Compass, a technology-driven real estate brokerage, announced Monday it has agreed to acquire rival Anywhere Real Estate Inc. in an all-stock transaction valued at approximately $1.6 billion.

This move will create the world’s largest residential real estate brokerage.

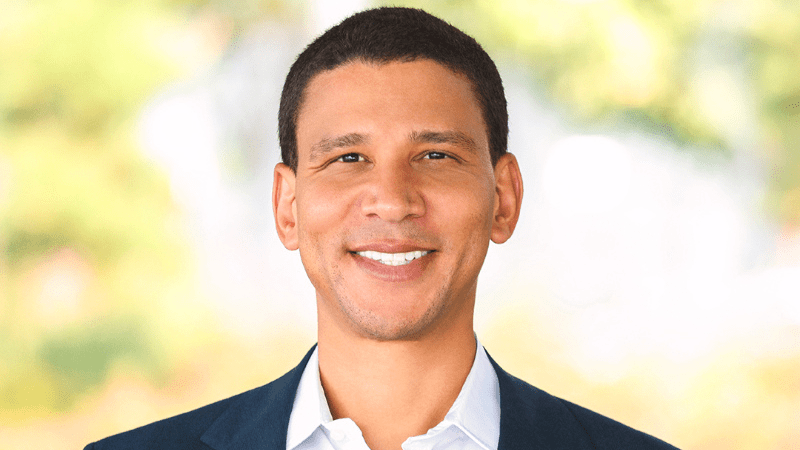

Founded in 2012 by CEO Robert Reffkin, Compass has built its reputation as an agent-first platform, leveraging proprietary software to help real estate agents market listings, manage transactions, and serve clients more efficiently.

The company has rapidly expanded its footprint in luxury and urban markets across the United States.

The merger, unanimously approved by both companies’ boards of directors, is expected to close in the second half of 2026, pending regulatory and shareholder approval.

Under the agreement, shareholders of Anywhere will receive 1.436 shares of Compass Class A common stock for each share they own, valuing Anywhere shares at $13.01 apiece based on Compass’s 30-day trading average.

“This transaction marks a defining moment for Compass and the real estate industry at large,” Reffkin said in a statement. “By bringing together the best talent, technology, and global reach, we are building a platform that can better serve agents, clients, and communities everywhere.”

Both companies have reported strong performance this year. Compass’s second-quarter 2025 revenue climbed to $2.06 billion, up 21% year-over-year, with net income nearly doubling and its agent network growing by over 20%.

Anywhere Real Estate reported $1.68 billion in quarterly revenue, with its luxury brands—such as Coldwell Banker Global Luxury and Sotheby’s International Realty—leading market gains.

The combined company will operate across every major U.S. market and more than 120 countries, with a network of approximately 340,000 real estate professionals worldwide.

Compass is known for its technology-driven platform and rapid growth, while Anywhere brings an extensive franchise portfolio that includes Coldwell Banker, Century 21, Sotheby’s International Realty, and Better Homes and Gardens Real Estate.

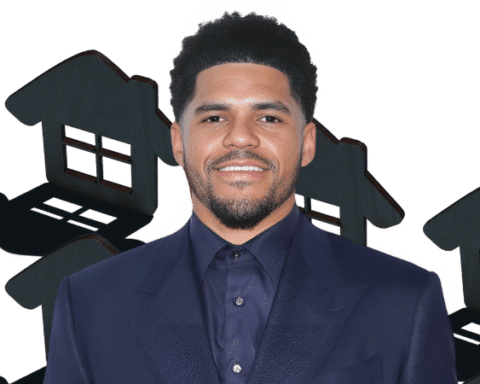

“Joining forces with Compass will allow us to accelerate innovation and offer even greater value to our agents and franchisees,” said Ryan Schneider, president and CEO of Anywhere Real Estate. “Together, we are positioned to lead the industry through its next chapter.”

The companies expect to achieve at least $225 million in annual cost savings by streamlining operations and combining resources.

Compass has secured a $750 million financing commitment from Morgan Stanley Senior Funding to support the deal.

Both firms said they plan to maintain their respective brand identities following the merger, ensuring continuity for agents and franchisees.

The announcement comes at a time when residential real estate remains highly competitive, with technology, efficiency, and scale increasingly crucial for growth.

Update (January 2026): The all-stock merger between Compass and Anywhere Real Estate has officially closed following regulatory and shareholder approval, creating the world’s largest residential real estate brokerage by sales volume.