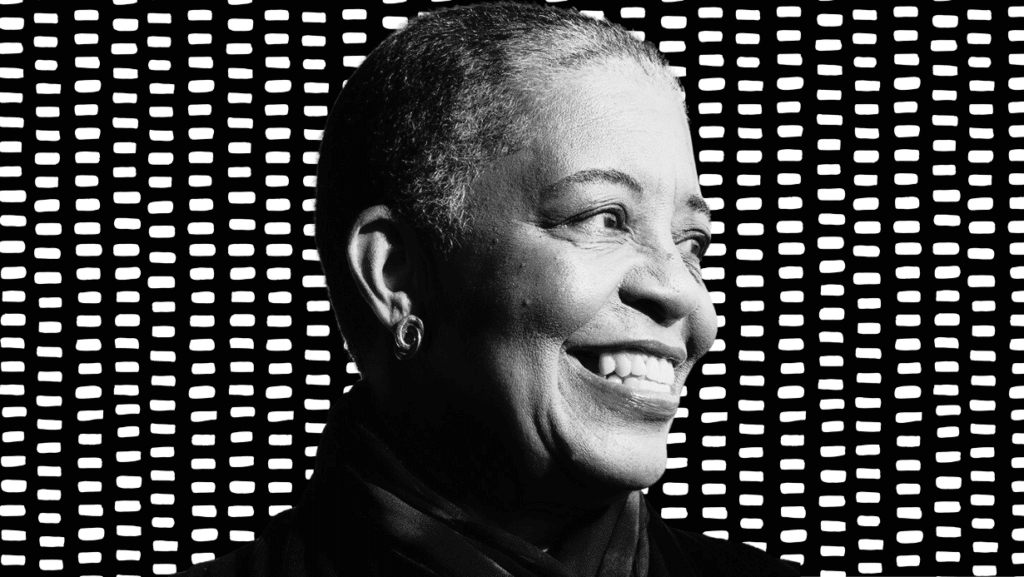

In this interview, Nia Batts, a General Partner at Michigan-based Union Heritage Ventures, provides insights into her journey into venture capital and her perspectives on the evolving landscape in Michigan.

With over three decades of experience in the capital markets, Nia is not only committed to driving growth in investment portfolios but also dedicated to empowering minority and women-led firms and the communities they serve.

Can you tell us about your journey into the world of venture capital?

My background is in corporate media and entertainment. I spent the majority of my professional career at what is now Paramount (formerly ViacomCBS) overseeing Strategic Partnerships and Social Impact. That work brought me back to my hometown of Detroit at a time when the city was undergoing a significant period of revitalization. When you’re from Detroit, even if you’ve only lived there briefly, it never leaves you. You carry it with you and talk about it every chance you get because you feel a responsibility to combat the dominant narrative with stories of your lived experiences.

In 2012 I helped put together a weekend with a group of friends to show our friends on the coasts what was possible in our city. We thought maybe 20 people would show up, but we ended with more than 125 participants. We named it after a mural created by youth in the Detroit Summer program: Another Detroit is Happening. Another Detroit is still happening.

I too, with my partners, Katy Cockrel and Sophia Bush, built and launched a business in Detroit, raised a pre-seed round of investment and unfortunately faced the reality of winding down a business that was not built for the economic effects of COVID that lasted much longer than expected. But that fueled the next chapter, bringing the conversation around equity for women of color from the beauty space into the investment space.

We’re currently the only African-American majority-owned venture capital firm in the state of Michigan, and we are also majority women-owned and led.

Are there any exciting trends or opportunities you’re currently observing in your focus industries within the VC space?

I’m a third-generation Michigander, so I’m long on Michigan. I also feel the same existential dread about climate change that most others my age and younger do. So I’m interested in building for the future. Not only are there great climate tech and clean energy companies coming out of Michigan, but many are diversely owned and led. One of the greatest wealth transfers in a generation is going to happen in this space, so as an investor, I’m interested in the long game.

A trend I don’t like is these grant competitions that are advertising non-dilutive capital for winners but then in the fine print you find out it’s a SAFE (Simple Agreement for Future Equity). I’ve seen this impact diverse founders especially. There needs to be more cultural competency from early-stage investors and truly value-added capital. We’re trying to be really intentional about not just critiquing the problem, but being a part of the solution, as well.

What excites you the most about Michigan’s tech and entrepreneurial landscape?

Michigan has always been a place where we make things, and we make things happen. We have shown over and again that we are a resilient and innovative community. The only place in the country that has more engineers per capita outside of Silicon Valley is Southeastern Michigan. Before there was Silicon Valley there was Detroit. If I were a betting woman, I’d say Detroit is going to Detroit again.

The other thing about Detroit and Michigan is we’re not waiting for anyone to save us. There’s an incredibly, diverse, leaderful movement of entrepreneurs here that have self-organized and are helping each other. The Black Tech Saturdays community that convenes at Newlab is really leading that charge, as well as Michigan Tech Week’s annual conference.

How can Michigan continue to build on its momentum as a tech hub, and what role do you see Union Heritage Ventures playing in this ongoing development?

We talk a lot about diverse entrepreneurs, and absolutely should. But we also need to talk about diverse allocators. So, that means everyone with a meaningful budget has to engage and participate. There has to be accountability in the system.

That means the state, corporations, and non-profits; everyone making the decisions needs to acknowledge that there is an ecosystem of entrepreneurship that doesn’t only begin and end with founders. Frankly, as venture investors, we owe a debt of gratitude to the angel community who have invested in companies and believed in founders before they had an MVP.

Without them, there is no us. I think part of our role moving forward has to be creating space for more diversity on the cap table of investments we make. How we go about doing that is an active conversation at our firm.

Interested in investing in Black founders? Please complete this

Interested in investing in Black founders? Please complete this