Two Black-Led banks, City First in Washington, DC and Broadway Financial Corporation in Los Angeles, CA announced today that they have entered into a transformational Merger of Equals agreement to create the largest Black-Led bank in the nation with more than $1 billion in combined assets under management and approximately $850 million in total depository institution assets.

Combining the two institutions will increase their collective commercial lending capacity for investments in multifamily affordable housing, small businesses, and nonprofit development in financially underserved urban areas while creating a national platform for impact investors.

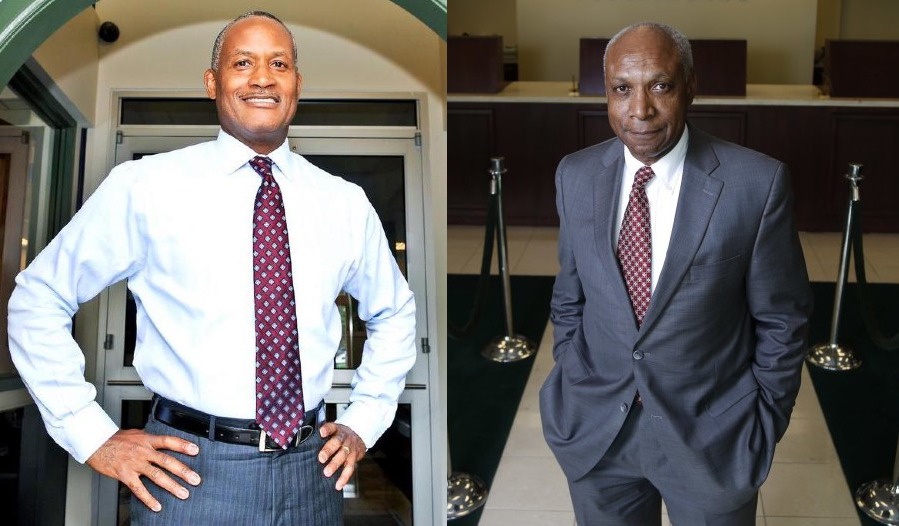

Brian E. Argrett, chief executive of City First, will be chief executive of the combined company, which will use City First as its banking brand but keep the publicly traded Broadway Financial Corporation as its bank holding company. Wayne-Kent A. Bradshaw, Broadway’s chief executive, will be the chairman of the combined company.

Broadway and City First are Community Development Financial Institutions (CDFIs), and have a longstanding history of advancing economic and social equity through the provision of capital in low- to moderate-income communities. The combined institution will maintain its CDFI status, requiring it to deploy at least 60% of its lending into low- to moderate-income communities

Since the beginning of 2015, City First Bank and Broadway Federal Bank have collectively deployed over $1.1 billion combined in loans and investments in their communities

“Given the compounding factors of a global pandemic, unprecedented unemployment and social unrest resulting from centuries of inequities, the work of CDFIs has never been more urgent and necessary,” said Brian E. Argrett.“As part of this historic merger, we are demonstrating that thriving urban neighborhoods are viable markets that require a dedicated focus, long-term commitment and critical access to capital.”

“The new combined institution will strengthen our position and will help drive both sustainable economic growth and societal returns,” said Mr. Bradshaw. “We envision building stronger profitability and creating a multiplier effect of capital availability for our customers and for the communities we serve.”

The new institution will maintain bi-coastal headquarters and will continue to serve and expand in the banks’ current geographic areas, with a desire to scale to other high-potential urban markets.

Shares of Broadway Financial were up 17 percent on Wednesday afternoon. The transaction, which is expected to close early next year, will leave Broadway stockholders with 52.5 percent ownership of the new company and City First shareholders with 47.5 percent ownership.

Related: Black Banks That Are Still Operating In 2020

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram, YouTube & Twitter

Get your SHOPPE BLACK Apparel!