Yesterday, the NAACP, the nation’s oldest and largest civil rights organization, announced the launch of NAACP Capital, a $200 million fund of funds that will invest in diverse fund managers and startups focused on addressing systemic inequities.

This bold initiative aims to drive economic empowerment and social change by providing capital and support to underrepresented entrepreneurs.

The fund, conceptualized in partnership with Kapor Capital and Kapor Center, is a testament to the NAACP’s commitment to advancing racial justice and economic equality. By investing in diverse fund managers and startups, NAACP Capital seeks to unlock the full potential of innovation and technology to address critical societal challenges.

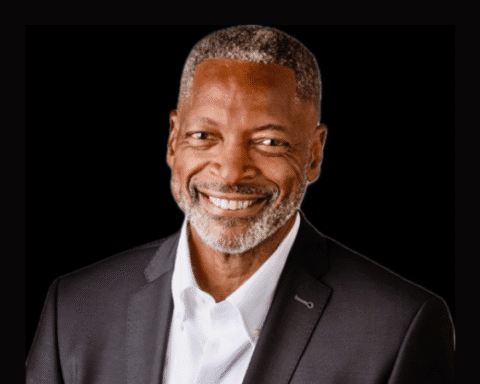

“As an ever-evolving legacy organization, the NAACP knows that innovation is born out of inclusivity,” said Derrick Johnson, President and CEO of the NAACP. “Impact investing has the power to drive historic financial returns and uplift overlooked communities.”

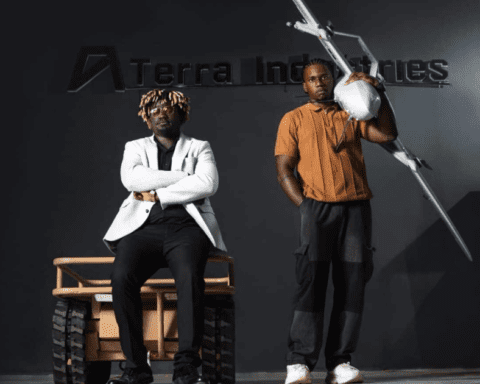

Jay Lundy, Managing Director of NAACP Capital, brings a wealth of experience in venture capital and impact investing to the role. He is passionate about leveraging technology to create a more equitable future and is excited to lead this groundbreaking initiative.

“Through this fund, we have an opportunity to invest and capitalize the next generation of managers and founders who will work to bring technology and innovation into our communities,” said Lundy. “Our investment strategy will target the intersection of generational impact and tech innovation, driving both impact at scale and top returns on investment.”

NAACP Capital will operate as a standard fund of funds and co-investing strategy, providing capital and support to diverse fund managers and startups.

The fund will focus on sectors such as fintech, healthtech, edtech, and climate tech, where innovation can have a significant impact on underserved communities.

By investing in diverse talent and innovative solutions, NAACP Capital aims to create a more inclusive and equitable future for all.