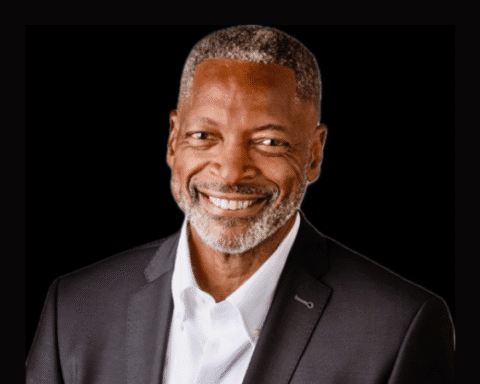

Stacy Brown-Philpot has launched Cherryrock Capital, raising $172 million for a venture fund focused on supporting underrepresented founders, particularly those from Black and Latinx backgrounds.

Cherryrock Capital, named after Brown-Philpot’s childhood nickname “Cherry Pie,” is positioned as the first Black woman-founded, multi-hundred-million-dollar venture firm focused on Black and Latinx founders.

The fund provides Series A and B financing to technology companies, aiming to address a critical gap in the venture capital landscape.

“We’re on a mission to change the face of wealth creation and build an enduring institution,” Brown-Philpot said. “We are looking for founders who have the courage to be audacious in their vision, accountable to their goals, and authentic to who they are.”

The firm targets a unique niche in the venture capital ecosystem. While many early-stage investors focus on pre-seed and seed rounds with small checks, Cherryrock Capital concentrates on Series A and B rounds for underinvested founders.

The firm has already begun making investments. Their portfolio includes Coactive AI, a multimodal AI company, where they co-led a Series B round with Emerson Collective. They also led a Series A round for Vitable Health, a YC company providing affordable primary care-driven health plans to businesses with hourly workers.

The fund has attracted investments from financial institutions including JPMorgan Chase & Co., Goldman Sachs Group Inc., and Massachusetts Mutual Life Insurance Co. Notable individual backers include LinkedIn co-founder Reid Hoffman and former Meta Platforms Inc. chief operating officer Sheryl Sandberg.

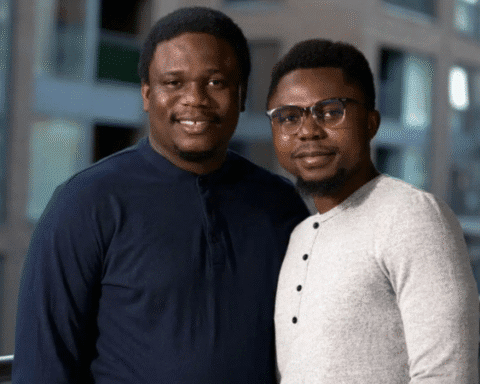

Brown-Philpot brings over 20 years of experience in the technology industry to Cherryrock Capital. She co-founded the firm with Saydeah Howard, and together with their team, they bring more than 60 years of operating, board, and investing experience to build a different kind of venture firm.

Cherryrock Capital aims to help emerging technology startups scale from $1 million to $100 million through operational excellence, CEO coaching, and talent support. The firm typically invests between $6-$10 million per deal and is actively exploring opportunities in the future of work and fintech spaces.

This new venture represents a significant step in addressing the funding gap for underrepresented founders in the tech industry, potentially reshaping the landscape of wealth creation in the startup ecosystem.