This is the first installment in our series around the topic of “Growing and Maintaining Black wealth through sound legal strategies and problem solving.” Let’s begin with a discussion about Estate Planning.

Estate Planning

In October of 2015, retired NBA player Lamar Odom suffered several strokes and kidney failure at the young age of thirty-five, leaving many people shocked and shaken by the fact that someone so young and presumably healthy could possibly die.

Of course, given his position in the Kardashian realm, many were also enthralled by the latest drama in America’s most famous (for now) family. Yet, if we unpack that drama and look at it plain and simple, Lamar’s circumstances should be a lesson for us all.

At the age of 35, Lamar was in the final stage of divorce and a father of two minor children from a previous relationship when he experienced a life-altering medical event.

Those are the mind-numbing facts: 35 years old, estranged wife, father of two minor children—and a very uncertain future. While his medical crisis was extraordinary, the other key circumstances in Lamar’s life were not.

Amidst all of the sensational discussions surrounding Lamar’s unfortunate situation, there was little, if any discussion around whether or not he had legal documents appointing someone to handle his affairs, i.e. step into his shoes to make his medical and financial decisions.

Presumably he did not, because his estranged wife put a halt to their divorce, and under the authority of California law as his wife, became his decision-maker.

Thankfully, Lamar’s health has improved and he is still with us. However, imagine if someone in the exact same situation as Lamar passed away leaving an estranged wife, two minor children, and no legal documents to dictate what happens with whatever assets they have and how their affairs are settled.

Now ask yourself, if something happened to you today, who would step in? Who could legally step into your shoes? You may not know the answer to the last question. And you probably do not even like the question.

So, let’s consider this question instead: if you had the rare opportunity to become a secret agent on some James Bond-type mission but you had to pick a family member or friend to assume your identity and continue living your life until you came back, who would that person be?

Who is most likely to have your life intact when you come back? Who would be your agent? The person you would choose to be your agent and who the law chooses could and likely would vary greatly when you do not have the legal documents in place to effectuate your choices.

The solution is simple. Go to a knowledgeable estate planning attorney and create an estate plan.* If you don’t know who to use then you might want to check out someone like this new york estate attorney. However, there are loads that you could use. Many, in fact, most of us avoid estate planning. We think we do not have an “estate” or that lawyers are too expensive. We believe our loved ones will “take care of everything” because we trust them. We think we are too young. Most importantly, it is very unpleasant and scary to think about a time when we cannot take care of ourselves or when we die. If you have any questions about preparing your estate it is worth speaking to an estate planning lawyer as they might have the information needed to put your mind to rest and help you plan for the future.

So, consider the fact that you have a unique opportunity to put the law on your side. This power is especially important during a time when many of us have considerable doubts and questions about the laws of our nation and our states when it comes to issues such as policing, voting, and clean water—to say the least.

You have the power to create a plan and make decisions about how you are cared for in a time of need or transition. You have the power to create a plan for optimizing your assets for their use while you are living and when you pass away.

Take advantage of this opportunity! ??The first step is developing a basic understanding of estate planning, which is the purpose of this series of articles.

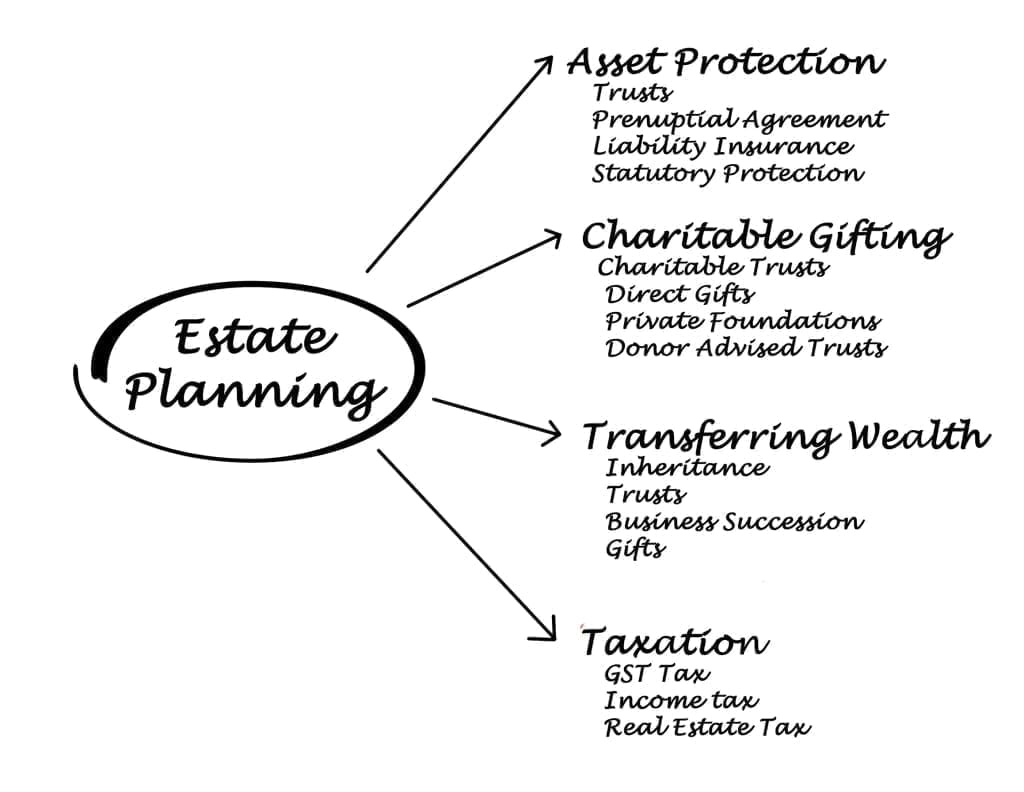

What is estate planning? Estate planning is making a plan in advance for what happens to you and your assets when you cannot take care of them yourself and for when you die. You get to make the decisions on the who, what, when, and how of your affairs rather than that determination being made by the law. A basic estate plan includes a will, a financial power of attorney, a healthcare power of attorney, and a healthcare directive (a “living will”).

