We often talk about the importance of shopping at Black-owned businesses. But far less attention is paid to a parallel and arguably more powerful strategy: buying and combining Black-owned businesses.

Despite growing interest in economic collaboration, one high-impact strategy remains underutilized across the Black business ecosystem: strategic mergers between Black-owned companies.

While large corporations routinely merge to expand market share, improve margins, and build durable scale, small and mid-sized Black-owned businesses rarely pursue this path. This is not due to a lack of ambition or opportunity, but rather structural barriers that have historically limited access to capital, advisory expertise, and deal infrastructure.

Still, when Black-owned firms do merge, the results demonstrate what is possible.

When Black Business Mergers Have Worked

There are notable examples that illustrate the upside of consolidation.

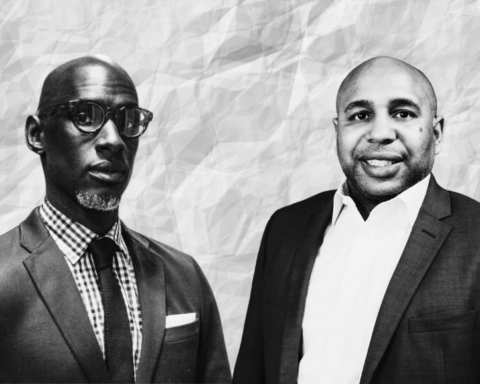

In banking, the 2021 merger between City First Bank and Broadway Financial Corporation created the largest Black-led bank in the United States, surpassing $1 billion in assets.

The combined institution gained greater balance sheet strength, expanded geographic reach, and improved its ability to serve both individual and commercial clients at scale.

In technology and education, Black-owned company Stemuli announced the merger of Infinity.careers and Oppti in 2023, bringing together Black founders to build a stronger, AI-driven workforce development platform. The move combined complementary capabilities and positioned the company to compete more effectively in a crowded market.

These examples reinforce a simple truth: scale changes outcomes.

Where Modern Black Business Mergers Make Sense

Several sectors are particularly well positioned for consolidation:

Professional Services

Law firms, accounting practices, and advisory shops can merge to pursue larger corporate and institutional clients while retaining cultural competency and community trust.

Food and Beverage

Independent restaurants and food manufacturers can combine brands, production capacity, and distribution to improve margins and supplier leverage.

Technology Services

Smaller IT and consulting firms can merge to meet the staffing depth and technical breadth required for government and enterprise contracts.

Beauty and Retail

With sustained growth in Black-owned consumer brands, particularly those led by Black women, consolidation offers a path to stronger brand portfolios and operational efficiency.

Edtech and AI

Emerging technology sectors benefit from early consolidation, where shared data, talent, and infrastructure can create defensible market positions.

Why We Still See So Few Mergers

Several persistent challenges continue to limit merger activity:

Access to Capital

Mergers require patient, flexible capital. Black entrepreneurs have long faced structural disadvantages in both lending and equity markets.

Limited M&A Expertise

Many founders lack access to advisors who understand deal structuring, valuation, and integration, particularly within the context of Black-owned businesses.

Control and Trust Considerations

For many owners, businesses represent generational achievement. Relinquishing full control, even in a merger of equals, can feel risky without trusted partners and aligned incentives.

Valuation Gaps

Systemic undervaluation of Black-owned businesses makes it harder to structure fair and balanced transactions.

A Path Forward

If Black-owned businesses are to build lasting scale and generational wealth, consolidation must become part of the strategic toolkit, not an exception.

This requires more than capital. It requires deal literacy, trusted intermediaries, aligned ownership structures, and long-term thinking around control, governance, and value creation.