New York Life, the nation’s largest mutual life insurer, announced today that it has acquired a minority stake in Fairview Capital, one of the largest minority-owned investment management firms in the U.S.

Fairview is a leader in venture capital and private equity investing, with over $10 billion under management since its inception 30 years ago. The firm invests on behalf of institutional investors, including public and private pension plans, foundations, and endowments.

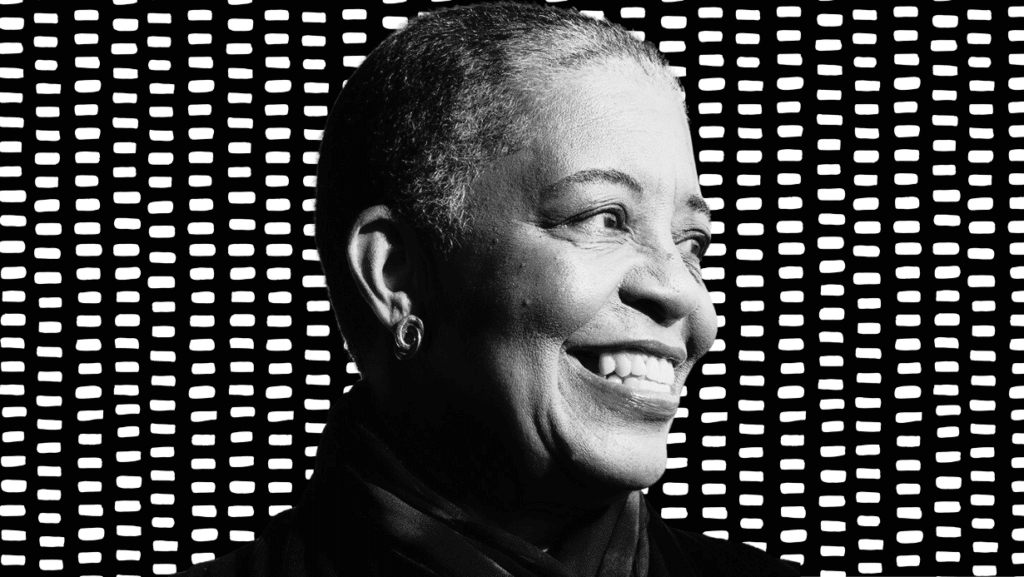

Fairview’s leadership team will retain majority ownership of the firm following this investment. This team includes Co-founders JoAnn Price and Larry Morse, alongside Managing Partners Kola Olofinboba, Alan Mattamana and Aakar Vachhani, and Partner Kwesi Quaye.

This partnership promises mutual benefits. “New York Life’s investment will create exciting opportunities for Fairview’s growth,” stated Larry Morse, Fairview’s Co-Founder. “We’ll be able to accelerate our expansion and collaborate with the industry’s top venture capital firms and leading diverse and emerging fund managers,” he elaborated.

Fairview Co-Founder JoAnn Price underscored the firm’s unwavering commitment to transforming the venture capital and private equity landscape. “We remain dedicated to fostering positive change within the industry while maximizing value for our investors,” Price remarked.

This move bolsters New York Life’s $1 billion impact investment initiative, launched in 2021 to tackle the racial wealth gap. The company has already committed $200 million to Fairview, which has subsequently invested in numerous diverse and emerging fund managers, impacting hundreds of businesses in total.