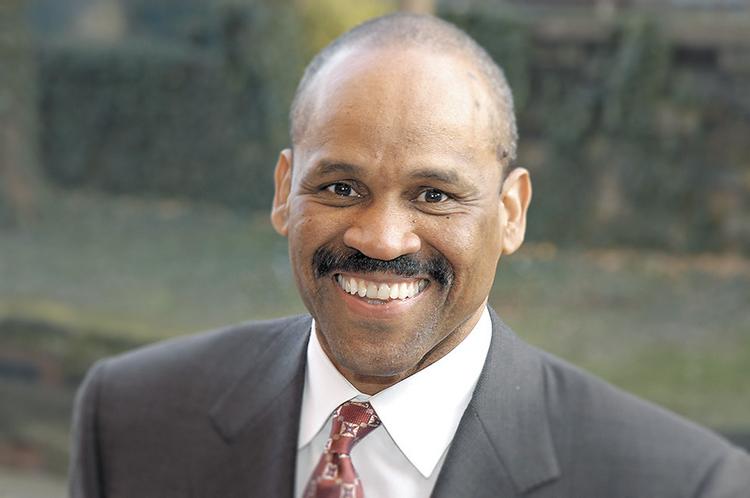

Tawan Davis is the founder of The Steinbridge Group, a Philadelphia-based, impact-focused real estate investment firm. As a residential property developer, the company is dedicated to providing working families with high-quality, affordable housing and empowering them with homeownership opportunities.

In this interview, Tawan shares the inspiring story behind the company’s inception and how his family’s legacy of providing housing support to newcomers and underprivileged communities led him to embark on a mission to bridge the wealth gap and create lasting positive change through real estate investment.

We delve into the strategies, milestones, and partnerships that have shaped the company’s growth, and we get a glimpse into their exciting plans for the future.

What inspired you to start an impact-focused real estate investment firm?

I was inspired to start an impact-focused real estate investment firm because of two experiences in my life.

My great-grandmother and her sisters bought several homes in Northeast Portland, Oregon, to help relatives and friends resettle in the area after the Vanport flood. These homes provided a safe and stable place to live, which helped families to walk the path out of poverty and close America’s pervasive wealth gap.

My widowed neighbor, Mrs. Georgia Smith, let my single mother with two children use a Section 8 voucher to rent her house when she remarried and moved. That home provided my sister and me safety through the rocky 1990s and stability through the regentrification of the early 2000s.

Through these experiences, I saw an opportunity to do for others what my great-grandmother and Mrs. Smith did for us. Over the last 15-25 years, America has rediscovered its urban centers, creating domestic emerging markets but pushing many to the wayside. By investing in these areas, we can produce outsized returns for private capital while making a profound impact on families and communities.

For us, investment and impact move together. We believe that by investing in communities that have been historically underserved, we can help to create a more just and equitable society.

How has The Steinbridge Group evolved since its inception? Are there any key milestones or moments that have shaped the direction and growth of the company?

I started Steinbridge as a commercial office company. We structured and executed over $900 million in office building investments.

After thorough research and thankfully before the COVID pandemic wreaked havoc on the office sector, I came to two realizations. First, that offices were not the major growth space for a burgeoning real estate company. Second, the most potential to do real estate well while having maximum impact was in residential property.

Having started our residential strategy in Philadelphia, we’ve since expanded our investment pipeline to major metros like Washington DC, New Jersey, Massachusetts, Texas and Virginia. We’ve scaled up our investment team, raised additional capital, and expanded our capacity to catalyze latent assets in some of the country’s densest cities, with the fundamental goal of providing higher-quality homes at an attainable price for working families

We’ve made several milestones and will share more in the coming months. A recent milestone was our strategic collaboration with PNC Bank, the 6th largest commercial bank in the United States. The work with PNC is aimed at expanding homeownership among hardworking families. PNC is providing dedicated loan officers to assist homebuyers in securing mortgage financing.

The bank is contributing down payment assistance, waiving significant fees, access to financial education, and other financial support. Having this major financial institution as a partner means that our value-add to working families includes an expansive network of financial support, education, and waived requirements for restrictive down payments and closing fees for prospective homebuyers. This will supercharge our ability to reduce the wealth gap for working families in the United States.

Could you elaborate on some of the strategies or initiatives you have implemented to rethink housing development in Black neighborhoods?

We see a big opportunity in building homes for the teachers, the fireman and nurses, and the everyday professionals who make up a community’s backbone. As a firm, our ethos is driven by a fundamental strategy of latent asset activation. We believe the most impactful way to bridge the opportunity gap in wealth creation is to catalyze latent assets throughout working neighborhoods to deliver homes that:

-

Activate underutilized properties in rapidly transitioning areas;

-

create a foothold for existing families to maintain their roots;

-

bring aging homes up to a high quality without dramatically raising the rents;

-

turn renters into homeowners faster.

