Equity crowdfunding has become an important option for raising capital, offering founders and investors a pathway that sits outside traditional venture capital and bank financing.

This shift is especially relevant for Black founders, who have long faced structural barriers in accessing early-stage capital.

Recent data shows that the percentage of venture capital invested in Black founders remains extremely low, falling from 1.3 percent in 2021 to around 1 percent in 2022.

A Path Around Traditional Gatekeepers

Equity crowdfunding allows founders to raise up to $5 million within a 12-month period under Regulation Crowdfunding (Reg CF). Instead of pitching to a small set of investors, founders can share their opportunity with a broader community and build early support around their company.

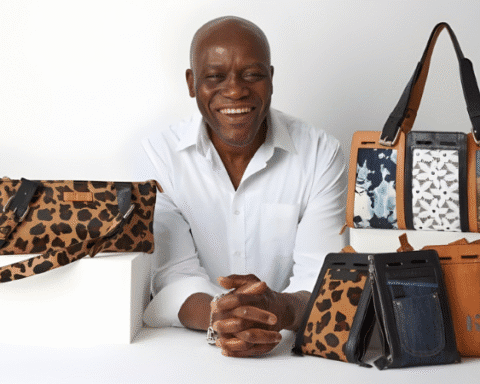

This approach allows Black founders to validate market demand, activate a customer base, and bring supporters into the ownership journey earlier.

Expanding Access for Black Investors

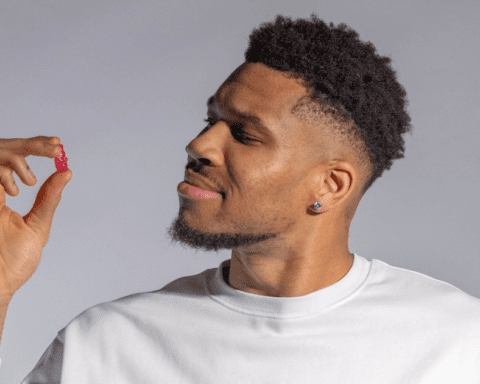

Equity crowdfunding also opens the door for more Black investors to participate in early-stage opportunities. Many people who may not have the wealth, networks, or accreditation typically required in venture capital can still invest through regulated crowdfunding offerings.

Investment minimums can be as low as a few hundred dollars, making it possible for more people to develop a diversified investment portfolio and support founders they believe in.

Risks and Considerations

Like all private-market investments, equity crowdfunding carries risk. Investments are illiquid, there is no guarantee of return, and early-stage companies can fail. Investors should review offering documents carefully and understand the terms before committing capital.

Founders must also understand the legal and compliance requirements, including disclosure obligations and communication rules. Consulting a knowledgeable legal professional is essential.

A Growing Opportunity

Equity crowdfunding creates a pathway for Black founders and investors to participate more fully in wealth creation. It expands access to early-stage investing, supports entrepreneurial visibility, and broadens who gets to build and back new companies.

As the sector grows, it has the potential to reshape participation and ownership within the broader startup and investment landscape.

Interested in investing in Black founders? Complete this brief form.