by Tony Lawson

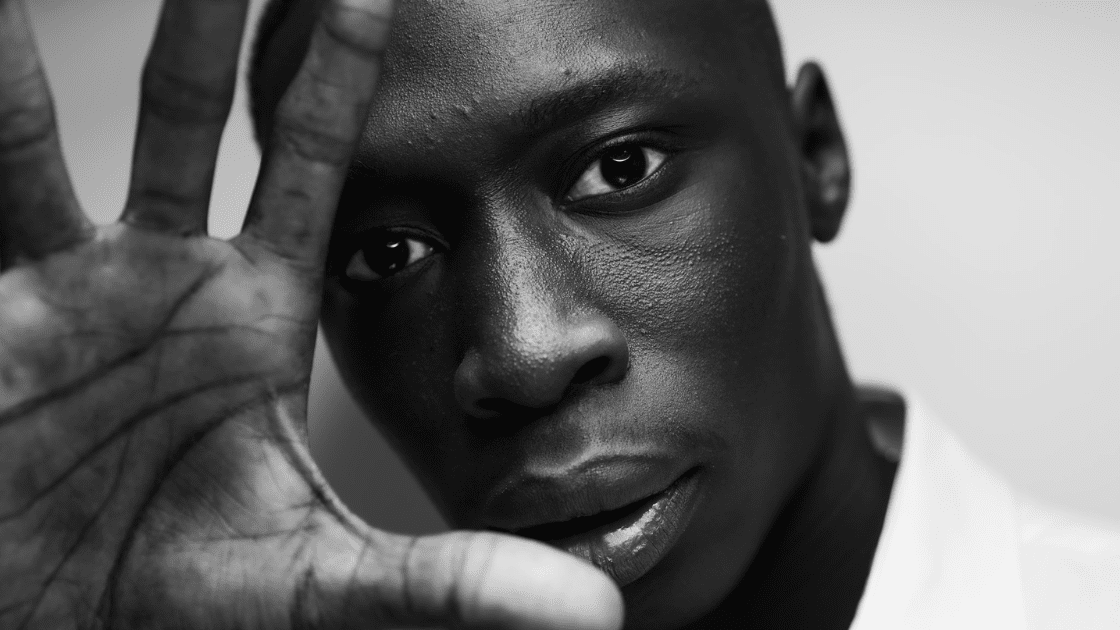

Khaby Lame became the world’s most-followed TikTok creator, with more than 160 million followers, building one of the largest personal audiences on the internet.

That scale didn’t just make him visible. It created the foundation for a business that could exist beyond social platforms.

Rich Sparkle Holdings recently announced plans to acquire Step Distinctive Limited, Lame’s operating company, in an all-stock deal valued between $900 million and $975 million. Step Distinctive oversees Lame’s commercial activities, including licensing, e-commerce, and brand partnerships.

As part of the agreement, Rich Sparkle will hold exclusive rights to Lame’s commercial operations for the next three years. This includes the use of an AI twin, which allows his likeness to be licensed for commercial purposes.

The size of the deal has captured attention. The more important story is what the agreement actually does. It locks in wealth and confirms ownership today, while leaving open how control will take shape over time.

At its core, the transaction turns long-term visibility into lasting value. Lame’s audience was already generating economic opportunity well before an institutional partner entered the picture. His reach was established across markets and platforms without depending on a single trend or format. The deal formalizes that value and places it inside a structure designed to scale it globally.

Ownership is the clearest outcome. Lame retains a meaningful equity stake in Step Distinctive, keeping him connected to the future performance of the business. That matters because ownership shifts the focus from short-term earnings to long-term participation. As the business grows into new markets, technologies, and commercial uses, the value he helped create can continue to grow with it.

Wealth is equally straightforward. The deal provides financial security and reduces dependence on algorithms, shifting platform priorities, or unpredictable brand budgets. For many creators, income arrives early and remains unstable. In this case, financial certainty comes after global reach is firmly established, which changes the balance of leverage.

Control is the part of the story that will unfold over time. Day-to-day decisions, partnerships, and execution now sit with a larger organization, which is common when a business moves into a new phase of scale. What matters next is how influence shows up in practice, from how the brand is used to how major decisions are handled over time. Those realities become clearer after deals are signed, not at the moment they are announced.

The three-year exclusivity window is especially important. It creates a defined period where commercial activity is centralized, followed by a point where terms, renewals, and leverage can be revisited. That moment will offer the clearest signal of how power functions in the long run.

For the broader creator economy, the lesson is not about deal size. It is about timing. Lame built leverage first, then entered a transaction that converted that leverage into ownership and stability. That order matters.

Attention alone is no longer the end goal. Ownership, timing, and long-term participation increasingly determine who benefits as creator-led businesses grow inside larger systems.

The $900M figure will continue to draw interest. The more useful question is how control looks once the deal has time to settle. Wealth and ownership are immediate. Influence reveals itself gradually.

That evolution will determine what this deal ultimately represents beyond the money.