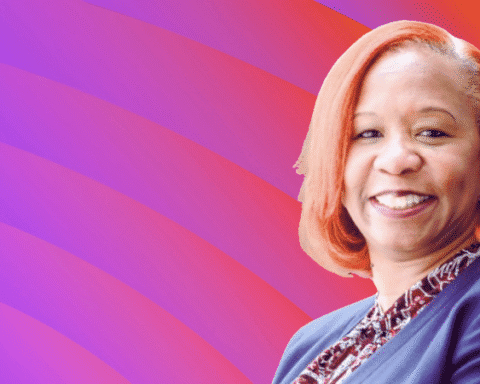

Dria Ventures, founded and led by Megan Maloney, has closed its first fund, raising $8 million to invest in pre-seed and seed-stage startups focused on reducing costs in health care and Main Street productivity, the firm announced.

Personal experience shapes Dria’s mission

The inspiration behind Dria Ventures is rooted in Maloney’s family history. The fund is named after her grandmothers, Dorothy and Sylvia, whose resilience and practicality guided Maloney’s values.

Maloney said her approach was also shaped by her own experiences with the health care system. When Maloney’s mother’s medical practice was hit by fraud, it was a breach of trust that changed how her family lived.

The experience reframed how she understood risk, systems and how easily people can fall through the cracks.

Investing in structural change

Dria Ventures is focused on founders building solutions to lower costs in industries where inefficiency, complexity, and outdated systems have driven up prices for years.

In health care, that could mean technology to streamline administrative tasks or platforms that help providers deliver better care at a lower cost.

On Main Street, Dria is looking for tools and services that help small businesses automate tasks, increase productivity, or access new resources that were previously out of reach.

By backing founders who address these cost burdens at the system level, Dria aims to create lasting, wide-reaching impact—not just incremental improvements.

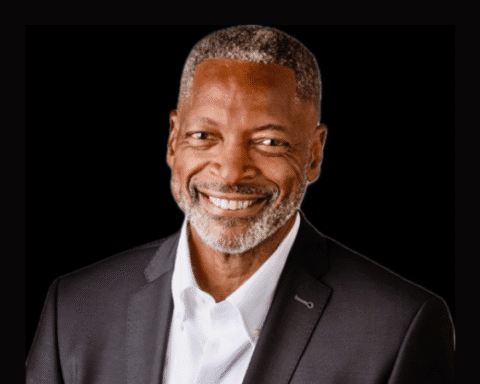

Limited partners and founder background

Limited partners in Dria Ventures Fund I include Next Legacy Partners, Global Endowment Management, Spring Point Partners, Stardust, General Catalyst and Handmade Capital.

Individual investors include Elad Gil, Katherine Boyle, Glen Tullman, Lee Shapiro, Diogo Monica and Jules Maltz.

Maloney, the firm’s sole general partner, holds an economics degree from Columbia University and an MBA from Harvard Business School.

She previously held roles at Morgan Stanley and General Catalyst and has experience as a board observer for high-growth companies.

Interested in investing in Black founders and fund managers? Join our Investor List