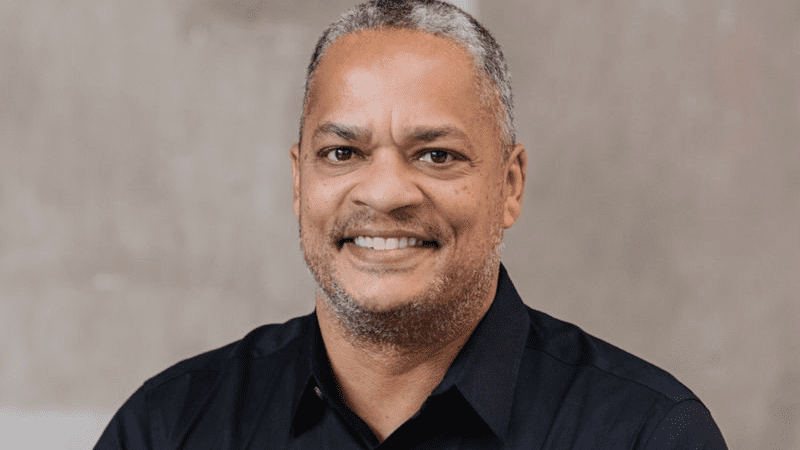

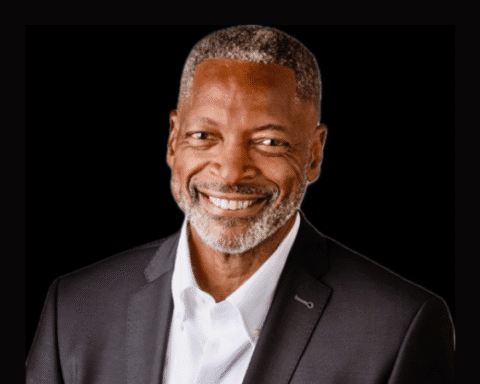

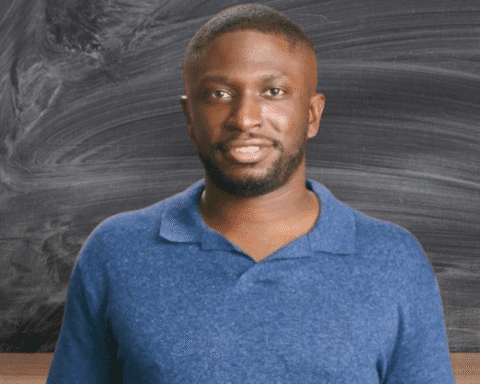

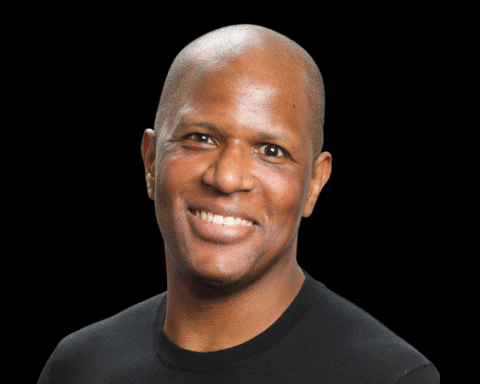

Footwork is a San Francisco-based venture capital firm co-founded by Mike Smith and Nikhil Basu Trivedi.

The firm has built a reputation as an operator-first investor. Since launching in 2021, Footwork has become a key partner for startups at the intersection of technology and real-world business challenges.

Footwork has raised two funds: a $175 million debut in 2021 and a $225 million second fund in 2025. The portfolio includes high-growth companies such as Table22, Cradlewise, GPTZero, Watershed, and now Confido.

They recently announced it has led a $15 million Series A in Confido, a platform bringing AI-powered financial automation to consumer-packaged goods (CPG) brands.

The deal underscores Footwork’s operator-first approach to early-stage investing, leveraging deep operating experience to help founders build category-defining companies.

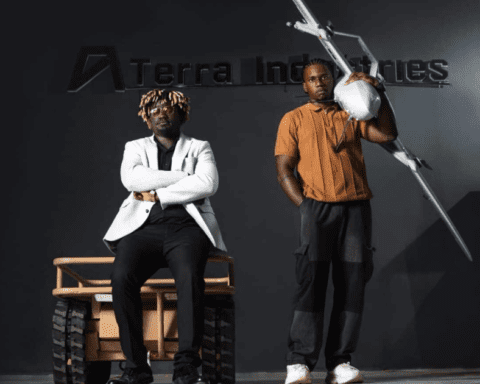

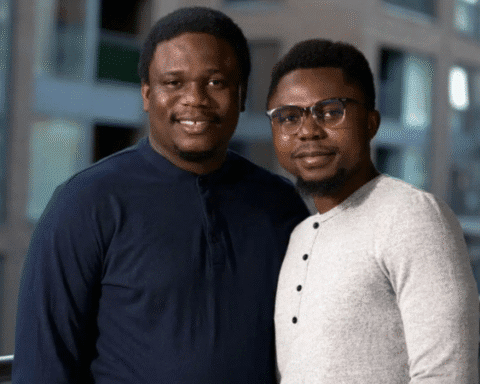

Confido, founded by Kara Holinski and Justin Hunter, offers an end-to-end platform that automates core finance and trade workflows for CPG brands. Its clients already include industry disruptors like Olipop and DUDE Wipes.

“As a former COO & CFO, I’ve seen how the right software can transform both a company’s P&L and the way teams work. That’s why I’m so excited to be partnering with Kara Holinski and Justin Hunter at Confido, who are building the AI-powered financial operating system to help amazing CPG brands thrive as they grow into retail channels,” said Footwork co-founder Mike Smith, who will join Confido’s board of directors as part of the deal.

Other investors in the round include Watchfire Ventures, Y Combinator, BFG Partners, Fintech Fund, Barrel Ventures, and several prominent angels.

Footwork’s expanding portfolio and operator-led model are reshaping the landscape for early-stage capital, demonstrating the value of hands-on guidance and real-world experience in building the next generation of high-growth startups.

Don’t miss stories like this.

Subscribe to our newsletter for insights on founders, fund managers, and the business of capital.

Know a fund manager or founder making moves? Submit a business to be featured.

Interested in investing in Black founders and fund managers? Join the Investor List