Black-led community development financial institutions (CDFIs) are on the frontlines of building economic opportunity.

Yet, despite their central role, these institutions remain under-resourced. White-led CDFIs control six times the assets of Black-led organizations—a gap that has barely changed, even as the need for equitable investment has grown.

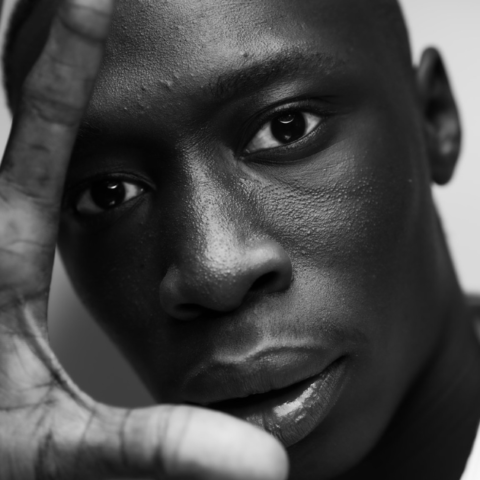

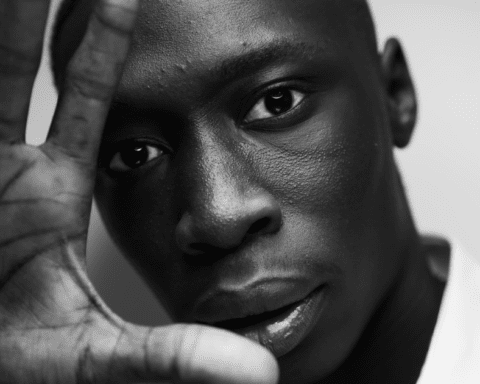

Lenwood Long sees this reality up close every day. As President and CEO of the African American Alliance of CDFI CEOs, also known as The Alliance, he leads a network of 67 Black-led CDFIs with a shared mission: closing the capital gap and strengthening Black communities.

The Mission and Impact of Black-led CDFIs

The Alliance’s work is built on three pillars—capacity, connection, and power. For Long, real power means using the group’s collective voice to change public policy and direct resources where they are most needed.

CDFIs are not just smaller banks. While traditional banks are driven by profit and serve shareholders, most CDFIs are nonprofit and deeply mission-focused. Their priority is helping low-income and historically underserved communities. That difference shapes how they work. Instead of turning away entrepreneurs for not fitting a strict credit profile, CDFIs look for solutions. They partner with credit repair agencies, provide technical support, and often dig deeper to understand the story behind the numbers.

Supporting Black-owned Businesses

This extra effort matters. Many Black-owned businesses start out without perfect credit or financial histories. CDFIs offer them a pathway to become bankable—preparing them for the future and giving them a shot at success. “CDFIs work hand in hand with the clients who walk through their doors,” Long says. The goal is not just access, but growth and resilience.

Facing the Funding Gap

Despite their impact, Black-led CDFIs are themselves underserved. “Black-led CDFIs are the underserved serving the underserved,” Long explains. With limited resources, they work tirelessly to meet high demand from Black and brown entrepreneurs. But the numbers are stark: for every dollar a Black-led CDFI has, a white-led peer holds six. This gap mirrors the broader racial wealth divide that has shaped America for generations.

The Push for Equitable Investment

Long is clear about the origins of these disparities. “From Reconstruction to Jim Crow to the present day, this economy has not been fair to Black people and people of color,” he says. Closing the gap, he believes, will require bold, intentional investment—far more than anything seen to date.

That’s the vision behind the Black Renaissance Fund. Launched by the Alliance, it’s the first national fund devoted solely to Black-led CDFIs. Seeded with $12.5 million from Bank of America, the fund’s target is $125 million—a mix of operating support and capital designed to help these organizations grow and stabilize. “They need blended capital. Debt alone isn’t enough,” Long says. The real need, he adds, is in the billions.

Advocacy and the Role of Policy

Securing more funding is only part of the challenge. Advocacy is just as crucial. Long and his peers push for policy change so Black communities aren’t overlooked when federal programs roll out new rounds of capital. Too often, he warns, major funds intended for “disadvantaged” groups fail to reach Black-led organizations. “Wouldn’t it be a shame if those billions meant for our communities never reached Black nonprofits?” he says. The Alliance’s goal is to ensure that doesn’t happen.

Progress and the Road Ahead

These issues play out at the state level too. Many states don’t do the outreach needed to involve Black-led CDFIs, banks, or credit unions in new programs. The result is that old patterns of exclusion persist. “At the federal and state levels, we haven’t seen changes that amount to a hill of beans,” Long says. For real progress, he believes, collective action and clear accountability are essential.

There have been some positive signs. After 2020, some new funding found its way to Black-led CDFIs and banks. But as Long points out, if you look closer, much of the so-called “racial equity” money ended up strengthening white organizations rather than Black communities.

Still, Long remains hopeful. He credits the determination and skill of the leaders at Black-led CDFIs for keeping the movement alive. “We have something nobody can take away,” he says. “That’s the intellectual capital of some of the brightest Black men and women I know. They’re smart, they’re nimble, and they’re creating change.”

The work is far from done. But with leaders like Lenwood Long and the Alliance, the push to close the capital gap and build real wealth in Black communities continues.

Are you a lender or financier interested in supporting Black entrepreneurs and growth-stage businesses? Join our Capital Partners Network to share your lending and financing criteria.