Welcome to “The Wealth Moves Playbook,” a Shoppe Black series.

We break down what to do with $100K and other major money milestones—$250K, $1M, and beyond.

For entrepreneurs, professionals, and creators, these numbers are life-changing—but only if you make intentional moves at the right time.

Our goal is to demystify wealth-building through fictional case studies. We share actionable strategies for Black founders, business owners, and professionals.

We also spotlight those fork-in-the-road moments where smart choices can multiply your wealth or set you back.

Whether you just closed your first big contract, sold out a product, or steadily built your savings, this series is for you.

Why $100K Isn’t Just a Bonus—What to Do With $100K as a Solopreneur

For entrepreneurs and business owners, $100,000 isn’t just extra cash—it’s a sign you’ve reached a new level.

Maybe you just landed your biggest contract, had a viral sales month, or saw your side hustle finally break through.

But what you do next matters more than how you got here.

That’s where James finds himself: $100K in the bank, new doors opening, and one big question—what to do with $100K now?

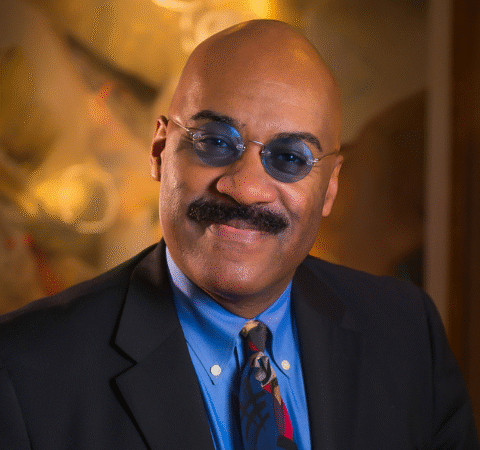

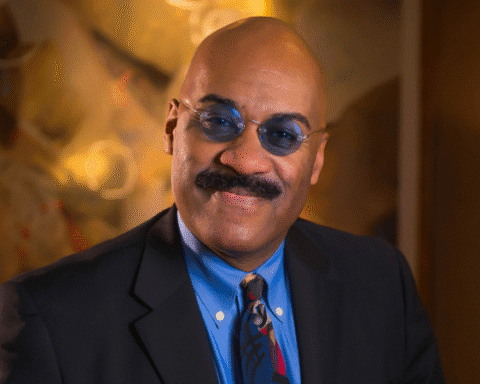

Meet James: From Solo Hustle to Breakthrough

James, 34, is a solopreneur who runs a creative agency and sells digital products online.

He’s been in business for five years, steadily building a reputation and a loyal client base—mostly working alone, managing everything from marketing to operations.

After years of grinding and gradual growth, James’s business just secured a $60,000 contract with a national client, brought in $30,000 from a viral product launch, and earned $10,000 from recurring services—all in just a few months.

With $100K in available cash, James is focused on leveling up—not just for this year, but for the next decade.

James’s $100K Playbook

James parked $25,000 in a high-yield savings account—his “sleep-well fund.” After years of hustling, he wanted to know he could breathe easy no matter what. The 4.5% APY adds a little extra, but what James values most is flexibility. He likes having cash on hand for unexpected opportunities, and this cushion keeps him from making any impulsive business moves.

He put $20,000 toward paying off debt—both business credit cards and a lingering personal loan. James remembers the stress of watching interest pile up each month. Now, with that debt gone, he can enjoy more freedom and less financial pressure, plus a boost in his monthly cash flow.

James set aside $25,000 as a business emergency fund. Running a solo business means some months are feast, others are famine. This fund covers three months of living expenses, software, and any help he might need from freelancers. It means he doesn’t have to panic when a client pays late or a project falls through—he’s built-in peace of mind.

He allocated $45,000 for long-term wealth, splitting it between a SEP IRA (which lets him save more for retirement as a solopreneur) and diversified index funds and bonds. For James, this money isn’t just an investment—it’s a promise to himself that his future won’t depend on the next client or gig.

James invested $20,000 right back into his business, but only where it counts. He upgraded his marketing tools and website, hired a top-notch freelancer to level up his branding, and registered for a major industry conference he’s always wanted to attend. Every dollar is meant to fuel the next wave of growth, not just keep the lights on.

He dedicated $5,000 to skill-building and networking. James signed up for an advanced course he’s been eyeing, hired a business coach for the first time, and joined a mastermind group of other ambitious solopreneurs. For him, investing in learning and relationships is just as important as new software or gear.

Finally, James made space for joy with $5,000 set aside for self-care and celebration. He booked a weekend getaway, upgraded his home office chair, and treated himself to a wellness retreat. After five years of building alone, he knows staying energized and inspired is just as important as the numbers.

What James Didn’t Do

Didn’t spend it all on flashy office space or the latest gadgets

Didn’t gamble on high-risk investments or crypto

Didn’t pour every dollar back into the business with no personal safety net

Didn’t ignore taxes, ongoing costs, or the need for downtime

Takeaway

Wondering what to do with $100K after a business breakthrough?

James’s approach shows that real leveling up isn’t about spending fas. It’s about building stability, investing in your business and yourself, and laying the groundwork for bigger wins.

Subscribe for More Personal Finance Playbooks

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Consult a licensed financial advisor or tax professional before making investment decisions or changes to your business strategy.