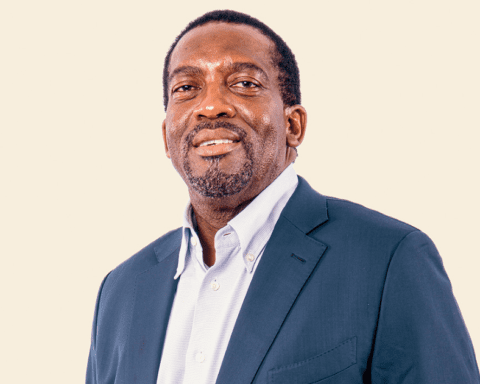

Recent headlines about Slutty Vegan and its founder, Pinky Cole, have stirred debate and speculation throughout the business and cultural landscape.

Many assumed the story was simply one of a failed business, but the reality behind the scenes is more complex and instructive for entrepreneurs everywhere.

What appeared to be a dramatic collapse was in fact a calculated use of a legal restructuring tool: the Assignment for the Benefit of Creditors, or ABC.

The Headlines vs. the Real Story

At first glance, it looked like Atlanta’s acclaimed Slutty Vegan—long celebrated for its viral success—had abruptly fallen on hard times.

Reports of closed locations, pending lawsuits, and lost ownership fueled public discussion. But the legal process underway was not a straightforward business failure. Instead, it was a pivot enabled by legal strategy.

For example, in August 2025, Slutty Vegan was named in a lawsuit alleging more than $87,000 in unpaid rent and late fees for its Georgia locations, with an additional $13,665.34 in monthly charges accruing according to the landlord’s court filing.

Public records and reporting confirm that legal action from creditors is still possible even after an ABC.

Despite the legal pressures, the brand publicly responded with humor and candor on social media. Pinky Cole posted, “Come buy a burger so we can pay this rent,” reflecting a transparent and unfiltered approach to handling public scrutiny and customer curiosity.

What Is an ‘Assignment for the Benefit of Creditors’ (ABC)?

An ABC is a state-level alternative to federal bankruptcy. In simple terms, a business owner voluntarily assigns company assets to an independent third party (the assignee), who manages asset sales and creditor payments. Compared to bankruptcy, ABCs are often faster, less public, and potentially less costly.

One important distinction: an ABC can sometimes provide the original founder with an opportunity to buy back assets, re-enter the business, or otherwise influence the outcome.

This tool is more common than many realize—particularly in sectors like technology and hospitality—but it is rarely discussed openly.

Why Do Businesses Choose This Route?

Rapid growth often brings operational complexity and high overhead, especially in the food and hospitality space. When expenses outpace revenue, founders sometimes use ABC to avoid a forced bankruptcy and to preserve brand value.

The process allows for restructuring, debt resolution, and—in some cases—an eventual relaunch or reset of the business.

In Slutty Vegan’s case, the company initiated an ABC process in early 2025 after facing rising costs and legal pressures.

Control of the business was briefly transferred to an assignee who managed the company’s obligations. Shortly thereafter, the founder reacquired the business, relaunching under a new structure and with a refreshed strategy.

While ABC can be a powerful tool for business survival, it’s important to note its limitations. The process does not automatically shield a company from all creditor actions or lawsuits, and there’s no guarantee a founder will successfully regain their business.

Lessons for Founders and Operators

The Slutty Vegan situation offers a broader lesson:

Legal tools like ABC can provide viable options during periods of financial stress.

Proactive use of restructuring mechanisms isn’t a sign of failure, but rather an example of managing risk and adapting to new realities.

Understanding your financials and seeking professional advice early can open up more strategic paths.

Destigmatizing Restructuring in Entrepreneurship

Business resets, pivots, and restructuring are part of the entrepreneurial journey. While some communities—particularly Black founders—face additional scrutiny and stigma when things go sideways, the use of legal tools like ABC should be seen as pragmatic, not scandalous.

Transparency and open dialogue about these processes can help normalize them and provide valuable insight to others facing similar challenges.

A Case Study in Strategic Resets

The story of Slutty Vegan’s restructuring is still unfolding. What’s clear is that the use of ABC as a restructuring tool is an option available to more founders than may realize.

For any entrepreneur, understanding the full range of business survival strategies is key—especially as growth, challenges, and market conditions change over time.

Staying informed about all available business tools—including lesser-known options like ABC—can make the difference between a setback and a true comeback.