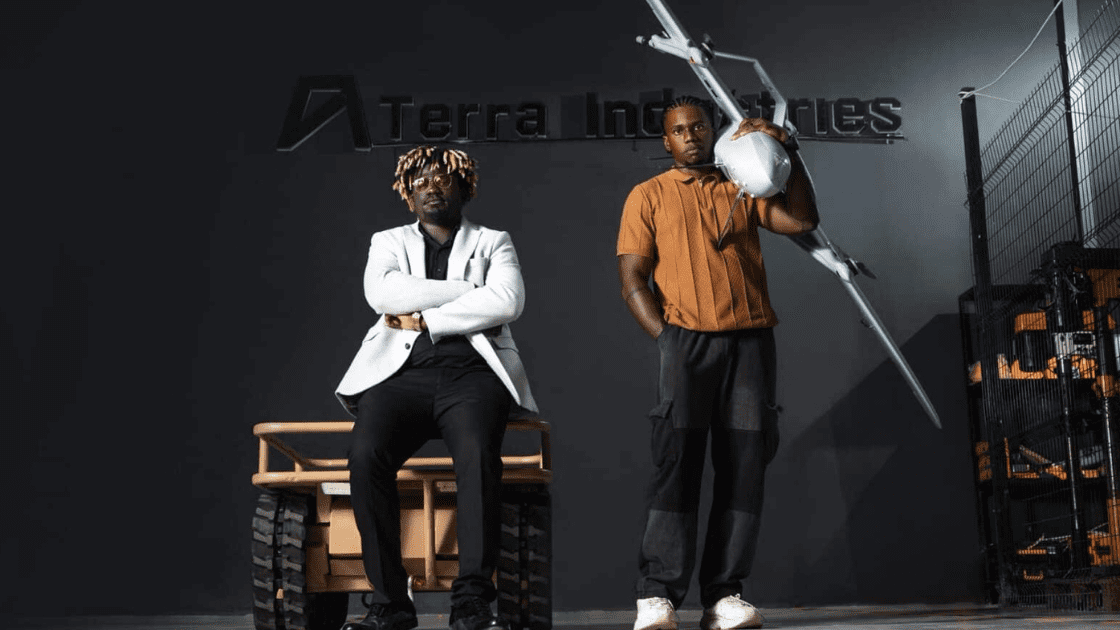

When Terra Industries announced an $11.75 million funding round to scale its defense and surveillance capabilities, the immediate response across African tech and investment circles was largely optimistic.

Observers pointed to job creation, industrial localization, and the promise of a stronger technological edge in protecting critical infrastructure and managing security risks.

Those reactions are understandable. They are also incomplete.

The significance of the raise lies less in the dollar amount than in what it represents. Africa is increasingly being underwritten as a market for security and defense infrastructure, not simply as a recipient of aid, peacekeeping missions, or imported military hardware.

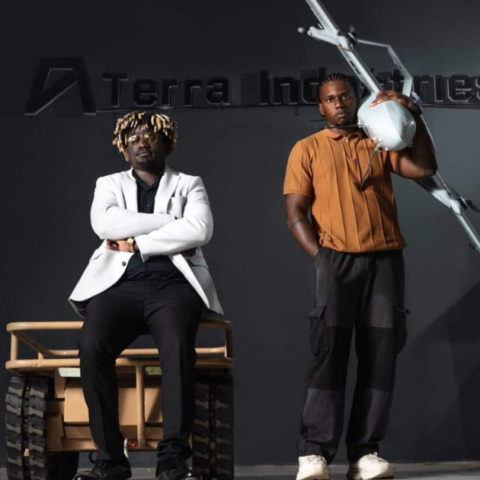

Terra’s stated ambition to become “Africa’s first defense prime” places the company within a broader conversation about sovereignty, industrial capacity, and the governance of advanced security technologies.

