City Girls Golf is Honoring Legacy and Swinging for Change

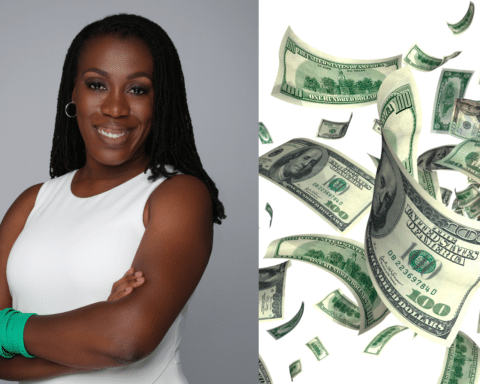

City Girls Golf is an organization founded with the mission of empowering women of color through the game of golf.

Founded by Sierra Morris, this organization specifically focuses on creating a space for women in urban areas to learn and enjoy golf, a sport traditionally seen as exclusive and expensive.

Morris’s inspiration stemmed not just from her own experience growing up in New York City where golf courses were scarce, but also from the rich legacy of the Wake-Robin Golf Club (WRGC).

Established in 1937, WRGC is the oldest registered African American women’s golf club in the United States.

These pioneering women paved the way for countless women of color to tee off and excel on the green. City Girls Golf proudly carries the torch, ensuring the legacy of Black women in golf thrives.

One of the biggest hurdles for newcomers, particularly women of color, is feeling out of place on the golf course. City Girls Golf tackles this by creating a sense of community. It’s about camaraderie, shared experiences, celebrating every accomplishment – from sinking a putt to finally figuring out your grip – and having a blast while doing it!

So, if you’ve ever been curious about golf but felt it wasn’t for you, City Girls Golf is here to rewrite the rules. It’s a chance to experience the thrill of the game, and meet like-minded women.

Pick up a club and join the City Girls Golf movement – they’re redefining what it means to be a golfer, one swing at a time.