If you’re an aspiring or existing business owner with goods or services that can be offered outside the U.S., you may want to consider international trade as part of your long term plans.

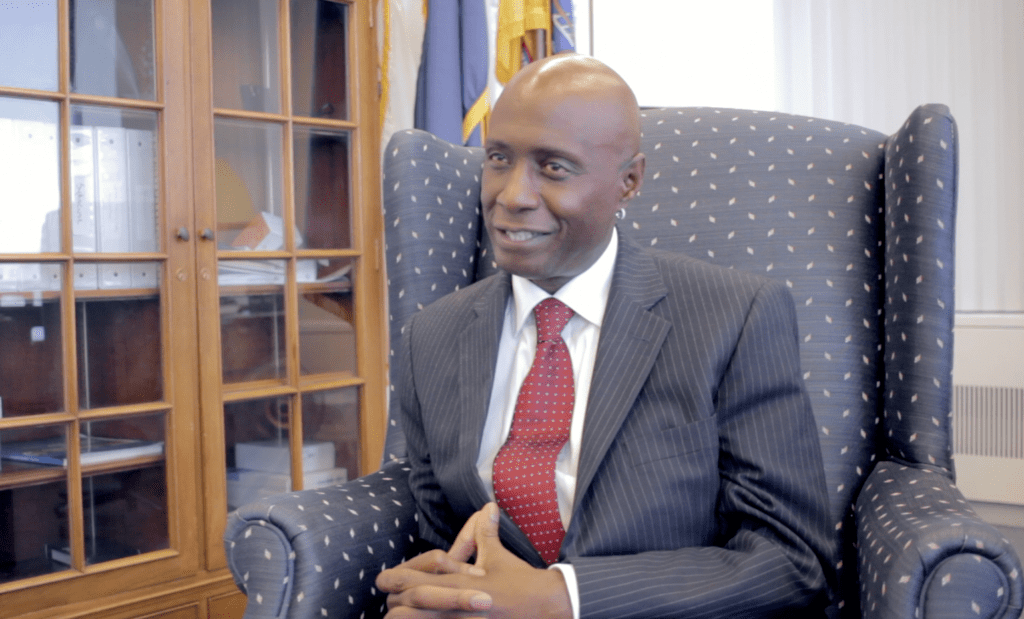

Eugene Cornelius, Jr., Senior Advisor to the Office of International Trade explains why.

What inspired you to create the Office of International Trade at the SBA?

I see my position as a quintessential leader of economic development. Therefore, I must take a strong stance on economic development issues for the future of U.S. small businesses. The U.S. represents only 5% of the world’s population. That means 95% of your potential customer base is outside the country.

Innovation is continuing to change the world economies at a faster pace than policy leaders can study and analyze. Small Businesses need to be in a position to participate on a level playing field. The Office of International Trade is prepared to assist in these efforts.

There are 1.8 Billion young people under the age of 35 worldwide all competing for jobs. The world will need 40 million new jobs each year for the next 15 years to keep up with demand. There are some facts we should acknowledge: 97 to 98 % of most economies job creators are entrepreneurs and small businesses.

As a case study, in the United States, small businesses contributed 66% of new U.S. jobs created since the recession between 2000-2017. According to the U.S. Black Chamber, African American Businesses grew from 1.9 million in 2012 to 2.6 million today, an increase of 700,000 or 27%. Small businesses created 8.4 million net new jobs and more than double the contribution of large businesses.

40% of those small businesses were women and 70% of those women were women of color. Why is this important? Because we also know that people trend to hire people who look like, relate to, or are culturally familiar to them.

The U.S. population is over 325 million people. Nearly one- in -seven Americans identify themselves as Black or African American (or about 13% of the U.S. population). That’s over 42 million African Americans. Yet, the median income for African Americans is merely $35,000. $24,000 less than White America. There is a clear disconnect between the growth of Black Businesses and the growth of black income or net worth. WE MUST DO BETTER.

What are some things entrepreneurs can do to prepare themselves for success in international trade?

DO YOUR HOME WORK! I can’t stress that enough. Seek out others who have been where you are going. Seek mentors and network. Contact your local SBA office and state economic development office and take advantage of these resources.

What do think needs to take place to achieve successful levels of economic development in the Black community?

Continual investment in, and improvement of the African American small business ecosystem to support sustainable, home-grown small businesses and provide resources for local talent, all while enabling growth and innovation through global connectivity. We know that entrepreneurs are the job creators.

Therefore, we must truly connect with them and provide a small business “support system,” because small business is big business!