Addressing this nation’s wealth gap is a core inspiration behind The Steinbridge Group. Today in America, the top 10% of residents own 76% of the nation’s wealth, and the bottom 50% own just 1%. On average, non-minorities in this country have seven times the wealth that African Americans and Hispanics have. Most Americans’ home is their largest asset, representing about 30% of their net worth. For us, this means that the one of most effective means to build wealth and close the wealth gap is to encourage homeownership.

We’ve developed several key investment strategies to help encourage the path to homeownership. One is single-family rental rehabilitation, in which we’ve redeveloped hundreds of existing single-family homes in momentum submarkets of America’s growing cities. Currently, only about 1.5% of 1 to 4-unit rental homes are owned by institutional investors, while the vast majority are owned by individual investors renting these houses for secondary income.

In many cases, these owners lack the resources and expertise to maintain these homes over time, resulting in dramatic variations in the quality and services applied to houses, largely serving the teachers, firefighters, nurses, and everyday professionals who make up the economic backbone of this country’s communities. We invest in and redevelop these homes to a high-quality standard and rent them to working families at sustainable rates.

We’ve also developed a Build-for-Rent strategy and pipeline of over 3,000 units through strategic partnerships with community organizations that own underutilized land and/or properties. We work with these organizations to identify the critical needs in transitioning areas in major metropolitan centers and develop high-quality homes for working families that are being priced out of America’s gateway cities.

We are also acquiring, developing, and repositioning hundreds of small to midsize multi-family units in areas like Harlem to ensure its mixed-income residents have access to high-quality residences at a fair price.

How does Steinbridge balance the financial objectives of the built-to-rent strategy with the social responsibility of providing quality, affordable housing and fostering a sense of community within its rental developments?

It’s quite simple. We have to make a strong return for our investors and be very profitable to maintain maximum impact. Otherwise, we will not exist long enough to pursue the change we’re called to make.

The housing crisis in America cannot be addressed by just building more blocks of apartments. 63% of rental units in the US are single-family homes. Two thirds of Americans live in houses and not condos or apartments. Unlike other parts of the world, the US is a single-family home country.

It takes longer and costs more to become a homeowner. In the 1980s, American families would rent for 2.2 years after marriage. That stretched to over 6 years after the 2008 financial crisis. That’s now up to 9-11 years by some estimates.

This is exacerbated by the current economic environment where both interest rates and property values are on the rise. New monthly mortgage costs are up by around 40%.

Higher quality homes at a reasonable price point are increasingly scarce. Our homes serve to reduce the rentership burden and shorten the gap to homeownership.

Our differentiator is that our build-to-rent investments are rooted in supporting the path to homeownership for working middle class families.

From your experience, why is it essential for private and public community organizations to form widespread partnerships in order for impact investing to succeed effectively?

Public resources and initiatives alone are insufficient to address this problem in both the short and long term. These programs don’t move quickly enough nor have the breadth and depth needed to help existing residents access long-term, stable, and high-quality residences. Steinbridge presents a private capital model that addresses affordability and equips working families with high-quality home options.

Community based organizations maintain billions of dollars of underutilized assets that they would benefit from activating. They make ideal partners because they need to contribute those assets to economically accretive activity, but they want to do so in a way that is consistent with their mission. Our strategy helps them to do that.

Capital from our investors and our real estate experts partners with mission-driven organizations. This is a fundamental component of our investment playbook, and we’ve developed many critical partnerships with community-focused organizations to convert valuable underutilized assets to productive uses.

How do you envision the future of The Steinbridge Group? Are there any plans to expand into new markets or explore different aspects of the real estate industry?

We plan to expand our latent asset activation strategy to economic centers nationwide. Currently, we’re managing over $500 million in active developments and plan to scale up to over $1.3 billion over the next two years, with the ultimate goal of investing over $2 billion through assembling a portfolio of several thousand homes.

Urban hubs like Boston, Washington DC, and New Jersey present a massive opportunity to invest in and partner with local organizations in areas like to ensure our portfolio results in a tangible impact.

Having a stable and affordable home is a prerequisite for a successful life, and we’re here to ensure the path to homeownership is as attainable as possible for the country’s hardworking families.

by Tony O. Lawson

Advertise with us

Advertise with us

Interested in investing in Black founders? If so, please complete this brief form.

Interested in investing in Black founders? If so, please complete this brief form.