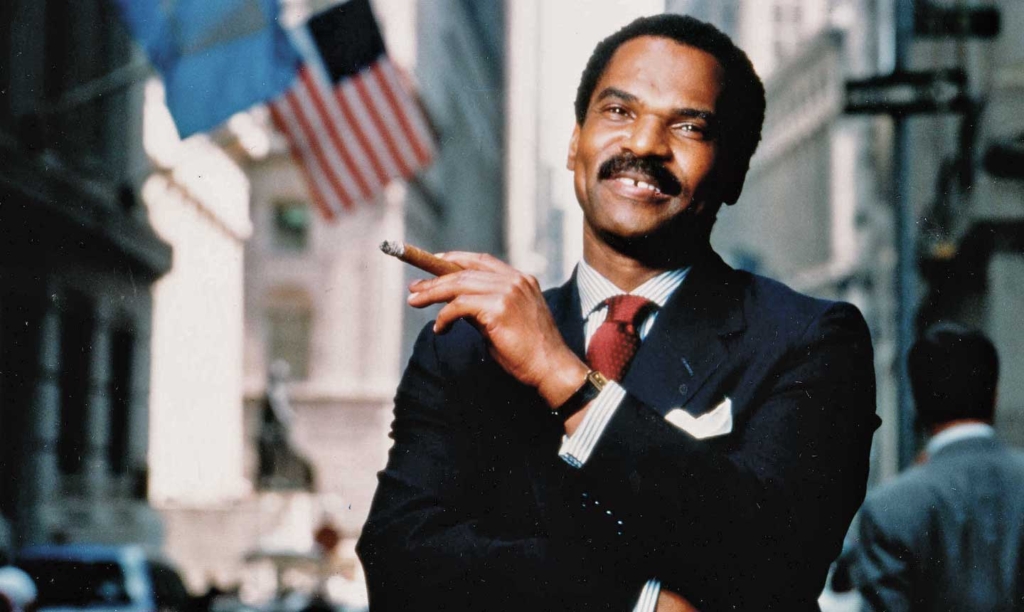

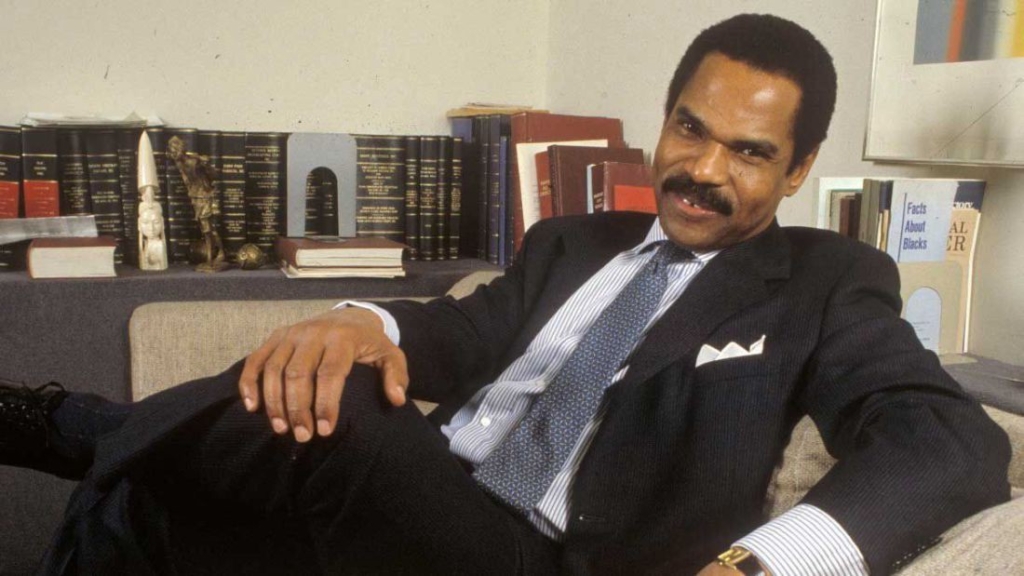

Reginald F. Lewis was one of the richest African-American men in the 1980s, and the first African American to build a billion-dollar company.

His bestselling book, “Why Should White Guys Have All The Fun?“, is one of my favorites. A small portion of the book briefly describes a conversation Lewis had with another Black attorney.

During this conversation, he expressed his desire to see more African Americans involved in mergers and acquisitions as a business and wealth creation strategy. This sparked my personal interest in M&A and led me to connect with Cedric Powel.

Cedric is an M&A Attorney who represents private and public companies, investment banks, and private equity firms in corporate and transactional matters, including mergers and acquisitions and joint ventures.

What are some of the potential benefits that M&A transactions may offer Black businesses (in particular small businesses)?

M&A can be an efficient way for small businesses, including Black-owned businesses, to increase their market share and their ability to compete with their larger organizations within the same industry. Consolidation within a particular industry is a common tool used to capitalize on synergies across organizations and to grow businesses faster than may be possible organically. The same is true for Black-owned businesses.

At what stage should a business owner consider an M&A transaction as part of their strategic plan?

M&A, either as part of a business’ growth strategy or as part of its owner’s exit strategy should be considered at founding or as soon as possible thereafter. Basically, it’s never too early to start thinking about potential investment transactions—whether it be a growth equity fund raise, the acquisition of another business or business line, or a liquidity event for the founder/owner. In my opinion, the potential benefits of an M&A transaction should always be a consideration as part of a business’ strategic plan.

What are some best practices for business owners who may be considering an M&A transaction to increase the likelihood of a successful transaction and integration process?

My main recommendation is to engage competent advisors—financial and legal—early. M&A is as much an industry as it is a process. And, like every other industry, there are qualified and sophisticated practitioner—financial, legal and otherwise—who focus on identifying, leading, and consummating M&A transactions on a daily basis.

Any business owner who is considering a potential M&A transaction should start, at minimum, by discussing the process with a financial advisor and a legal advisor to set expectations and better understand the potential pros and cons.

As part of your work representing private equity funds and strategic acquirers, what would you say makes a business/company most attractive for a growth investment or acquisition?

Institutional investors and strategic acquirers usually focus on the income generating history of the particular business, its scalability, and how that business fits the specific investor’s investment strategy. There is no one size fits all answer here, but building a strong customer pipeline with recurring revenue and great margins is always a positive.

However, often customer profiles and concentration are industry specific, so it is important to discuss your specific business, the universe of potential investors, and the current M&A trends with a specialized financial advisor to get a better understanding for where your particular business fits in the industry landscape.

In addition to the financial condition of the business, corporate hygiene and record keeping are key. It is important to be able to deliver complete and accurate records with respect to the business’ current and historical operations as part of any investment due diligence process. Lack of appropriate record keeping can sour an investor’s outlook on an otherwise great business.

You can connect with Cedric on LinkedIn.