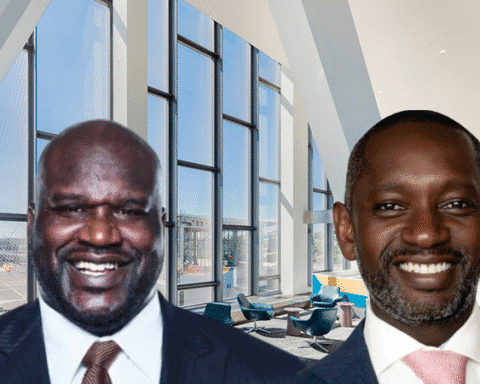

New Catalyst Strategic Partners has entered a new strategic partnership that reflects where healthcare private equity is headed and how emerging managers are reshaping the market.

The firm has officially backed the launch of Ironleaf Capital, a newly formed investment platform focused on technology-enabled healthcare companies.

The move represents New Catalyst’s first major partnership since its own formation in 2024 and highlights its model for supporting next-generation private market founders.

A New Healthcare Investment Firm Led by an Experienced Investor

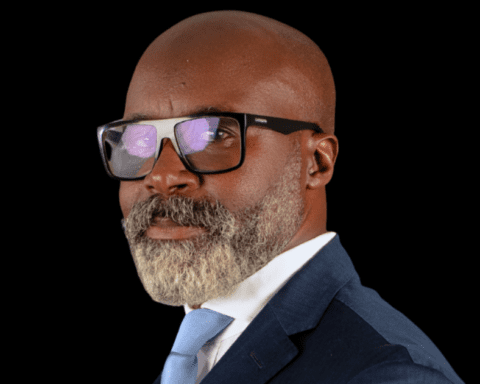

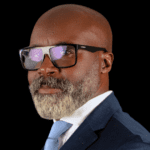

Ironleaf Capital is led by founder and managing partner T.J. Rose, a veteran investor with deep experience in healthcare private equity.

Before launching Ironleaf, Rose served as a partner at Veritas Capital and Abry Partners, where he invested in businesses at the intersection of healthcare and technology.

His new firm is built around a clear thesis: partner with founders and operators to build tech-enabled companies that improve efficiency, reduce costs, and address long-standing challenges across the healthcare ecosystem.

“In founding Ironleaf, we set out to assemble a cohesive team of investors and experienced operators with passion for improving healthcare costs and quality through technology,” Rose said. “From our first conversation with New Catalyst, it was clear that the team understands what it takes to build enduring, high-performing firms, and our partnership has already begun to help our vision come to fruition.”

To support this mission, Ironleaf is structured to combine investment experience with operational depth, creating a platform that can work closely with management teams and help companies scale with clarity, data-driven insights, and hands-on execution.

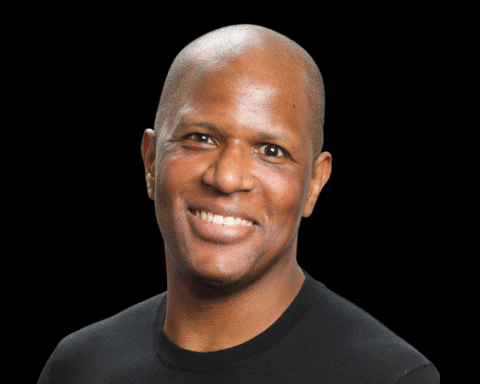

New Catalyst’s Model for Supporting Next-Generation GPs

The partnership offers a clear look at New Catalyst’s approach to backing emerging private market managers.

Instead of offering only seed capital, the firm provides acceleration capital paired with operational infrastructure, strategic guidance, and value-creation resources designed to help founders scale faster and more intentionally.

“Our partnership with Ironleaf reflects the caliber of thoughtful, differentiated managers that New Catalyst was built to invest in and support,” said Jason Howard, founder and managing partner of New Catalyst. “We are excited to announce our bespoke strategic partnership with Ironleaf, which includes capital to support the firm’s launch as well as operationally-intensive value creation resources.”

This model allows early-stage private equity firms to function with the sophistication and support typically found inside much larger institutions, while preserving the agility and focus that define emerging managers.

What the Partnership Says About the Broader PE Landscape

The formation of the New Catalyst–Ironleaf partnership highlights how modern private equity firms are being built.

Portfolio companies increasingly want investors who bring functional expertise—technology, operations, insights, and strategic support—in addition to capital.

Firms that launch with integrated investment and operating capabilities are better positioned to meet those expectations.

This is especially true in healthcare, where rising costs, regulatory pressures, and rapid technological adoption have created both challenges and opportunities.

Investors with a focused strategy and the ability to support operators directly are better equipped to help companies navigate complexity and scale effectively.

For institutional investors watching the next wave of emerging managers, this type of partnership represents a structure that feels both more grounded and more aligned with future expectations in private markets.