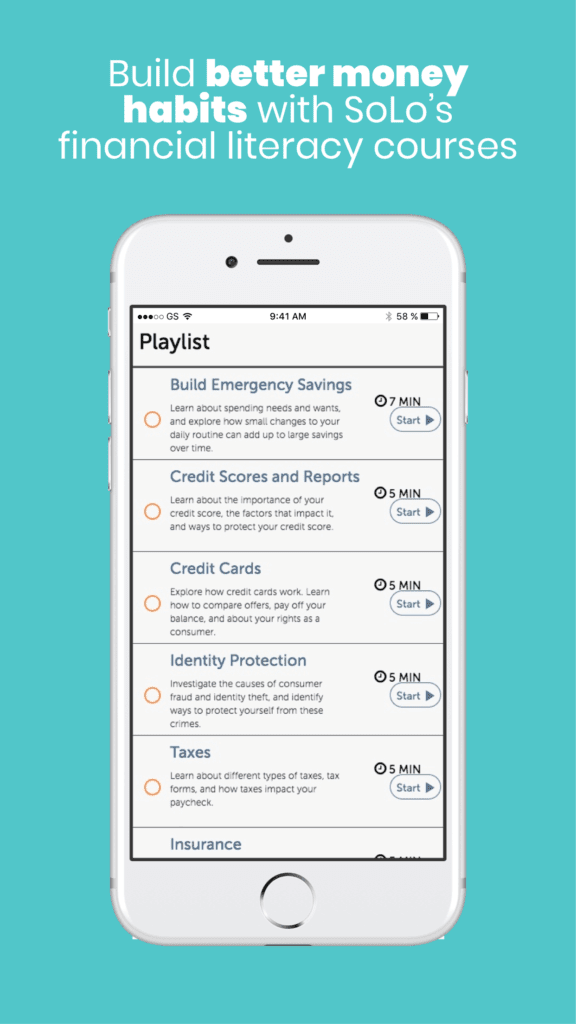

SoLo is a Black owned lending app that was formed in 2018 to create a viable, non-predatory option for moments when life happens. The Los Angeles based company is on a mission to help the millions of Americans that are experiencing financial hardship due to pandemic.

