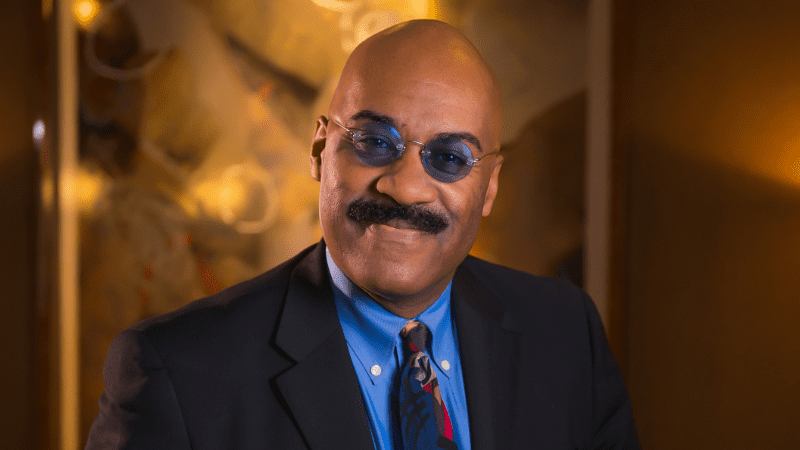

When Vada O. Manager describes his career, he doesn’t frame it as a straight line.

Instead, he speaks in terms of strategic stair steps — each role, board seat, investment, or acquisition designed to create leverage for the next.

That perspective has taken him from East St. Louis to Nike’s executive ranks, global boardrooms, private equity platforms, NBA ownership stakes, and Broadway production credits.

Today, Vada O. Manager is the founder of Manager Global Holdings, a diversified investment and advisory firm with equity interests in hospitality, residential real estate, sports business, experiential marketing, and tech-enabled service companies.

What began as a consulting practice evolved into a portfolio model: invest in companies he understands, add value where he has expertise, and stay diversified enough to navigate shifting markets.

“I never wanted to build a big company,” he says. “What I wanted was to build value — for founders, for investors, for communities, and for the next generation of owners.”

The Nike Years: Strategy, M&A, and Market Influence

As a hybrid investment banker/strategist, Vada helped shape the trajectory of one of the most influential brands in the world.

While serving as Senior Director of Global Issues Management at Nike, he contributed to several major portfolio moves, including the $305M acquisition of Converse, which later became a billion-dollar brand inside Nike, as well as the acquisitions of Starter and Umbro.

Larry Miller, Chairman Emeritus of Jordan Brand, describes Vada’s internal impact this way:

“Having Vada as a Nike teammate was tantamount to having an in-house strategic firm that could dually read the business impact of major decisions while helping Nike/Jordan Brand deepen our connection with global consumers. As several will attest, if the stakes were high at Nike, Vada was usually somewhere in the mix.”

At Nike, Vada innovated what he now calls “crisis marketing”, the idea that reputational pressure is not just a threat, but a strategic opportunity to pivot.

When a customer attempted to personalize a NikeID sneaker with the word “sweatshop,” sparking global headlines, the brand didn’t retreat.

By unveiling the newly launched personalized product during a Today Show interview, a huge spike in orders followed.

Board Leadership as a Value-Creation Platform

Vada joined his first major board at age 21, sitting alongside Fortune-level CEOs decades older.

That early exposure shaped his approach to governance: as a function that should expand value, not merely protect it.

He now serves on the board of Valvoline Inc. (NYSE: VVV), where he chairs the Governance and Nominating Committee, and previously helped guide its strategic spinout from Ashland Inc., a transformation that unlocked more than $6 billion in value. Vada is also Board Chair of Arizona Venture Capital Inc.

Sports, Private Equity, and the Business of Ownership

Vada holds limited partner stakes in four NBA franchises — the Sacramento Kings, Minnesota Timberwolves, Atlanta Hawks, and Charlotte Hornets — through the Blue Owl private equity model. He views team ownership not as a vanity asset, but as a long-horizon investment tied to cultural relevance, media rights growth, and global demand.

The logic became even clearer when the Los Angeles Lakers were valued at $10 billion, instantly lifting the implied valuation of other teams in the league.

As Vada explains, “A $10 billion valuation for one of the league’s limited franchises raises the valuation of all the others when they come up for sale. The key is being liquid enough to hold your position until the exit window opens.”

Turning Pressure into Strategy

During the pandemic, Vada encouraged the same mindset within Valvoline. While competitors struggled with in-person operations, he saw a competitive advantage in Valvoline’s stay-in-your-car oil change model, resulting in better-than-anticipated performance and stronger franchise loyalty.

From Mandela to Broadway: A Multi-Sector Career

Vada’s career includes advising Nelson Mandela’s transition cabinet, serving two governors and a Washington, D.C. mayor, and consulting across sectors.

He is also an executive producer of the documentary Stewart Udall & The Politics of Beauty and an investor/producer of Soul Train: The Musical, anticipating its Broadway premiere in 2026.

“It isn’t how you start in life, it’s how you finish. If you’ve been given access, the real measure of success is who you help unlock the door for next.”