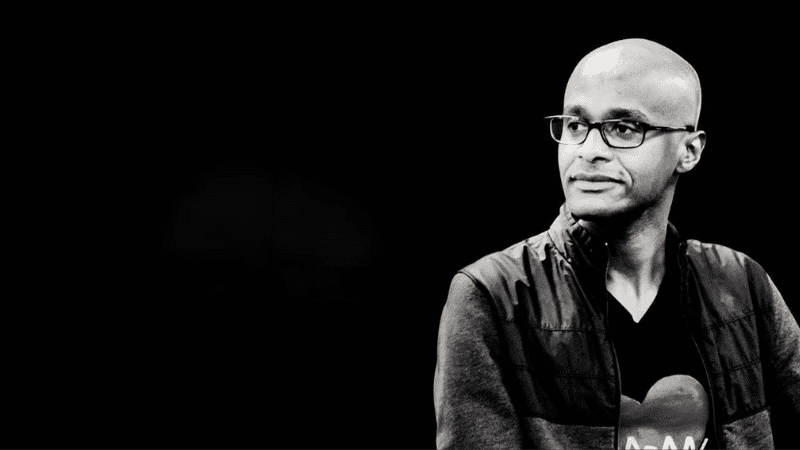

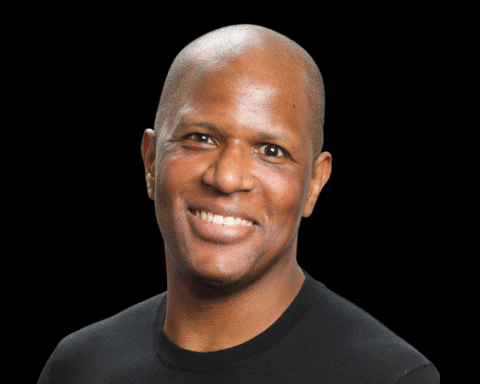

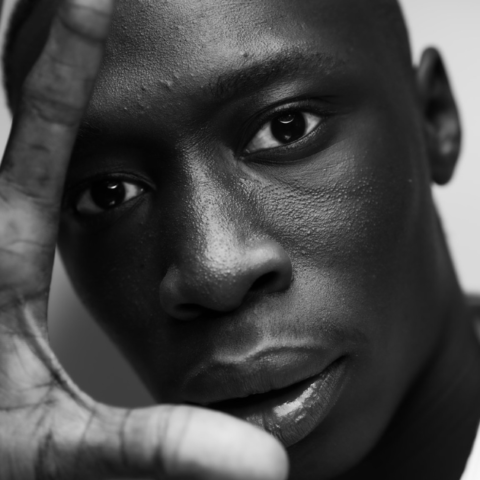

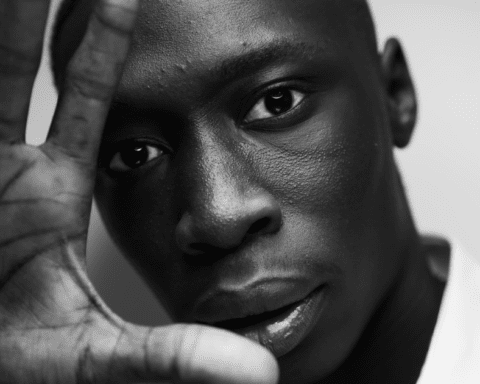

After decades in Big Tech, Moaz Hamid walked away—not because he was tired, but because innovation no longer excited him.

He had been there at the start of smartphones. He helped launch global tools at Microsoft and Google, from mobile payments to mapping.

But the work began to feel familiar. Every product cycle looked like a remix of the last. He wanted something new.

That search led him to a sector too often ignored: disability tech. And what he found there, he says, made him feel alive again.

From tech platforms to purpose-driven investing

In the early days of the COVID-19 pandemic, Moaz was helping run youth entrepreneurship programs. Many of the young people in these programs had a shared experience—one of their parents had become disabled.

That insight changed his thinking. It connected disability to productivity, to opportunity, to what we call risk.

He began digging deeper, researching the systemic challenges faced by people with disabilities and the gaps in technology designed to serve them.

That research turned into MVMT Ventures, a venture capital fund and studio dedicated to accessibility-first innovation.

Why disability tech is not a niche

Moaz challenges the idea that accessibility is for a small group of people. In his view, it’s the opposite.

“Two out of three of us will experience some form of disability by the age of 65,” he said. “This isn’t a niche. This is universal.”

He also believes that many people with disabilities are more focused, productive, and capable than the assumptions placed on them suggest. The problem isn’t the person—it’s the infrastructure and tools.

Disability tech, in his view, is where the most meaningful innovation is hiding. And the market still hasn’t caught up.