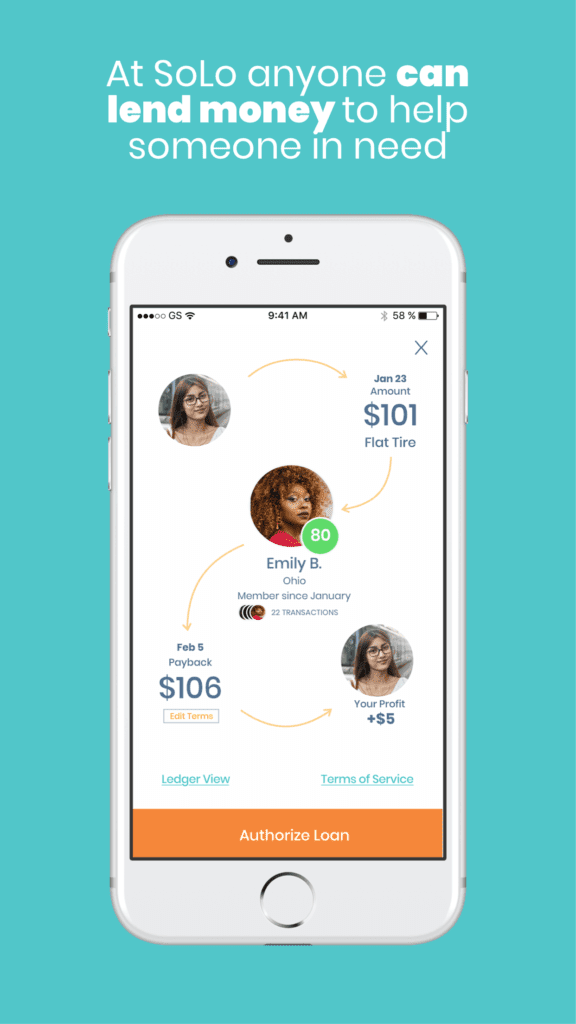

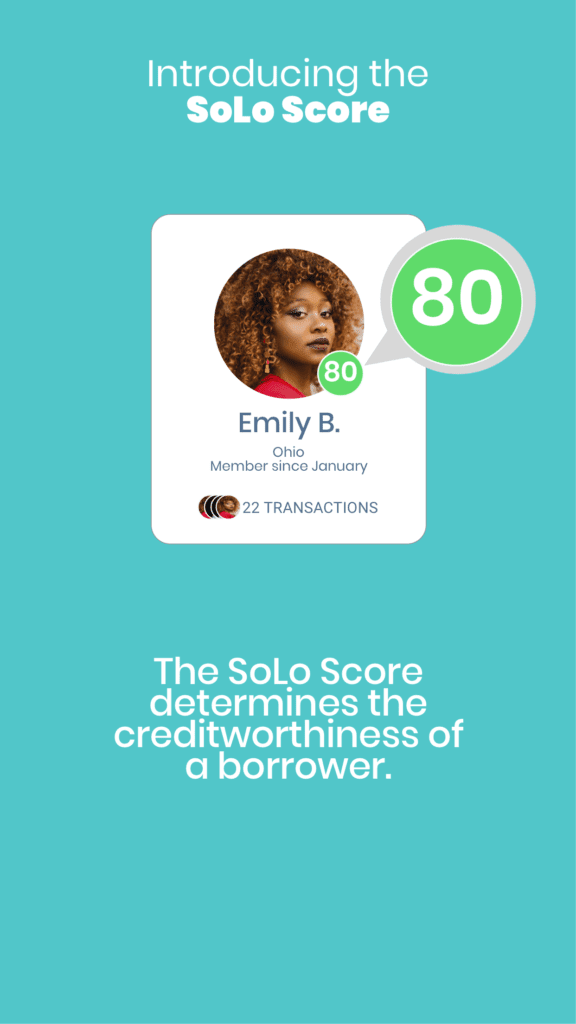

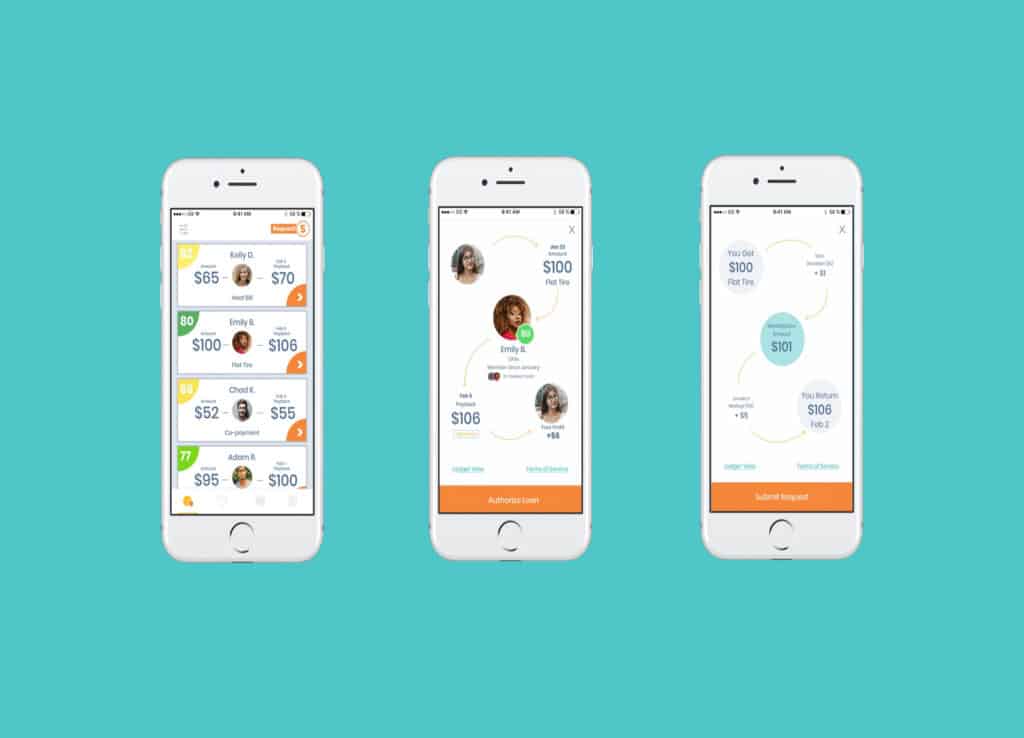

SoLo connects lenders and borrowers with access to loans under $1000.00 and allows borrowers to set their own terms and provide appreciation tips to lenders who agree to fund a loan.

SoLo also allows lenders to make loans based on personal preferences. You can filter the marketplace according to what factors are most important to your lending strategy e.g., payback date, borrower history, etc.

“Even before the pandemic, 70 percent of Americans were living paycheck to paycheck, and many didn’t have $400 in their savings account,” Travis Holoway, co-founder and CEO of SoLo Funds told Crunchbase News. “More than half of the country has been waiting on $600 for more than six months.”

The startup’s rapid growth (2,000% growth in 2020) has helped it raise $10 million to fuel expansion across the country. The latest round was led by ACME Capital, and includes Impact America Fund, Techstars, Endeavor Catalyst, CEAS Investments, and others.

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram &Twitter