Sahel Capital is a leading African private equity and impact investment firm focused on agribusiness. The firm recently announced that it has secured a $10 million investment from the Mastercard Foundation Africa Growth Fund.

Expanding Access to Capital for Agri-SMEs

Launched in 2021 with $24 million anchored by KfW Development Bank, SEFAA has since provided 33 financing facilities to 18 companies in seven African countries. With this new $10 million, the fund plans to expand to 13 countries across sub-Saharan Africa.

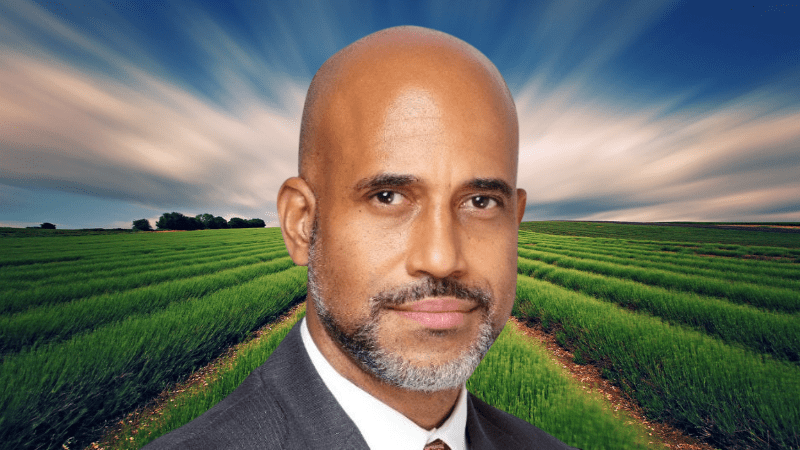

Mezuo Nwuneli, Managing Partner at Sahel Capital, said the commitment is “a testament to our team’s hard work and the impactful work we are doing. It will be instrumental in accelerating our efforts to improve the income opportunity for smallholder farmers by enabling the agri-SMEs that engage with them, further strengthening our position as a leading fund in the food and agriculture sector in Africa.”

Driving Job Creation and Inclusion

The Mastercard Foundation Africa Growth Fund is a $200 million initiative aimed at unlocking capital for African SMEs, with a focus on women and youth.

Through SEFAA, the new investment is expected to help create over 10,000 jobs and provide meaningful income opportunities, strengthening the agribusiness ecosystem.

Dorothy Nyambi, President and CEO of MEDA, added that the collaboration “strengthens our shared mission to catalyse job creation for women and youth by financing SMEs and MSMEs, while also helping to build the enabling ecosystems they need to thrive sustainably.”

A Step Toward Resilient Agriculture

Agriculture employs most of Africa’s workforce and remains central to the continent’s long-term growth. By supporting businesses across the value chain, from production to processing and distribution, SEFAA plays a critical role in building resilience and sustainability.

This partnership between Sahel Capital, the Mastercard Foundation, and MEDA Mauritius highlights agriculture as both an investment opportunity and a pathway for inclusive economic development.

Interested in investing in Black founders and fund managers? Join the Investor List