Ayesha Selden, also known as EldRich Cleaver, Millie Holiday, Fidel Cashflow, Cicely Titles, and Dr. Julius Earning is a real state investor, coach, mentor, and author of the book “Mud 2 Millions.”

She has garnered a large online following no doubt due to amongst other things, her no holds barred, tough medicine style of preaching her message of “owning sh*t”.

Own some shit 🦍 pic.twitter.com/tgrkRQWVf9

— Ayesha Selden, CFP® (@AyeshaSelden) July 23, 2020

We caught up with her to find out her thoughts on the ways that wealth can be created within the Black community.

What does wealth mean to you?

Wealth is the freedom of not having to trade time for money. Wealth is having the cash flow from performing assets support a life you deem comfortable. Wealth is being able to drop everything on a Tuesday and go spend time with your mom on her birthday.

Has becoming wealthy always been a goal of yours?

I grew up in a poor neighborhood in South Philly during the crack era where the wealthiest people we saw were drug dealers. Not only did I aspire to have wealth, I always knew I’d get there (legally or otherwise lol).

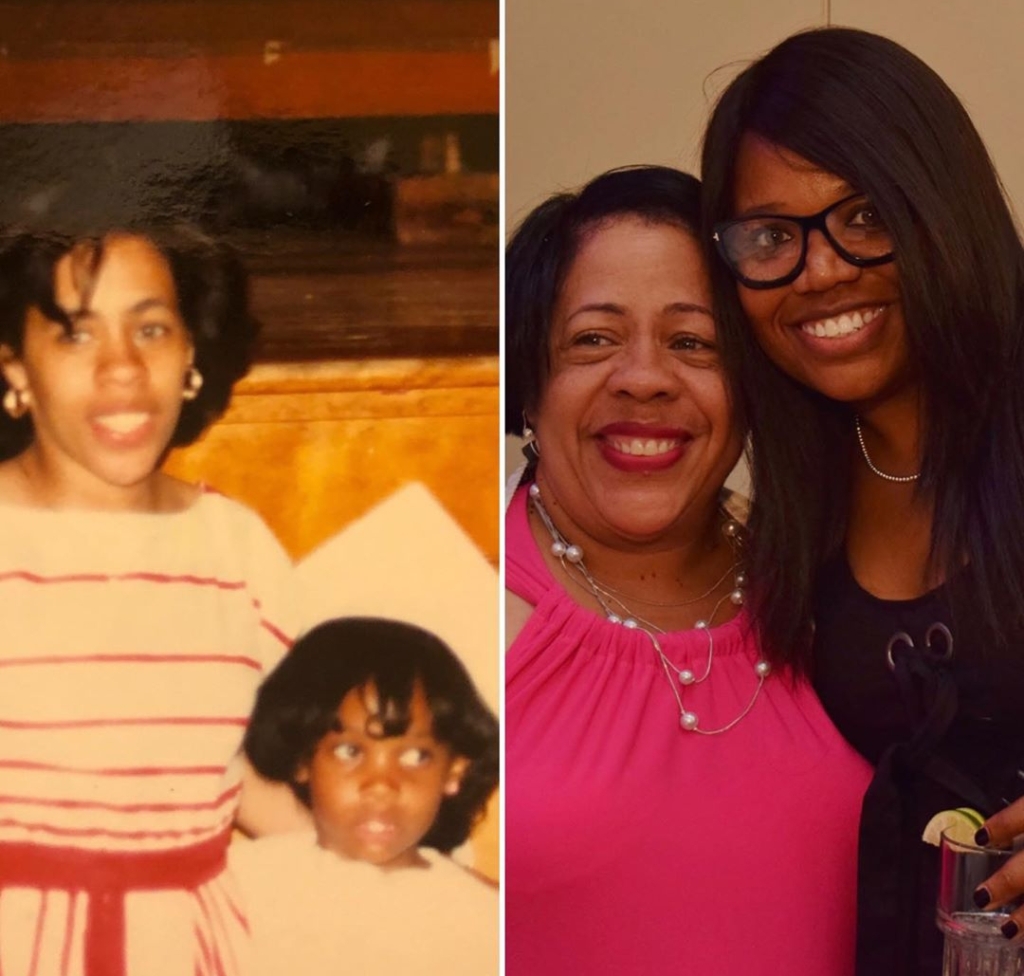

As a kid, I wanted a briefcase more than I wanted dolls. I was entirely fascinated by tall buildings, offices, and movies like Wall Street. My mom used to drive us to Gladwyn, an affluent suburb of Philly, to show us how the wealthy lived.

In stark contrast to the row homes and blight I saw in our neighborhood, our drives to Gladwyn showed me castle looking houses with pool houses larger than the modest home we lived in.

