Harith General Partners has entered into a Sale and Purchase Agreement to acquire 100 percent of FlySafair, South Africa’s largest domestic airline by seat capacity.

The transaction remains subject to customary regulatory approvals, including review by the Competition Commission and relevant aviation authorities.

If approved, the deal will place one of Africa’s leading infrastructure investors at the center of South Africa’s domestic aviation system.

Infrastructure Capital Moving Closer to the Consumer

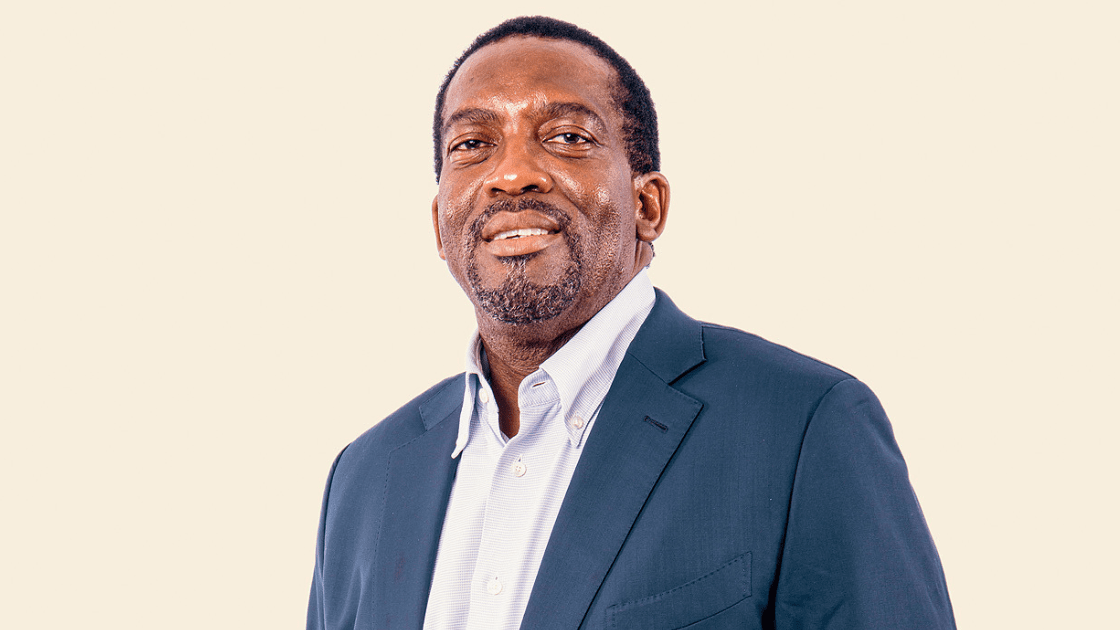

Founded in 2006 by Tshepo Mahloele, Harith General Partners is marking two decades of operation as a Pan-African infrastructure investment firm. The firm manages more than US$3 billion in assets across energy, connectivity, transportation, and logistics platforms throughout Africa.

Historically, Harith has deployed long-horizon capital into the systems that enable economic activity: power generation assets, fiber networks, logistics corridors, and transport-linked infrastructure.

Owning an airline introduces a different category of exposure.

Airports operate as regulated infrastructure assets with concession-backed revenue visibility. Airlines function within those systems and assume direct exposure to fuel volatility, labor intensity, pricing competition, and demand cycles.

Capital allocation shifts materially when an infrastructure investor moves from regulated, asset-based platforms into an operating mobility business.

The proposed acquisition indicates that FlySafair’s market dominance, cost structure, and governance framework are viewed as sufficiently resilient to justify that transition.

Market Dominance and Operational Continuity

FlySafair controls approximately 67 percent of South Africa’s domestic seat capacity and operates a fleet of more than 30 aircraft.

In aviation economics, scale is structural. A dominant seat share influences route economics, pricing power, load factor stability, and supplier negotiations. It creates insulation against competitive fragmentation and supports capital deployment efficiency.

Harith has confirmed that FlySafair’s existing leadership team will remain in place following completion of the transaction. That continuity reduces integration risk and reinforces that the investment thesis is built on operational stability rather than restructuring.

Infrastructure capital typically enters functioning systems.

Private Capital and the Evolution of African Aviation

African aviation has historically been shaped by state ownership, recapitalizations, and politically sensitive restructuring cycles.

The proposed acquisition of a commercially dominant domestic carrier by a private infrastructure investor reflects a broader structural evolution:

• Institutional capital assuming direct ownership of mobility platforms

• Governance discipline replacing subsidy dependency

• Long-term capital integrating transport systems across portfolios

This is not a distressed rescue. It is a strategic consolidation of a high-performing asset.

That distinction matters.

Regulatory Oversight and Systemic Impact

Airline ownership is not purely financial. It is systemic.

The transaction remains subject to regulatory approval, including review by competition and aviation authorities. Regulatory oversight shapes route rights, market concentration, and long-term competitive dynamics.

Domestic aviation functions as a proxy for economic velocity. Passenger traffic reflects business activity, tourism flows, and internal trade patterns.

Ownership decisions at this scale influence more than shareholder returns. They affect national connectivity.

A Maturing Infrastructure Thesis

With over US$3 billion under management, Harith’s expansion into full airline ownership reflects the maturation of African infrastructure capital.

Over two decades, the firm has invested in foundational systems. Integrating a dominant domestic airline into that portfolio moves capital further into the operating layer of the economy.

The strategic question is no longer whether African mobility platforms can attract institutional capital.

It is how that capital will steward them across multi-decade cycles.

Capital Ownership and Economic Visibility

Ownership of infrastructure assets shapes more than returns. It shapes who participates in economic systems, who governs them, and who benefits from their scale.

Transport infrastructure determines how people move, how businesses connect, and how markets function. When institutional capital rooted in the continent assumes control of dominant mobility platforms, it signals structural participation in sectors that influence national economic velocity.

Visibility in global capital markets is often tied to ownership of durable, system-level assets. Transactions of this scale contribute to that visibility.

The FlySafair acquisition, if approved, represents more than a portfolio addition. It reflects a continued evolution of African capital from infrastructure enabler to infrastructure steward.