Lendistry, a leading fintech lender and community development financial institution, has received a $5 million investment from Exelon.

The new funding aims to expand access to capital for small businesses in cities where the capital gap remains wide for diverse entrepreneurs.

The investment, announced Sept. 3, comes through Exelon’s Community Impact Capital Fund, managed in partnership with RockCreek. The fund supports businesses in Exelon’s service areas, including Chicago, Philadelphia, Washington, D.C., Baltimore, Wilmington, and Atlantic City.

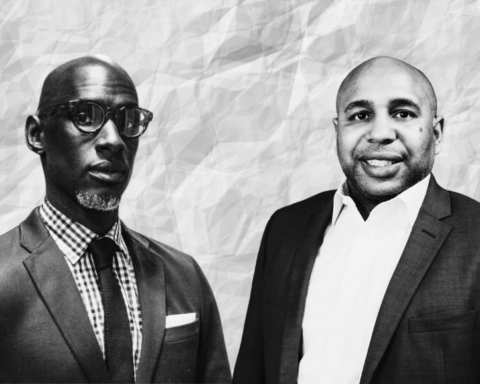

Lendistry Chief Executive Officer Everett K. Sands said Exelon’s support will help deliver capital and economic empowerment in the communities that need it most. “The Exelon team truly understands the connection between small businesses and local prosperity, and their investment in Lendistry will energize their service areas,” Sands said.

Exelon Chief Operating Officer Mike Innocenzo said supporting community-based businesses is key to promoting long-term growth. “We’re not only delivering energy, we aim to be an economic engine in the communities we serve,” Innocenzo said.

Founded in 2015, Lendistry has deployed more than $10 billion in loans and grants to undercapitalized business owners across the country. The company is recognized as the second-largest non-bank SBA 7(a) lender in the nation.

The timing of Exelon’s move is notable. As some large corporations are scaling back diversity and inclusion efforts, Exelon is investing in strategies designed to close the capital gap and support local economies.

For business owners in these cities, a loan from Lendistry can be a turning point for survival and growth.