It was important for my mom to show us that there was more out there than just our neighborhood. I am so grateful for those car rides because it let me imagine what was possible.

You are very vocal on social media about all things ownership and wealth building. Why are you so passionate about this topic?

Folk: all you talk about is money.

Me: last time I checked, there were 9 million black people living below the poverty line. There’s clearly a lot to talk about. Tf.

— Ayesha Selden, CFP® (@AyeshaSelden) March 10, 2020

I believe that we are the only solution for our community. Help is not on the way. It is the responsibility of “self-made” black people who came out of poverty to then reach back and teach others how to do the same.

Group economics is our way out but, chile, Black flight is just as real as white flight. We “make it”, head for the hills and never look back at those we have left behind. We then fixate on changing the political landscape, as our solution, and forget how powerful we are as a people.

To be clear: we need entrepreneurs and asset owners. https://t.co/lXDSEwPnn5

— Ayesha Selden, CFP® (@AyeshaSelden) July 22, 2020

And it’s easier to look at “voting” as a solution because it doesn’t require us to go back to “the hood”. We get to wear “I Voted” buttons and feel good about ourselves. Every election cycle reminds me of The Great White Hope meets Ground Hog’s Day.

Same promises (from normally some old white guy) and not a damn thing changes. We rely on a government system that has shown us for centuries that it shouldn’t be trusted.

Millions of Black people lived in poverty before we had a Black president and millions of Black people continue to live in poverty after we had a Black president. The government is not the solution for poor people and it amazes me that we think this same system we don’t trust will radically implement public policy to redistribute the wealth.

If we want to see real change in our communities, building an economy that allows the Black dollar to circulate and flip in our community the same way it circulates in the Jewish or Asian communities is where we start.

We then lobby with our capital to get done what we need. We buy a voice in Washington which is the only thing this country understands. Until then, a large percentage of black people will stay in poverty, we will continue to be shot by the police and we will keep marching and singing.

What do you feel is the first step on the path to wealth accumulation?

Let me start by saying that Black people are not at fault for the current state of our wealth as a people. Hell, the fact that we have survived generations of trauma is a testament to our resilience. Our income, wealth, and asset ownership are fractions of white wealth.

Systemic racism and the effects of redlining, mass incarceration of black men, racist hiring policies, etc all have a huge impact on black wealth today. I read a study done by Pew Trust that says even in the year of our Lord 2020, in most states, Black and Hispanic communities are taxed at higher rates than comparable predominantly white communities.

““All the problems you think are social problems are economic problems with social consequences.” pic.twitter.com/Om5AD47sLL

— Ayesha Selden, CFP® (@AyeshaSelden) July 19, 2020

We now know that our communities are paying higher property taxes but also continue to see that our resources (schools, roads, sanitation departments, etc) are inferior to predominantly white communities. We are also overpoliced with our own tax money.

I can point out a million ways the playing field isn’t leveled and has never been. But where do we go from here?

I choose to normalize Black wealth because I don’t believe there is a politician or political party that will change this. The path of wealth accumulation is exactly why I wrote my book Mud 2 Millions. It was my journey to a million by 30.

It sounds cliche but our mindset and our relationship with money are the genesis of wealth creation. We need a collective focus on changing the narrative in our communities. We need middle class and wealthy Blacks to come back and show those left behind how to build businesses and assets.

We also need some self-reflection about our individual relationships with money. Most of us weren’t left a penny of generational wealth. Most of us weren’t taught a thing about how to manage money. Most of what we were taught about money was a lie.

We need to completely deconstruct most of what we know about capital and how we feel about money and reframe with a mindset of building.

Once I change my mindset, where should I start on my wealth journey?

Your net worth builder is in that sweet spot between your income and expenses. We call the amount of money left over after all of your expenses are paid, “discretionary income”.

If you find yourself living paycheck to paycheck, there are generally two ways to tackle this:

Drastically cut expenses or generate additional income through a side hustle after your 9-5 and/or weekends. I prefer a combination of boffum–curbing expenses and a side hustle because I’m trying to get the bag expeditiously.

It’s important to look at where we are spending our money. Is it on things we need or are we overcompensating for being teased as kids for having trash sneakers?

In my book, I talk about a dozen or so side hustles to generate additional income (vending machines, real estate wholesaling, arbitrage online sales, trucking business, etc.).

If you can earn an extra $500 to $1,000/month in income, that could be all the difference in building wealth and leaving a legacy for generations.

Again, while where we are is not our fault, it is our responsibility to change the narrative for ourselves and future generations.

Why? Because no one else will. Peace.

Read the remaining wealth steps in Ayesha’s book, Mud 2 Millions.

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram & Twitter

Get your SHOPPE BLACK Apparel!