There are two essential pillars WE must adopt as a key stakeholder to the African American community:

(1) WE must invest in African American and Minority-owned banks

(2) We must change the mind set of doing business with African American businesses

Both have one thing in common and that is the circulation of Black dollars.

Number One. Access to capital is a global challenge for entrepreneurs and small Businesses. The U.S. Small Business addresses this gap by offering loan programs specifically tailored for small businesses through a national distribution system of lending partners.

This framework enabled SBA to approve more than 68,000 loans in FY 2017 which totaled more than $30 billion to small businesses and supported nearly 630,000 jobs. Our loan guarantees fill gaps just to show you what is possible when the government steps in to de-risk lending for our backbone of job creators.

The Bad news here is that less than 2% of those loans are with African American Banks. Over the last 20 years, very few African American businesses have been able to gain access to the predominantly white private equity, angel investors, and venture capital communities. And of course, these investors have been the drivers of innovation and start-ups fueling our economy.

If small businesses are the job creators, and we are to move to secure the future of the next generation of young African Americans, we need to direct our resources to the number one issue for small businesses: namely the disproportional lack of access to capital to and for African American small businesses.

Investing our savings deposits in Black Banks is the first and a major step in the effort. An increase in their reserves makes more funds available to our community businesses. Keeping in mind that we must keep them accountable for the circulation of those dollars back in the form of investments and loans to small businesses the job creators in or entering our communities.

Which leads directly to number two. Changing the mindset of doing business with African American Business owners. Whether we call it, “Programed Self Hate” or “Non-conscience Bias” or by some other name, it is preventing us from more fully sharing in the American Dream and from expanding African American economic growth and higher standards of living.

Just look at most every other ethnic minority community in the United States, such as Korean Americans or Cuban Americans, and how they have banded together to re-circulate their earnings and spending within their respective communities. As I mentioned, the number one issue is access to capital. Many Asians Americans often don’t even use traditional banks and financial institutions.

Instead, they pool their money together and provide funds in the form of investment and/or short-term loans to their community when they come to the country to open a business and employ family and friends. Have any of you gone into the black community and seen the take-out stores, laundry cleaners, liquor stores and in some cases even the soul food restaurants and who owes them? Need I say more?

Which foreign country do you feel is the most business friendly and why?

Most American small businesses prefer to do business with our neighbors Canada and Mexico. Europe and countries with democratic governments tend to be safe bets. However, with the internet, we see more and more companies dip their toes elsewhere. I would recommend looking at emerging markets. Countries that have growth in the middle class and disposal incomes. Eight of the top emerging markets are in Africa

What existing policies are most beneficial to business owners and what types don’t exist but should?

We know that entrepreneurs are the job creators. Therefore, it would be in the best interest of any economy to create a small business support system.

Serving under represented communities, minorities and women is essential. The SBA has four essential pillars that every support system has:

- Capital Access

- Counseling and Training

- Contracting

- Policy and regulations

There are trade agreements and the World Trade Organization policies to attempt to standardize international trade. However, not every country is a member or abides by the WTO standards. Entrepreneurs should become aware of the participation of the country or countries they are looking to do business with to become engaging.

What advice do you have for aspiring entrepreneurs?

DO YOUR HOME WORK

There is a wide range of support and information to assist entrepreneurs interring global markets, EX-Im Bank, the department of Commerce as well as SBA with its Export centers across the country can provide cost-saving and risk-reduction programs to assist small businesses enter markets and secure payment

https://www.sba.gov/sites/default/files/Whats-New-With-Small-Business-2018.pdf

Mr. Cornelius is the former Deputy Associate Administrator for the Office of International Trade with the U.S. Small Business Administration (SBA) responsible for administrating the oversight and execution of four program divisions:

(1) The Federal & State Trade Development Division — which focuses on the delivery and management of grants programs,

(2) The International Trade Finance Division — which provides Trade Financing, counseling, and training with SBA’s 3 Loan programs via 21 Export Assistance Centers Nationwide,

(3) The International Affairs & Trade Policy Division — which focuses on National initiatives, Trade policy mandates, export promotion interagency collaborative efforts, field network and outreach, and

(4) Administration & Operations with a focus on Budget, Human Resources, and Management. Duties included the development of international trade strategies and strategic plans, the leadership of the OIT and other staff in the formation and administration of policies and programs, technical direction and coordination of interagency activities with the U.S. Department of Commerce, the U.S. Trade Representative, the U.S. Department of Agriculture, the Export-Import Bank of the United States, the U.S. Department of State, the Overseas Private Investment Corporation, and other Federal, State, and local agencies.