Equity crowdfunding is evolving into a meaningful part of the early-stage capital landscape. Rather than relying solely on banks or venture capital firms, founders can now raise capital directly from their customers, supporters, and communities in exchange for ownership.

While annual funding totals fluctuate based on macroeconomic conditions, participation in regulated crowdfunding continues to deepen. In 2024, companies using Regulation Crowdfunding (Reg CF) raised more than $340 million, according to KingsCrowd, with Regulation A offerings contributing an additional $244 million. The total amount raised may vary year to year, but the model itself continues to gain traction and legitimacy.

Community Capital Is Growing in Influence

Even with short-term market shifts, the long-term trend is clear: more founders are exploring community-backed funding, and more investors are participating in early ownership.

Several forces are driving this movement:

• continued barriers in traditional financing

• increased retail investor interest in private-market opportunities

• regulatory clarity enabling broader participation

• the cultural shift toward democratized investing

• economic conditions that push founders to diversify capital sources

The rise of community capital is not measured solely by annual dollar totals. It is measured by expanding access, growing awareness, and more people entering the early-stage investment ecosystem.

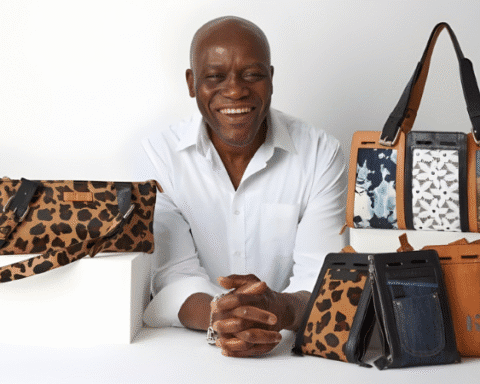

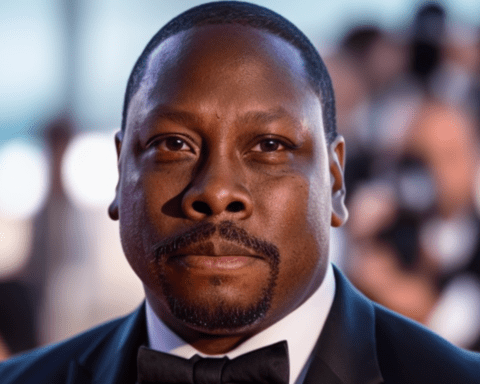

Why This Matters for Black Founders

For Black founders, equity crowdfunding offers a pathway around the structural barriers that persist in venture capital and traditional finance. Community-backed investment allows founders to:

• raise early capital directly from supporters

• validate their market and traction

• build a community of investors aligned with their mission

• grow without waiting for institutional approval

This is especially important in an environment where traditional funding sources remain difficult to access.

Opening the Door for New Investors

Equity crowdfunding also broadens who gets to invest. Many first-time investors do not have access to private-market deal flow or the net worth required for accredited investment. Reg CF lowers those barriers.

Minimums can start in the low hundreds, allowing more people to participate in early ownership and support founders they believe in. Even as market conditions fluctuate, the number of everyday investors participating in private offerings continues to rise.

Understanding the Risks

As with all private investments, equity crowdfunding carries risk. Offerings are illiquid, outcomes are uncertain, and early-stage companies can fail. Investors should review offering documents carefully, understand the terms, and evaluate risk before committing capital.

Founders must comply with regulatory requirements and reporting obligations. Working with legal and financial professionals is essential to protect both founders and investors.

The Future of Community Capital

Equity crowdfunding is not defined by year-to-year totals. It is defined by the shift toward more accessible, community-driven capital. The long-term trend points toward broader participation, more informed investors, and greater integration of community ownership into the earliest stages of business growth.

As the ecosystem matures, visibility and narrative will determine which founders benefit most. Equity crowdfunding is not just a financial mechanism. It is a pathway to participation, ownership, and more inclusive capital formation.

Shoppe Black will continue tracking this evolution and highlighting the founders and investors shaping the future of community capital.

Source: KingsCrowd 2024 Investment Crowdfunding Analysis.

Interested in investing in community-backed opportunities? Join our Investor Network for curated insights and updates on equity crowdfunding and early-stage capital.