What is an estate? Many people believe they do not have an “estate.” We all have an estate. An estate is everything you own from your collection of baseball cards or Chanel purses to your cash, retirement accounts, life insurance and vehicles. When it comes to real estate, find out more information through companies such as PFC Property Management, especially if you are looking to work in this particular industry. There’s a lot to learn, but it is quite interesting. I’m sure you’d rather know more now, than know nothing at all. Even if the cash value of your what you own is small, you have an estate.

What is a will? A will is a document that states your final wishes. In a will you appoint someone to settle your affairs: an executor. You state who gets your property, what property they get, and how much of it. You can even state when they get your property.

You can nominate guardians for your minor children. The court ultimately decides who the guardians will be, but a will provides very useful information in that determination. You can even provide instructions on paying your debts and on your funeral.

In most states, the property of someone dying without a will, leaving behind an estranged spouse and children from a previous relationship, would have to be divided between the estranged spouse and children. For most people, this scenario is not ideal, it’s a nightmare.

On the other hand, you could have circumstances that are not complex at all. Perhaps you are a single person with no children. Without a will, in most states, the person(s) eligible to manage your estate would be your parents. Does that work for you? If you do not have parents, the law looks to your siblings. Again, does that work for you? If you don’t have parents or siblings, then who?

A will is a critical document that can save relationships and money. It can also be a foundational element in your legacy. So, it is important to have a will and for it to be designed with a knowledgeable estate planning attorney.

What is a power of attorney? There are two types of power of attorney documents: financial power of attorney (also known as durable power of attorney) and health care power of attorney. Both allow you to appoint someone as your attorney-in-fact which means they can make the same actions you can make.

The types of activities the person operating under your power of attorney can do vary from speaking to financial institutions about your accounts, signing legal documents, such as contracts and deeds, to speaking with healthcare providers, including your doctor.

The power of attorney document can be very powerful, especially if you use a fill-in- the-blank type of document, instead of one tailored to your needs. If you use one that’s fill-in-the-blank, you could be unintentionally giving someone the ability to abuse the role you have given them.

In a customized power of attorney, you can set the conditions under which the attorney-in-fact can act, as well as limit the types of things they can do. For example, you can have a limited power of attorney for real estate that allows the attorney-in-fact to take actions related to a specific piece of property during a specific time or transaction.

Having either power of attorney, and preferably both, can give you peace of mind that the person you trust most will be able to help you when you are unable to take care of yourself.

If you are incapacitated and do not have power of attorney documents, it is extremely difficult and costly for someone to be able to help you.

The absence of power of attorney documents could even lead to litigation and destruction of relationships. Consider the scenarios discussed under the description of the will when thinking about what would happen.

Also, keep in mind, a power of attorney document does not replace a will. Many people mistakenly believe that the instructions in their power of attorney or in their loved one’s power of attorney carry over after a person dies. The power stops at death.

What is a living will? A living will is also known as an advanced directive and it is a document in which you give the medical personnel instructions for your end-of-life medical care. It comes into to play when your death is certain and gives instructions on things such as palliative care (easing pain and suffering), extraordinary measures, and nourishment.

The decisions you have to make in a living will are very difficult to think about but imagine if your spouse, child, or parent had to make those decisions for you. Having a living will is also a key part of your estate plan.

How do I get started on my estate plan? The first step is to find an attorney who specializes in estate planning. Many people believe they can do their estate planning themselves and want to do so to save money. Imagine your profession is a hair stylist, a bank manager, or a professional athlete.

You are very good at what you do. Your car needs new brakes and they are expensive. You can probably go on YouTube to find a video with instructions for putting new brakes on your car. Let’s say that technically you can put new brakes on your car and save a good deal of money.

Is this the best choice? Alternatively, you could save money by taking the car to the detail shop where you get your car cleaned and let the owner put brakes on your car. He takes good care of your car and he can save you money. Is he the best choice, though?

If your well being or the well being of those you love depended on it, are you or the detail shop guy the right choice for putting brakes on your car? Can you be reasonably sure that the condition of your car will be safe and it will not lose monetary value after you or the detail shop guy repair it?

Your life and your assets deserve the same level of consideration and you deserve to have a comprehensive estate plan done by an attorney who focuses on estate planning.

Attorneys charge by the hour or offer a flat fee for estate planning. A typical plan costs on average $600-$800 for a single person and around $1,000 for a couple. The costs depend on your circumstances. Many attorneys require a retainer.

A retainer is money delivered in advance to the attorney and held in trust for the client. They take the fees earned from that retainer. Many people balk at the request for a retainer. However, you should consider the retainer as incentive to you fulfilling your role in this process.

It is not uncommon for someone to start the process and then not complete it because they still have the fears around estate planning or simply do not prioritize it.

In the next articles we will discuss the financial components of your estate planning including life insurance, retirement accounts, and real and personal property. Stay tuned!

– Contributed by Mavis Gragg

Mavis Gragg is an attorney at the Gragg Law Firm, PLLC in Durham, North Carolina where she specializes in estate planning and estate administration. She is very passionate about maintaining and growing Black wealth through sound legal strategies and problem solving. When she is not being a justice girl, she can be found at an art gallery, trotting the globe, or on the dance floor.