by Tony O. Lawson

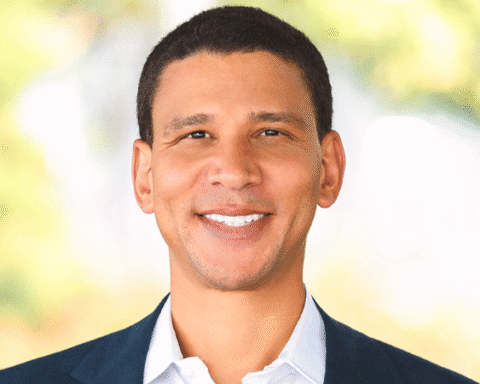

Daryl Carter is the founder, chairman, and CEO of Avanath Capital Management, a real estate investment firm focused on affordable and workforce housing.

In this interview he shares how he built a multi billion dollar platform, why he invests in underserved communities, and what it takes to attract institutional capital while staying true to his values.

Since launching Avanath in 2008, he has acquired almost four billion dollars worth of multifamily properties in 15 states, including a high-rise in New York for $101 million, two properties in California for $132 million, and a $119 million acquisition in Chicago, one of the city’s largest transactions.

From Detroit To Institutional Real Estate

Daryl grew up on the west side of Detroit in the 60s and 70s. He watched his neighborhood shift from a flourishing community to one deeply affected by disinvestment. That experience, combined with his early fascination with construction, shaped the focus of his career.

After studying at the University of Michigan and earning a graduate degree from MIT, he started out in banking. Over the next four decades, he focused on strategies for investing in communities that had been overlooked by institutional capital, particularly communities of color.

The thesis is simple. If disinvestment drives communities down, the right investments can bring them back.

Through Avanath, he has helped deploy nearly four billion dollars in neighborhoods in West Oakland, the south side of Chicago, Detroit, North Long Beach, and South Central Los Angeles. Quality housing and intentional community investment, he argues, attract more capital and improve long-term outcomes for residents and investors.

The State Of Affordable Housing

Daryl is direct about the national housing shortage. Estimates vary, but experts agree the United States is short by millions of housing units. The gap is especially severe for households earning 50 to 100 percent of area median income.

This shortage leaves many families paying 40 to 60 percent of their income on rent. That strain affects healthcare, savings, and long-term financial stability.

While there is broad political agreement that housing affordability is a national problem, solutions remain heavily debated.

He spends significant time in Washington engaging with policymakers to keep housing at the center of the conversation.

Housing Quality And Resident Wellbeing

For Daryl, taking care of residents is inseparable from delivering strong returns. About 40 percent of Avanath’s tenants are Section 8 households. He is clear that stigmas around affordable housing usually reflect poor ownership or management, not the residents themselves.

The firm invests in programs that support families and seniors. At many family communities, Avanath partners with nonprofits to host after-school programs. These initiatives help parents keep kids in safe environments and reduce turnover and maintenance costs.

Roughly a quarter of the portfolio serves seniors. Wellness programs, fitness classes, and access to fresh produce through farmers markets extend independence and improve quality of life. Healthier residents stay longer, which strengthens both the community and the economics of each property.

Avanath also partners with proptech companies such as Esusu to report on time rent payments to credit agencies. Thousands of households in the portfolio now benefit from improved or newly established credit histories, which had previously been out of reach for many renters.

Scaling With Institutional Investors

Raising capital is a constant part of Daryl’s job. He sees it as being driven by three core elements. First, the firm has to deliver competitive, risk-adjusted returns.

Second, the strategy must be scalable so investors can see a path to growth. Third, investors increasingly want measurable impact on communities and the environment.

Behind those headline themes is a disciplined operational engine. Institutional partners expect accurate reporting, strong risk management, and robust financial systems.

Daryl emphasizes how much time and capital go into building the right infrastructure in technology, accounting, and operations so that quarterly and annual reporting is both timely and reliable.

Investing In Residents And Building For The Future

As an entrepreneur with more than forty years in the industry, Daryl points to several traits that have shaped his leadership.

Patience is at the top of the list. It may not fit the stereotypical image of an entrepreneur, but he considers it essential for long-term investing.

He also prioritizes building diverse teams with different perspectives. Lived experience influences how people see risk, safety, design, and opportunity.

Daryl tells a story about a boss who forced him to consider whether his sisters would feel safe at a property he was evaluating, not just whether he felt safe as a tall man from Detroit. That shift in perspective still shapes his decision-making.

Time management is another key. He pushes himself to spend time not only on acquisitions, which he loves, but on the areas where his oversight is most needed. He continuously thinks about how the organization should evolve as the portfolio grows from tens of thousands of units toward the next level.

Technology is part of that future. From smart thermostats to digital locks to resident apps, he looks for tools that improve efficiency and resident satisfaction. He studies innovations in the hotel sector and elsewhere that might translate into multifamily housing, always with an eye toward service and cost savings.

Building An Ecosystem With Black Owned Partners

Daryl is intentional about building an ecosystem that includes Black owned and minority owned businesses. His largest contractor, Tec Construction, is led by his longtime collaborator Tim Coffey, whom he describes as one of the most skilled builders in the industry.

He also partners with firms like McFarland Partners and Laurel Street Residential, among others. For him, working with Black owned businesses is not about checking a box.

It is about collaborating with exceptional operators who understand the communities Avanath serves and share a long-term, values-driven approach to growth.

Lessons For Entrepreneurs And Investors

In closing, Daryl offers advice to real estate professionals and founders who are raising capital or building companies.

Patience and persistence matter. So does learning from rejection. When he and his co founder launched their first company, Capri Capital, they held 57 meetings before getting a yes.

A turning point came when one early meeting offered detailed feedback on what was missing. From that point on, every rejection became data they used to refine their pitch and structure.

He encourages Black and brown entrepreneurs to look for insight in every no instead of assuming that rejection is always about race or background. That mindset, he believes, can make the difference between giving up and breaking through.

Watch The Full Interview

You can watch the full conversation with Daryl below.