From Development Narratives to Security Infrastructure

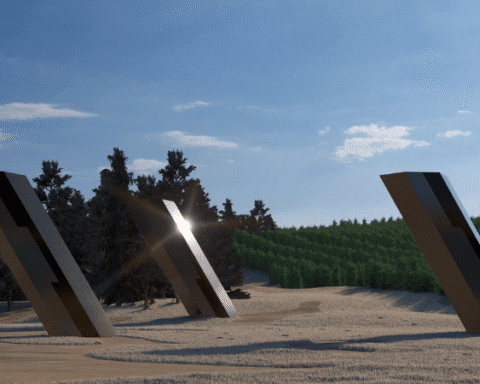

Terra does not present itself as a niche drone manufacturer or a standalone software vendor. According to its official materials, the company’s mission is to protect Africa’s critical infrastructure using autonomous systems powered by its proprietary ArtemisOS platform.

It positions itself as a vertically integrated defense technology company, combining autonomous hardware, surveillance software, and operational deployment designed to secure high-value assets across sectors such as energy, mining, and power generation.

In this framing, defense technology is not simply about militarization. It functions as economic infrastructure, supporting industrial continuity, asset protection, and state authority in environments where insecurity directly undermines growth.

The Signal Embedded in the Capital

The $11.75 million round was led by 8VC, with participation from Valor Equity Partners, Lux Capital, SV Angel, Leblon Capital, Silent Ventures, Nova Global, and a group of angel investors.

Terra has said it intentionally raised from investors with deep familiarity with defense markets rather than generalist technology capital.

This distinction matters. Defense-focused capital is accustomed to long procurement cycles, sovereign customers, and politically sensitive deployments. That context reframes Terra’s trajectory.

The company is not being optimized for rapid user growth or short-term exits. It is being positioned for institutional durability: long-term contracts, government and infrastructure clients, and systems designed to operate in high-stakes environments.

For African defense technology, this signals a potential shift away from reliance on imported platforms toward domestically built systems designed for local threat profiles, regulatory realities, and operational conditions.

Early Traction and Competitive Positioning

Terra reports that within its first year of operations, it recorded approximately $2 million in orders and, in 2025, secured a $1.2 million contract to protect hydropower dams, outperforming an international competitor for the work.

The company has also stated that its technology is currently used to help protect infrastructure assets valued at roughly $11 billion across multiple locations.

These figures are company-reported, but they indicate early traction in a sector where credibility is typically earned through deployment rather than pilots or proofs of concept. Defense and infrastructure security contracts tend to favor vendors that can operate reliably under real-world conditions, making early wins particularly consequential.

Defense, Sovereignty, and Industrial Ambition

Supporters of Terra’s rise often frame defense technology as a catalyst for sovereignty and industrialization.

Historically, defense manufacturing has played a central role in building advanced industrial capacity. Countries that control their security infrastructure tend to develop adjacent capabilities in systems engineering, advanced manufacturing, and specialized workforce training.

If Terra succeeds, the impact may extend beyond surveillance or counterterrorism. It could contribute to localized production, technical skill development, and the emergence of regional defense supply chains.

In this sense, defense technology becomes a lever for economic complexity rather than a narrow security tool.

That framing, however, also introduces harder questions.

Surveillance, Dual Use, and Governance

Several observers have raised questions about dual-use applications. Could the same technologies be applied to civilian use cases such as disaster response, environmental monitoring, or infrastructure maintenance?

The question highlights a central tension. Many defense technologies are inherently dual use. The same systems that secure borders or critical assets can also be deployed for civilian oversight and emergency response. The difference lies not in the technology itself, but in governance.

As advanced surveillance capabilities expand, the critical issues become control, data ownership, and accountability. Similar technologies in other regions have drawn criticism for expanding state surveillance faster than oversight mechanisms can keep pace.

Locally built systems may offer greater sovereignty, but they also require strong institutions to prevent misuse.

Terra’s emergence does not resolve this tension. It brings it into sharper focus.

A Test Case for African Security Infrastructure

It would be premature to frame Terra Industries as either a triumph or a threat. More accurately, it represents a test case.

Can African-built defense and surveillance infrastructure scale without importing the political and ethical liabilities that have made similar systems controversial elsewhere? Can defense capital coexist with civilian oversight and institutional accountability? And can security technology be developed as an industrial asset rather than a blunt instrument of power?

These questions extend beyond any single company. But Terra’s $11.75 million raise makes one thing clear: defense capital is increasingly shaping African security infrastructure.

How that infrastructure is governed may matter as much as how quickly it grows.

Explore partnership opportunities with an editorial distribution platform reaching 1.8M+ people monthly