Ariel Alternatives, the private equity subsidiary of Ariel Investments, has acquired Groome Industrial Service Group.

Groome is a leading provider of specialized maintenance and industrial cleaning services for critical infrastructure across the U.S. The company serves power plants, refineries, manufacturing sites, and municipal utilities.

Their services include high-stakes cleaning, catalyst and emissions control, mechanical maintenance, and industrial coatings. Groome helps clients meet strict safety, regulatory, and operational standards.

A Strategic Expansion

Groome Industrial Service Group, headquartered in Denville, New Jersey, is recognized for its technical expertise across a range of high-stakes, mission-critical services. The company’s offerings include industrial cleaning, emissions and catalyst management, mechanical maintenance, industrial coatings, and its proprietary “KinetiClean” technology. Groome’s team of nearly 900 employees (including 830 technicians) operates across more than 20 locations nationwide, serving customers in natural gas-fired power generation, refining, manufacturing, shipping, aviation, and municipal utilities.

With the energy transition and data center growth fueling new infrastructure investments, the demand for reliable maintenance and utility services is surging. Ariel Alternatives, through this acquisition, is betting on the continued expansion of these sectors—and on Groome’s ability to scale to meet the moment.

Deal Details

The transaction was completed with Ariel Alternatives as the majority owner, joined by a minority co-investment from JPMorgan Chase & Co. (through its asset management division). The previous owner, Argosy Private Equity, exited as part of the deal. Baird served as exclusive financial advisor to Groome, and Massumi + Consoli LLP represented Ariel.

While the deal price remains undisclosed, the acquisition is seen as a key strategic win for Ariel. It expands the firm’s reach in industrial services at a time when aging U.S. infrastructure, decarbonization trends, and increased data center construction are all driving demand for advanced maintenance solutions.

Growth Potential

Industry analysts note that Ariel Alternatives brings not only capital, but also a network of operating advisors, potential for further acquisitions, and a long-term growth vision for Groome. The company’s patented KinetiClean technology, paired with its national footprint, positions it to support both legacy and next-generation infrastructure projects.

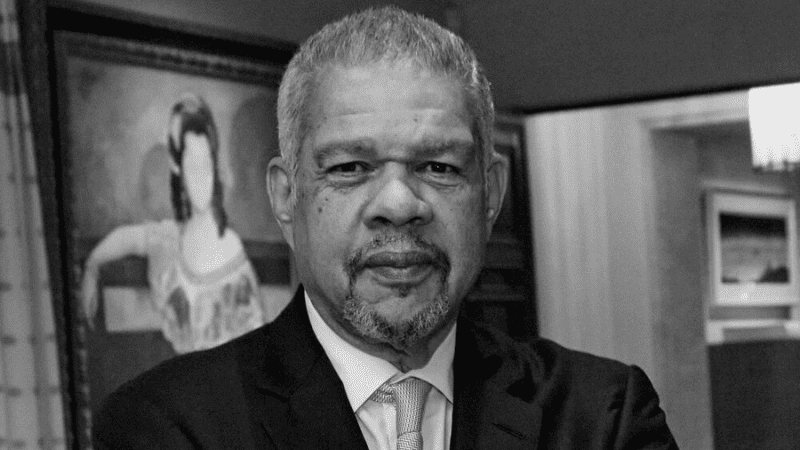

Les Brun, Co-Founder, Chairman and Chief Executive Officer of Ariel Alternatives, said: “At Ariel Alternatives, our mission is to support companies and leadership teams with a bold vision for growth and the talent to realize it. In Jeff and the Groome team, we have found exactly that. We are energized by the partnership and confident in what we will accomplish together.”

For Groome’s clients, the transition to Ariel ownership is expected to mean more capacity, additional resources, and an expanded service offering—while retaining the technical excellence and reliability for which the company is known.

A Broader Signal

Ariel Alternatives’ acquisition of Groome reflects a powerful trend: private equity is doubling down on industrial services at the intersection of energy, infrastructure, and technology.

Global infrastructure funds raised over $87 billion in 2024, with a significant portion aimed at supporting the energy transition and driving digital infrastructure growth.

Surging demand for data centers, stricter emissions standards, and government incentives are driving up the need for specialized maintenance and compliance services. Private equity firms are seeking companies with recurring, essential services and proven technical expertise—like Groome—to deliver both growth and resilience.

In this environment, Ariel’s move positions them as a key partner in the modernization of U.S. infrastructure and highlights the rising value of scalable, specialized service providers in the private markets.