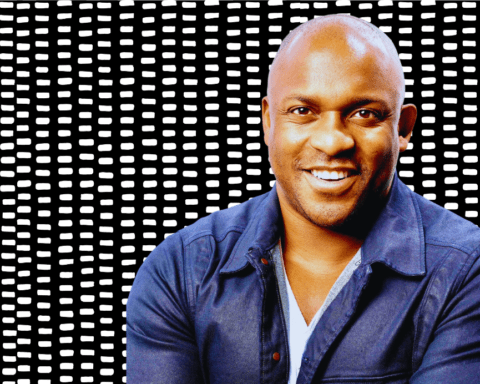

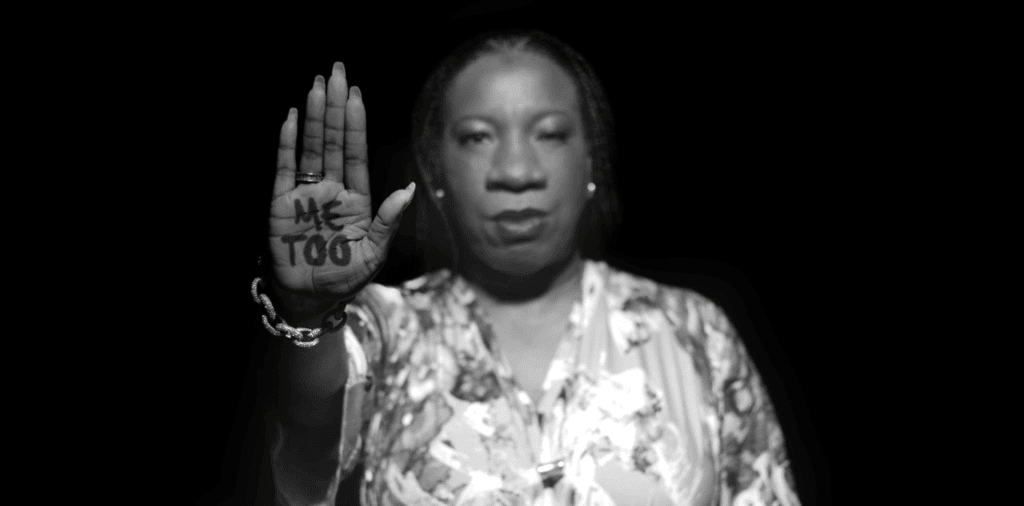

Tarana Burke on the TIME 100 Most Influential People 2018 Cover

TIME just announced their list of the 100 Most Influential People in the world, and MeToo founder, Tarana Burke is one of them.

Tarana started the “Me Too” movement in 2006 and it has since blossomed into a world-wide campaign to raise awareness about sexual harassment, abuse, and assault in society.

In this issue of TIME, actress Gabrielle Union wrote about Tarana, saying,

“When I first met Tarana Burke, I found a kindred spirit, somebody else who’s been screaming into the hurricane. Somebody else who’s been advocating for survivors of rape and sexual assault, and specifically young black women, whose voices have been silenced at best and completely erased from the national dialogue at worst.

She was kind enough to film a guest spot for the upcoming finale of Being Mary Jane. Between takes, it was both of us talking and strategizing, venting and celebrating. You want a leader who truly believes in inclusivity. For Tarana, it’s not about personal gain or attention but doing the work in a way that makes people feel like they can join in.

When you’ve been sidelined for so long, it’s exhilarating to know that such a powerful voice is finally breaking through. Tarana will continue to do this work, but the stage will be bigger and the microphone turned all the way up. She will inspire legislation and new crops of voters.

She will sway old voters. She will open eyes. She’s not even going to bring more seats to the table—she’s going to turn the table over and build a new one.”

TIME describes their annual list of the world’s most influential people as “a designation of individuals whose time, in our estimation, is now.”

Tarana’s time is definitely now 🙂

-Tony Oluwatoyin Lawson (IG @thebusyafrican)