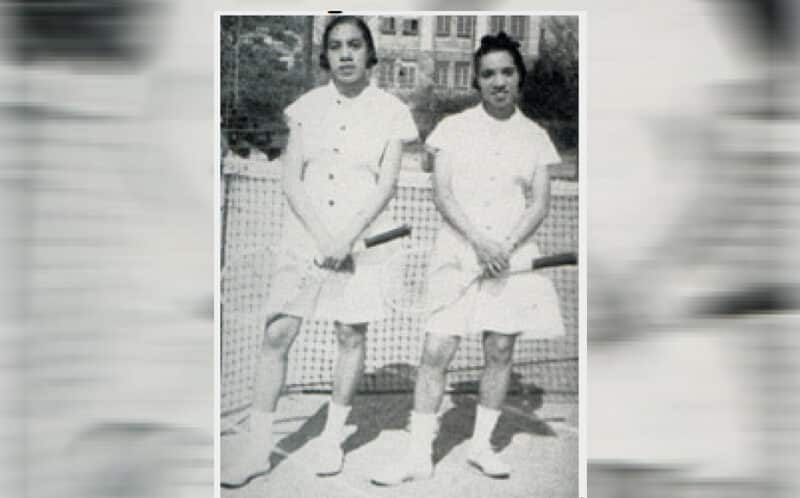

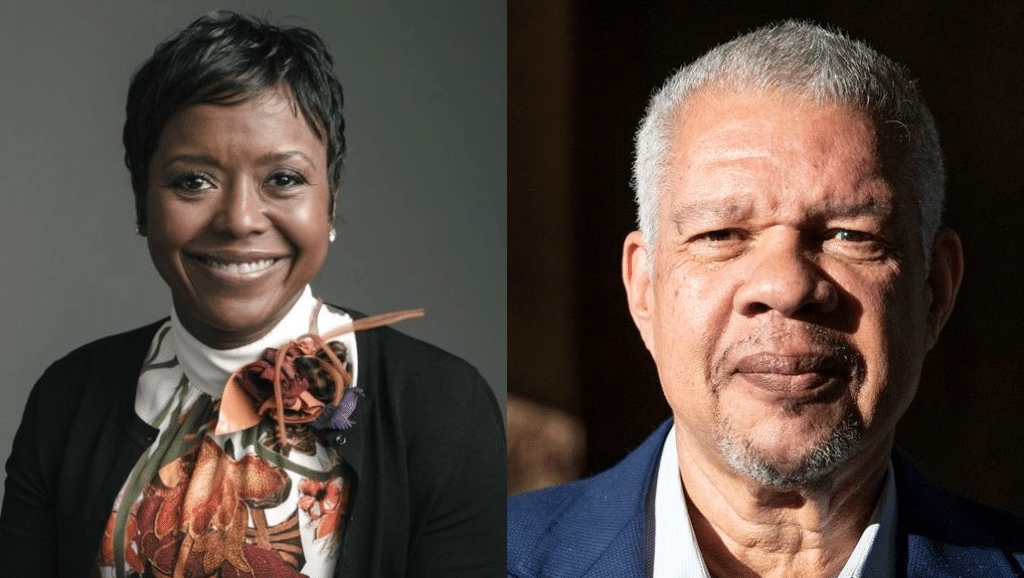

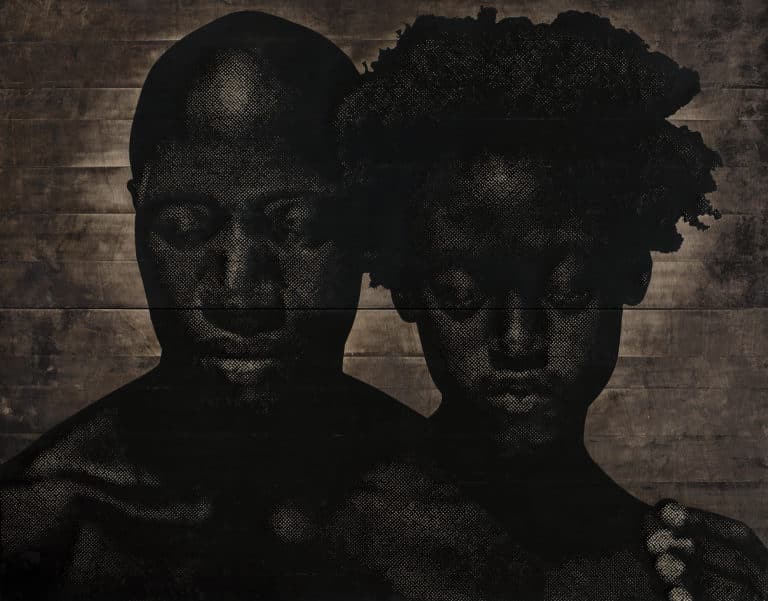

Margaret and Roumania, The Tennis Superstars That Paved The Way For Venus And Serena

Decades before Venus and Serena Williams overpowered the sport, Margaret and Roumania Peters changed the face of women’s tennis.

Affectionately known as “Pete” and “Repeat” Peters, they made history with their doubles record from the 1930s to the 1950s. At a time when African Americans were not allowed to compete against whites, the Peters sisters played in the American Tennis Association, which was created specifically to give Blacks a forum to play tennis competitively.

Margaret Peters was born in 1915 in Washington, D.C., and Roumania Peters was born two years later in the same city. The girls began playing tennis for fun when Margaret was about ten years old. They played in a park across from their home in Georgetown.

They began to play competitively when they were teenagers in the 1930s. The Peters sisters played for the American Tennis Association (ATA), which was created in 1916 to organize Negro Tennis Clubs across the country and to provide competitions for African-American tennis players.

At that time tennis, like most other sports, was segregated so African Americans were not allowed to compete against whites.

By the time tennis integrated, Margaret and Roumania Peters were in their 30’s — considered to be the retirement age for elite players. As a result, they barely missed their own opportunity to make history.

As Roumania’s daughter, Fannie Walker Weeks put it, “My father always said that they just came along at the wrong time but they were happy with their lives. They were happy with what tennis did for them.”

After retiring from the ATA in the early 1950s, Margaret and Roumania earned master’s degrees and worked in the D.C. Public Schools, while continuing to inspire and encourage the next generation of D.C. tennis players.

For twelve years, Roumania taught tennis in the Department of Recreation’s summer tennis camp at Rose Park. Many of her protégés went on to receive four-year-athletic scholarships to college.

Years later, Margaret and Roumania Peters received overdue recognition for their athletic accomplishments. In 2003 the USTA presented the sisters with an “achievement award” and inducted them into the Mid-Atlantic Section Hall of Fame. In 2015, the DC Government officially dedicated the Rose Park Tennis Courts to Margaret and Roumania Peters.