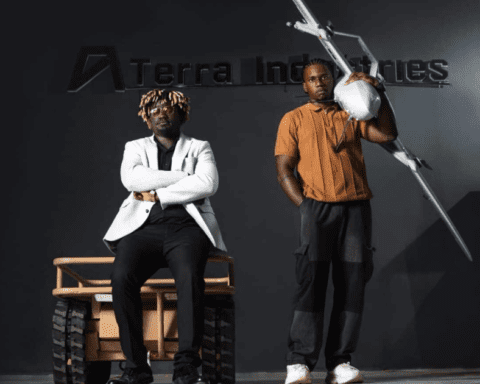

What he’s investing in right now

Two startups stood out during our conversation. One is a mental health platform that anonymously connects people going through a challenge with others who’ve already lived through it. The system adapts over time, finding better matches and creating a stronger, more human-centered peer support network.

The second is a tool that detects concussions using a simple saliva test. It’s designed to be used in schools and on the sidelines of youth sports—giving caregivers a faster and more accurate way to know when a child should sit out.

Both startups reflect mvmt’s focus on products that don’t just scale—they solve.

What accessibility-first really means

When Moaz says “accessibility-first,” he doesn’t mean compliance or add-on features. He means starting from inclusion.

“You have to talk to the people. You have to design with them in the room,” he said. “When you build for everyone from the beginning, you get a better product for everyone.”

He believes inclusive design is a source of competitive advantage, not a constraint.

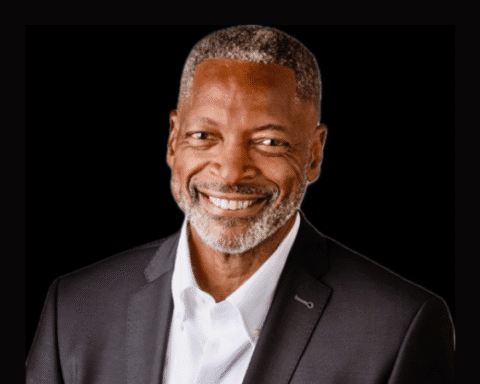

The state of venture capital and what needs to change

Since COVID, Moaz has seen more attention paid to underserved sectors. But attention doesn’t always translate into capital. He says many emerging VCs focused on inclusion are still underfunded.

At mvmt, he started with research—offering data, pipeline insight, and a network to help other investors raise capital and gain traction with LPs.

He wants to see 1,000 disability-focused funds in the next five years. And he’s not just building his own. He’s helping others build theirs, too.

Rethinking the LP–GP relationship

Moaz is also exploring a new approach to fund structure.

“The LP–GP model is still broken,” he said. “If we want to serve real people, we need a new model.”

He hinted that mvmt will soon announce a restructured fund approach—one that delivers returns while supporting entrepreneurs solving real problems, even if their products don’t scale to millions.

You don’t have to choose between doing good and doing well, he said. You just have to rethink how capital flows.

The future of being human

Moaz believes the best innovation doesn’t come from chasing hype. It comes from solving problems that matter.

“This is about the future of being human,” he said. “And disability tech is at the center of that.”

Watch the full interview

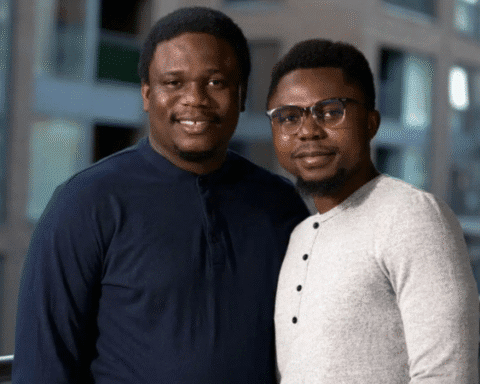

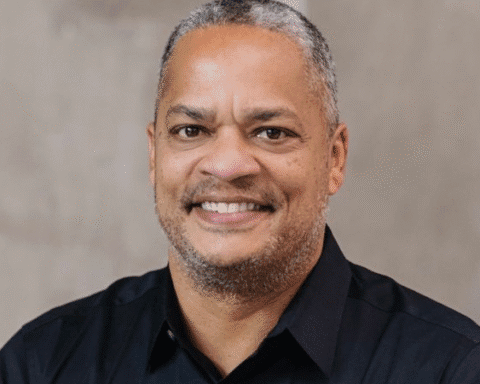

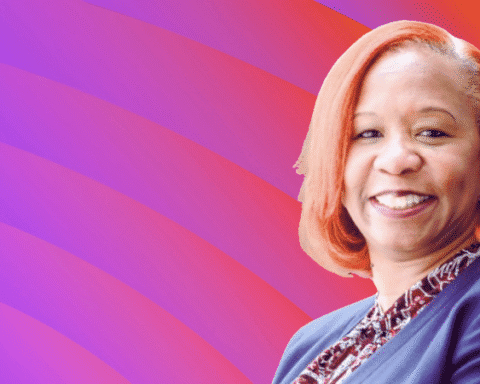

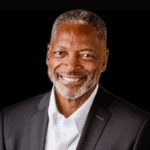

Interested in investing in the future leaders of Black business and investing?

Join our Investor List for insights and updates on today’s most promising, investment-ready founders and fund managers.