Shield, a fintech startup positioning itself as a “crypto neobank” for global trade, has raised $5 million in seed funding to scale its cross-border payments infrastructure.

The round was led by Giant Ventures, with participation from a16z’s crypto accelerator, Factor Capital, and strategic angels from Coinbase, Bank of America, and American Express.

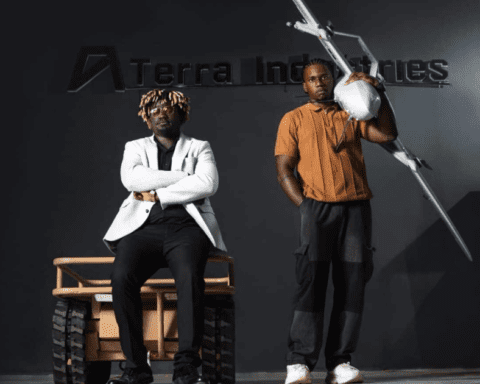

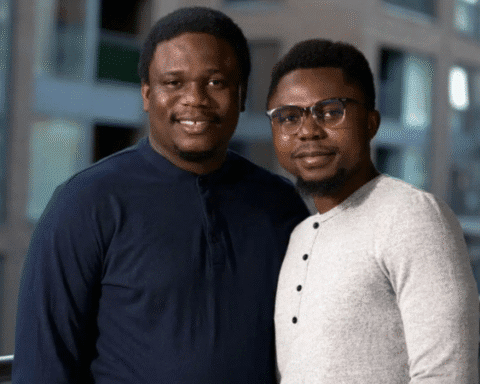

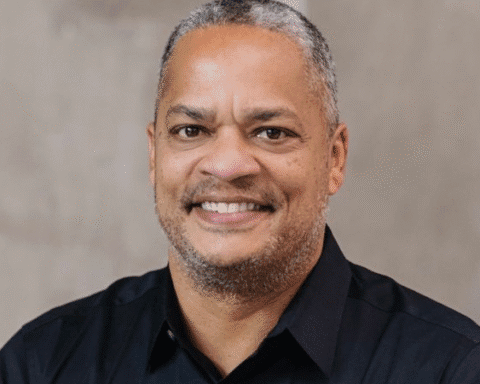

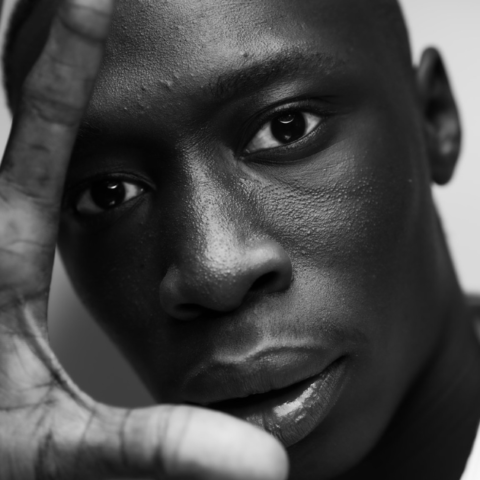

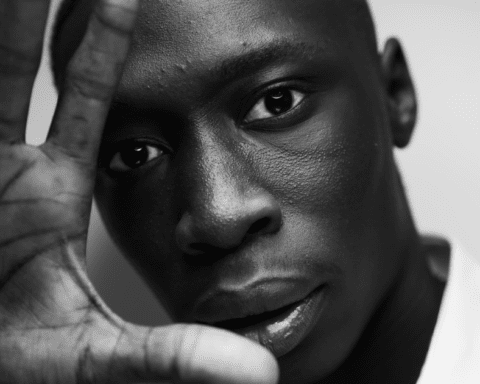

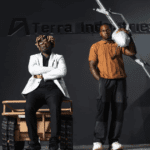

Founded by Emmanuel Udotong (CEO), Isaiah Udotong (COO), and Luis Carchi (CTO)—all with backgrounds as exporters between Africa, Latin America, and the U.S.—Shield was built to solve a problem they faced firsthand: unreliable international payments.

The founders say they entered the blockchain space determined to ensure that people from their backgrounds would benefit from the advancements of blockchain technology and not be left behind.

Originally focused on digital asset security, the team pivoted to payments after experiencing repeated banking issues as exporters.

They describe a reality where bank accounts would get closed every six months, even with proper documentation, invoices, and shipping records.

For many exporters, accounts are frequently closed and legitimate payments can get stuck in limbo for days or weeks, tying up capital and blocking growth.

Shield’s platform allows importers and exporters to accept stablecoin payments like USDT from international buyers and receive same-day USD wires.

The platform offers the speed and cost savings of blockchain without the constant fear of account closures or unwarranted delays.

The company has built trade-specific compliance into its system, including AI-driven document checks and embedded regulatory controls, to minimize false positives and efficiently flag real risks.

Since launching in 2024, Shield reports it has processed more than $150 million in cross-border payments, including $40 million in the past month alone.

The company is registered as a Money Service Business in the U.S. and as a crypto exchange in the European Union.

With this new funding, Shield plans to expand its licensing coverage, strengthen compliance, roll out USDT-friendly bank accounts, and enter additional underserved trade sectors.

The founders say they see a world where global trade payments are as fast as domestic wires, where compliance opens doors instead of closing them, and where exporters everywhere can finally access a banking and payments experience designed for their needs.