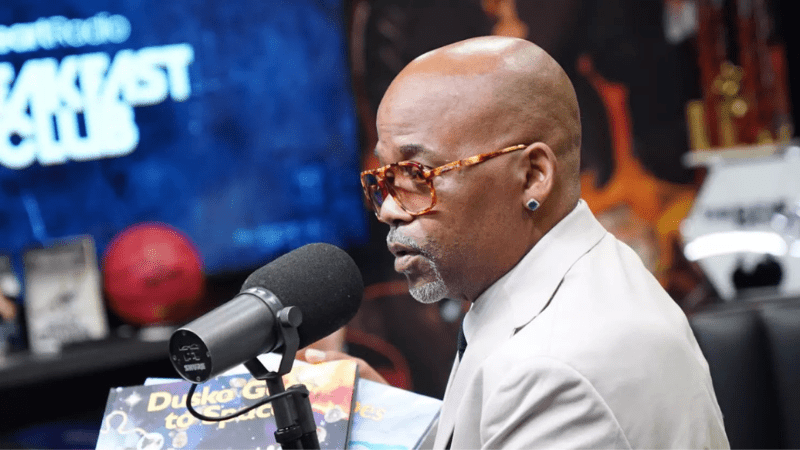

Dame Dash’s fiery return to The Breakfast Club made waves for more than just viral soundbites.

Between the arguments and the headlines, he used his airtime to break down one of the most misunderstood strategies in wealth: the family office.

For most people, “family office” is a phrase you only hear when reading about billionaires, Wall Street dynasties, or European old money.

But as Dame made clear—sometimes in between interruptions—the family office is a tool for privacy, power, and protection that every serious wealth builder should understand.

The Real Meaning of a Family Office

A family office is not a bank account or a trust fund. It’s a private company set up to manage a family’s money, investments, taxes, legal matters, and sometimes even day-to-day life.

It can be as simple as a few trusted advisors and an LLC, or as complex as a team of professionals handling everything from investment deals to philanthropy, travel, and generational education.

When Dame was challenged about his net worth and why “nothing was in his name,” he said:

“Most companies aren’t owned like rich people or rich families. They don’t put anything in their name. They build their family office.”

That line, dropped mid-debate, is the playbook of real generational wealth. For Dame—and for thousands of wealthy families—the goal isn’t just to make money, but to protect it, keep it in the family, and use it strategically.

Why Do the Wealthy Use Family Offices?

One of the most important points Dame made—without ever using the word “asset protection”—is that visibility and ownership are not the same.

Public headlines, lawsuits, divorces, and even bad business partners can threaten what you’ve built.

By holding assets through a family office, everything from real estate to intellectual property can be legally separated from your personal finances.

“Nothing could be in my name. They put liens on all my accounts years ago. So I’ve been building my family office.”

This isn’t just about hiding money.

It’s about resilience. Dame explained how, after paying millions in taxes and facing lawsuits, he restructured his life and businesses so that lawsuits and headlines couldn’t destroy his family’s stability or his legacy.

In many ways, this is what sophisticated wealth looks like: playing defense as much as offense.

Beyond Billionaires: Why Family Offices Matter Now

Family offices aren’t just for the Rockefellers or the Murdochs anymore.

In recent years, more first-generation entrepreneurs, entertainers, and even athletes have created their own—sometimes with less money than you’d think.

In a world of constant litigation, online snooping, and generational change, the idea of putting assets under professional management is going mainstream.

A family office can help you:

Manage complex finances and investments

Shield assets from public or legal attacks

Create a structure for philanthropy, scholarships, or community impact

Ensure wealth is passed down wisely—without the drama or loss that plagues so many families

For Dame Dash, that meant making sure his children were debt-free, his partners and children’s mothers were housed, and his businesses could survive legal drama. As he put it:

“If all my children and all my family is taken care of, how am I broke? … Rich people have family offices. You don’t put things in your name. You have a family office.”

What Does a Family Office Do?

Depending on size and scope, a family office might:

Oversee all investments, from real estate and startups to stocks and art

Handle taxes, accounting, and legal matters

Pay bills, manage properties, and run day-to-day finances

Coordinate philanthropy, foundations, or impact investing

Educate younger family members on money, business, and values

Dame’s approach—making his family office the center of his new deals and projects—reflects a global trend.

Today, private family offices directly invest in companies, buy real estate, fund social causes, and even compete with traditional private equity firms.

Why This Matters for Black Wealth

Too often, conversations about Black wealth are limited to “who’s a millionaire?” or “who has the biggest house?”

The family office model flips that script. It’s not about looking rich. It’s about staying rich, building structures for the future, and playing the long game.

Family offices are about making sure the next generation doesn’t start from scratch, about insulating your legacy from the volatility of fame, media, or even the court system.

As Dame Dash’s headline moment made clear, sometimes what’s not in your name is more powerful than what is.

Interested in investing in Black founders and fund managers? Join our Investor Network to get curated updates on capital-raising opportunities.